Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

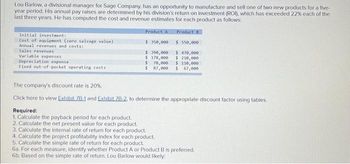

Transcribed Image Text:Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-

year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 22% each of the

last three years. He has computed the cost and revenue estimates for each product as follows:

Initial investment:

Cost of equipment (zero salvage value).

Annual revenues and costs:

Sales revenues

Variable expenses

Depreciation expense

Fixed out-of-pocket operating costs

Product A

Required:

1. Calculate the payback period for each product.

2. Calculate the net present value for each product.

Product B

$ 350,000

$ 390,000

178,000

$

$

70,000

$

$ 550,000

$ 470,000

$ 210,000

$ 110,000

87,000 $ 67,000

The company's discount rate is 20%.

Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor using tables.

3. Calculate the internal rate of return for each product.

4. Calculate the project profitability index for each product.

5. Calculate the simple rate of return for each product.

6a. For each measure, identify whether Product A or Product B is preferred.

6b. Based on the simple rate of return, Lou Barlow would likely:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Concept.

VIEW Step 2: Computation of annual cash inflows.

VIEW Step 3: answer to part 1. Computation of Payback period.

VIEW Step 4: answer to part 2. Computation of Net present value (NPV ).

VIEW Step 5: Computation of Net present value (NPV ) if rate of discount is 30% .

VIEW Step 6: answer to part 3. Computation of internal rate of return .

VIEW Solution

VIEW Step by stepSolved in 7 steps with 22 images

Knowledge Booster

Similar questions

- Juniper Design Limited of Manchester, England, provides design services to residential developers. Last year, the company had net operating income of $440,000 on sales of $1,700,000. The company's average operating assets for the year were $1,900,000 and its minimum required rate of return was 16%. Required: Compute the company's residual income for the year. Residual incomearrow_forwardCasey Nelson Is a divisional manager for Pigeon Company. His annual pay ralses are largely determined by his division's return on Investment (ROI), which has been above 23% each of the last three years. Casey is considering a capital budgeting project that would require a $4,100,000 Investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 19%. The project would provide net operating Income each year for five years as follows: Sales $ 4,000, 000 1,840, e0e Variable expenses Contribution margin 2,160,000 Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs $ 760, 000 820, 000 Depreciation Total fixed expenses 1,580, e00 Net operating income $ 580, 000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Requlred: 1. What is the project's net present value? 2. What is the project's Internal rate of return to the nearest whole percent? 3. What Is the…arrow_forwardDerrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $4,650,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 18%. The project would provide net operating income each year for five years as follows: $ 4,000,000 1,750,000 Sales Variable expenses Contribution margin Fixed expenses: 2,250,000 Advertising, salaries, and other fixed out-of-pocket costs Depreciation $745,000 745,000 Total fixed expenses 1,490,000 Net operating income $ 760,000arrow_forward

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 19% each of the last three years. He computed the following cost and revenue estimates for each product: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 190,000 $ 400,000 Annual revenues and costs: Sales revenues $ 270,000 $ 370,000 Variable expenses $ 128,000 $ 178,000 Depreciation expense $ 38,000 $ 80,000 Fixed out-of-pocket operating costs $ 72,000 $ 52,000 The company's discount rate is 17%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5.…arrow_forwardCasey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,800,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 18%. The project would provide net operating income each year for five years a follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income. EXHIBIT 7B-1 Present Value of $1; Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would…arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 17% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 176,600 $ 390,000 Annual revenues and costs: Sales revenues $ 260,000 $ 360,000 Variable expenses $ 124,000 $ 174,000 Depreciation expense $ 36,000 $ 78,000 Fixed out-of-pocket operating costs $ 71,000 $ 50,000 The company’s discount rate is 15%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each…arrow_forward

- Paula Boothe, president of the Bramble Corporation, has mandated a minimum 8% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 10%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 12% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,816,000 in a new line of energy drinks that is expected to generate $319,000 in operating income. Assume that Monty Corporation's actual weighted average cost of capital is 10% and its tax rate is 30%. Calculate the economic value added of the proposed new line of energy drinks. Economic value added $______________arrow_forwardDerrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $5,170,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 19%. The project would provide net operating income each year for five years as follows: Sales $ 4,500,000 Variable expenses 2,000,000 Contribution margin 2, 500,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $780,000 Depreciation 1,034,000 Total fixed expenses 1,814,000 Net operating income $ 686,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3 a. Would the company want Derrick to pursue…arrow_forwardHoffman Ceramics, a division of Fielding Corporation, has an operating income of $64,000 and total assets of $400,000. The required rate of return for the company is 10%. The company is evaluating whether it should use return on investment (ROI) or residual income (RI) as a measurement of performance for its division managers. The manager of Hoffman Ceramics has the opportunity to undertake a new project that will require an investment of $100,000. This investment would earn $14,000 for the company. Read the requirements. From the standpoint of Fielding Corporation this investment is is more than Fielding's required rate of return. desirable. The ROI of the investment opportunity Requirement 4. What would the residual income (RI) be for Hoffman Ceramics if this investment opportunity were to be undertaken? Would the manager of the Hoffman Ceramics division want to make this investment if she were evaluated based on RI? Why or why not? First determine the formula to calculate the RI.…arrow_forward

- Oscar Clemente is the manager of Forbes Division of Pitt, Inc., a manufacturer of biotech products. Forbes Division, which has $4.18 million in assets, manufactures a special testing device. At the beginning of the current year, Forbes invested $5.05 million in automated equipment for test machine assembly. The division 's expected income statement at the beginning of the year was as follows. Sales revenue $ 16,080,000 Operating costs Variable 2,040, 000 Fixed (all cash) 7,600,000 Depreciation New equipment 1,610,000 Other 1,350,000 Division operating profit $ 3,480,000A sales representative from LSI Machine Company approached Oscar in October. LSI has for $5.85 million a new assembly machine that offers significant improvements over the equipment Oscar bought at the beginning of the year. The new equipment would expand division output by 10 percent while reducing cash fixed costs by 5 percent. It would be depreciated for accounting purposes over a three-year life. Depreciation would…arrow_forwardCasey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 24% each of the last three years. Casey is considering a capital budgeting project that would require a $4,450,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 20%. The project would provide net operating income each year for five years as follows: $ 4,300,000 1,960,000 2,340,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $ 790,000 890,000 1,680,000 660,000 Net operating incomearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education