Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

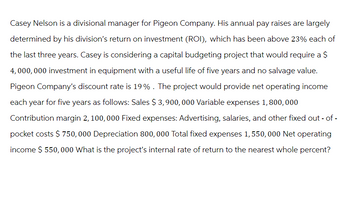

Transcribed Image Text:Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely

determined by his division's return on investment (ROI), which has been above 23% each of

the last three years. Casey is considering a capital budgeting project that would require a $

4,000,000 investment in equipment with a useful life of five years and no salvage value.

Pigeon Company's discount rate is 19%. The project would provide net operating income

each year for five years as follows: Sales $ 3,900,000 Variable expenses 1,800,000

Contribution margin 2, 100, 000 Fixed expenses: Advertising, salaries, and other fixed out-of-

pocket costs $750,000 Depreciation 800,000 Total fixed expenses 1,550,000 Net operating

income $ 550,000 What is the project's internal rate of return to the nearest whole percent?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 24% each of the last three years. Casey is considering a capital budgeting project requiring a $4,200,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company’s discount rate is 20%. The project would provide net operating income each year for five years as follows: Sales $ 4,100,000 Variable expenses 1,880,000 Contribution margin 2,220,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 770,000 Depreciation 840,000 Total fixed expenses 1,610,000 Net operating income $ 610,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project’s net present value? 2. What is the project’s internal rate of return to the nearest whole…arrow_forwardCasey Nelson Is a divisional manager for Pigeon Company. His annual pay ralses are largely determined by his division's return on Investment (ROI), which has been above 23% each of the last three years. Casey is considering a capital budgeting project that would require a $4,100,000 Investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 19%. The project would provide net operating Income each year for five years as follows: Sales $ 4,000, 000 1,840, e0e Variable expenses Contribution margin 2,160,000 Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs $ 760, 000 820, 000 Depreciation Total fixed expenses 1,580, e00 Net operating income $ 580, 000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Requlred: 1. What is the project's net present value? 2. What is the project's Internal rate of return to the nearest whole percent? 3. What Is the…arrow_forwardThe first 3 parts of this question have been answered. Need help with the last two: 4.A. & 4.Barrow_forward

- Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $4,650,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows: $ 4,000,000 1,750,000 Sales Variable expenses Contribution margin Fixed expenses: 2,250,000 Advertising, salaries, and other fixed out-of-pocket costs Depreciation $745,000 745,000 Total fixed expenses 1,490,000 Net operating income $ 760,000arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 170,000 $ 380,000 Annual revenues and costs: Sales revenues $ 250,000 $ 350,000 Variable expenses $ 120,000 $ 170,000 Depreciation expense $ 34,000 $ 76,000 Fixed out-of-pocket operating costs $ 70,000 $ 50,000 The company’s discount rate is 16%. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate…arrow_forwardRocky Pines golf course is planning for the coming season. Investors would like to earn a 12% return on the company's $47,000,000 of assets. The company primarily incurs fixed costs to groom the greens and fairways Fixed costs are projected to be $20,000,000 for the golfing season About 450,000 golfers are expected each year. Variable costs are about $20 per golfer Rocky Pines golf course has a favorable reputation in the area and therefore, has some control over the price of a round of golf. Using a cost-plus approach, what price should the course charge for a round of golf? (Round the final answer to the nearest cent) OA $110.00 OB$76.98 OC $20.00 OD 564 44arrow_forward

- Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management is concerned that Sales Revenues and Expenses could be rising due to inflationary factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that fixed out-of-pocket operating…arrow_forwardCasey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,800,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 18%. The project would provide net operating income each year for five years a follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income. EXHIBIT 7B-1 Present Value of $1; Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would…arrow_forwardMonica is a senior financial manager of Eclipse Ltd. She is conducting a capital budgeting analysis on a new product. She has already authorised an extensive market research on the marketability of the product that cost $15,000, which she paid yesterday. The new project is expected to generate yearly revenue of $390,000 for 4 years. The related variable costs are expected to be $100,000 p.a. and Monica estimates the relevant fixed costs would be another $30,000 p.a. The project will require the company to purchase new equipment at a cost of $500,000. The new equipment will be installed in a building which the company already owns but the building is currently left vacant. The company will depreciate the equipment by the straight-line method to zero salvage value over the 4 years and Monica believes that they can sell the equipment at the end of 4 years for $20,000. Eclipse Ltd’s required payback is 3 years and the required rate of return is 12% p.a. The relevant tax rate is 30% and tax…arrow_forward

- Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $5,170,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 19%. The project would provide net operating income each year for five years as follows: Sales $ 4,500,000 Variable expenses 2,000,000 Contribution margin 2, 500,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $780,000 Depreciation 1,034,000 Total fixed expenses 1,814,000 Net operating income $ 686,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3 a. Would the company want Derrick to pursue…arrow_forwardHawk, Inc. has a 15% required rate of return. Three divisions of Hawk have proposed three projects to increase income over the next 12 years. Three divisions report different measures as follows: Project A was reported to have an NPV of ($530) or negative $530. Project was reported with an internal rate of return of 18%. Project C was reported to have a payback period of 15 years. With which of these projects should Hawk move forward? O All three sound great! O Project A O Project C O Project Barrow_forwardCamber Corporation has to decide if they can finance purchasing 10 new machines for all their manufacturing sites. The machines cost $1.73 million each, and the supplier agreed to the following payment terms, 40% upfront, and the remainder to be paid over 4 years at an annual rate of 12%. Executives at Camber Corporation review their budgets and discover that they can pay the supplier 40% now, but their budget will only allow them to pay $4,000,000 per year for the next four years. Will that be enough to make the purchase? Critically discuss the effect of increasing the amount paid upfront when corporations make capital purchases, focusing on the benefits and drawbacksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education