FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

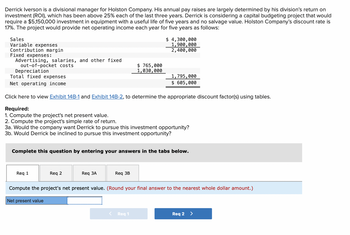

Transcribed Image Text:Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on

investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would

require a $5,150,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is

17%. The project would provide net operating income each year for five years as follows:

Sales

Variable expenses

Contribution margin

Fixed expenses:

Advertising, salaries, and other fixed

out-of-pocket costs

Depreciation

Total fixed expenses

Net operating income

Req 1

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the project's net present value.

2. Compute the project's simple rate of return.

3a. Would the company want Derrick to pursue this investment opportunity?

3b. Would Derrick be inclined to pursue this investment opportunity?

Req 2

Complete this question by entering your answers in the tabs below.

Req 3A

$ 765,000

1,030,000

Req 3B

$ 4,300,000

1,900,000

2,400,000

1,795,000

$ 605,000

Req 1

Compute the project's net present value. (Round your final answer to the nearest whole dollar amount.)

Net present value

Req 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Casey Nelson Is a divisional manager for Pigeon Company. His annual pay ralses are largely determined by his division's return on Investment (ROI), which has been above 23% each of the last three years. Casey is considering a capital budgeting project that would require a $4,100,000 Investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 19%. The project would provide net operating Income each year for five years as follows: Sales $ 4,000, 000 1,840, e0e Variable expenses Contribution margin 2,160,000 Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs $ 760, 000 820, 000 Depreciation Total fixed expenses 1,580, e00 Net operating income $ 580, 000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Requlred: 1. What is the project's net present value? 2. What is the project's Internal rate of return to the nearest whole percent? 3. What Is the…arrow_forwardDerrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $4,650,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows: $ 4,000,000 1,750,000 Sales Variable expenses Contribution margin Fixed expenses: 2,250,000 Advertising, salaries, and other fixed out-of-pocket costs Depreciation $745,000 745,000 Total fixed expenses 1,490,000 Net operating income $ 760,000arrow_forwardJordan Corporation is considering a new product that will be very popular for a couple of years and then slowly lose its commercial appeal. Sales are projected to be $90,000 in year one, $100,000 in year two, $60,000 in year three, $40,000 in year four, $20,000 in year five, and $10,000 in the final year six. Expenses are expected to be 40% of sales with net working capital requirements to be 15% of the following time period’s revenue. Equipment of $126,000 will be required for the launch of the product; this equipment can be depreciated straight-line over six years and will be worthless at the end of the project. The Tax Rate is 20% and the opportunity cost of capital is 14.5%. What is the Internal Rate of Return (rounded to two places)? Multiple Choice 32.61% None of the above 13.39% 18.32% 19.46%arrow_forward

- Rocky Pines golf course is planning for the coming season. Investors would like to earn a 12% return on the company's $47,000,000 of assets. The company primarily incurs fixed costs to groom the greens and fairways Fixed costs are projected to be $20,000,000 for the golfing season About 450,000 golfers are expected each year. Variable costs are about $20 per golfer Rocky Pines golf course has a favorable reputation in the area and therefore, has some control over the price of a round of golf. Using a cost-plus approach, what price should the course charge for a round of golf? (Round the final answer to the nearest cent) OA $110.00 OB$76.98 OC $20.00 OD 564 44arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management is concerned that Sales Revenues and Expenses could be rising due to inflationary factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that fixed out-of-pocket operating…arrow_forwardCasey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,800,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 18%. The project would provide net operating income each year for five years a follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income. EXHIBIT 7B-1 Present Value of $1; Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would…arrow_forward

- Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $5,170,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 19%. The project would provide net operating income each year for five years as follows: Sales $ 4,500,000 Variable expenses 2,000,000 Contribution margin 2, 500,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $780,000 Depreciation 1,034,000 Total fixed expenses 1,814,000 Net operating income $ 686,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3 a. Would the company want Derrick to pursue…arrow_forwardK- Yoga, Spa, and Swim Club is planning for the coming year. Investors would like to eam a 10% rebum on the company's $39,000,000 of assets. The company primarily incurs fixed costs maintain the swimming pools, Fixed costs are projected to be $12,600,000 for the year. About 520,000 members are expected to swim each year. Variable costs are about $10 per swimmer. The club is a price-taker and won't be able to charge more than its competitors who charge $38 for a membership. What profit (loss) will it earn in terms of dollars? OA $12,600,000 OB. $1,900,000 OC. $7,919,962 OD. $(1,960,000)arrow_forwardHawk, Inc. has a 15% required rate of return. Three divisions of Hawk have proposed three projects to increase income over the next 12 years. Three divisions report different measures as follows: Project A was reported to have an NPV of ($530) or negative $530. Project was reported with an internal rate of return of 18%. Project C was reported to have a payback period of 15 years. With which of these projects should Hawk move forward? O All three sound great! O Project A O Project C O Project Barrow_forward

- Sanders Inc. has developed a new product line that they believe will revolutionize their industry and ensure they remain an industry leader. The projected sales are as follows: Year Unit Sales 1 97,500 2 112,000 3 120,000 4 135,000 5 103,000 The project will require $750,000 in net working capital to start and additional net working capital investments each year equal to 10 percent of the projected increase in sales for the following year. Total fixed assets are $4,100,000 per year. Variable costs will be $215, and units will sell for $335 each. The company will need to purchase equipment for $15,000,000 which will be depreciated as a seven-year MACRS property. In five years, the equipment can be sold for $3,500,000. The company is in the 21 percent tax bracket and has a 14 percent required return on their projects. The company will use land that was purchased for $1,800,000 three years ago. The land could be sold today for $2,400,000 and it…arrow_forwardCamber Corporation has to decide if they can finance purchasing 10 new machines for all their manufacturing sites. The machines cost $1.73 million each, and the supplier agreed to the following payment terms, 40% upfront, and the remainder to be paid over 4 years at an annual rate of 12%. Executives at Camber Corporation review their budgets and discover that they can pay the supplier 40% now, but their budget will only allow them to pay $4,000,000 per year for the next four years. Will that be enough to make the purchase? Critically discuss the effect of increasing the amount paid upfront when corporations make capital purchases, focusing on the benefits and drawbacksarrow_forwardMacquarium Inc. provides computer-related services to its dients. Its two primary services are Web page design (WPD) and Internet consulting services (ICS). Assume that Macquarium's management expects to earn a 35% annual return on the assets invested. Macquarium has invested $5.4 million since its opening. The annual costs for the coming year are expected to be as follows: Variable Costs Fixed Costs Consulting support Sales and administration $225,000 $1,575,000 135,000 765,000 The two services expend about equal costs per hour, and the predicted hours for the coming year are 15,000 for WPD and 25,000 for ICS. Required a. If markup is based on variable costs, how much revenue must each service generate to provide the profit expected by corporate headquarters? What is the anticipated revenue per hour for each service? Hint: Start by determining the markup rate. WPD $ Total Revenue Reveue per Hour ICS S b. If the markup is based on total costs, how much revenue must each service…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education