College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

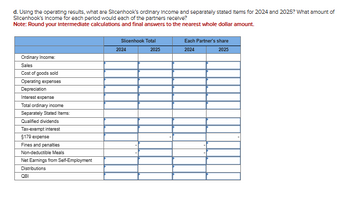

Transcribed Image Text:d. Using the operating results, what are Slicenhook's ordinary Income and separately stated Items for 2024 and 2025? What amount of

Slicenhook's Income for each period would each of the partners receive?

Note: Round your Intermediate calculations and final answers to the nearest whole dollar amount.

Ordinary Income:

Sales

Cost of goods sold

Operating expenses

Depreciation

Interest expense

Total ordinary income

Separately Stated Items:

Qualified dividends

Tax-exempt interest

$179 expense

Fines and penalties

Non-deductible Meals

Net Earnings from Self-Employment

Distributions

QBI

Slicenhook Total

Each Partner's share

2024

2025

2024

2025

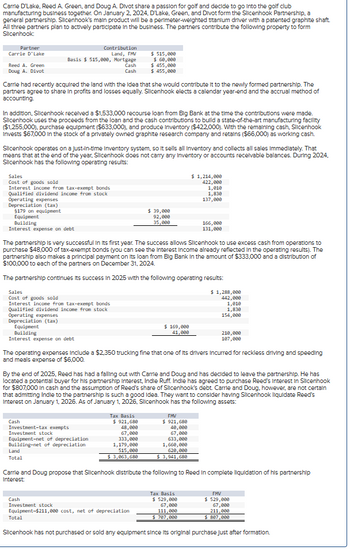

Transcribed Image Text:Carrie D'Lake, Reed A. Green, and Doug A. Divot share a passion for golf and decide to go into the golf club

manufacturing business together. On January 2, 2024, D'Lake, Green, and Divot form the Slicenhook Partnership, a

general partnership. Slicenhook's main product will be a perimeter-weighted titanium driver with a patented graphite shaft.

All three partners plan to actively participate in the business. The partners contribute the following property to form

Slicenhook:

Partner

Carrie D'Lake

Contribution

Land, FMV

$ 515,000

Basis $515,000, Mortgage

$ 60,000

Reed A. Green

Doug A. Divot

Cash

Cash

$ 455,000

$ 455,000

Carrie had recently acquired the land with the idea that she would contribute it to the newly formed partnership. The

partners agree to share in profits and losses equally. Slicenhook elects a calendar year-end and the accrual method of

accounting.

In addition, Slicenhook received a $1,533,000 recourse loan from Big Bank at the time the contributions were made.

Slicenhook uses the proceeds from the loan and the cash contributions to build a state-of-the-art manufacturing facility

($1,255,000), purchase equipment ($633,000), and produce Inventory ($422,000). With the remaining cash, Slicenhook

Invests $67,000 in the stock of a privately owned graphite research company and retains ($66,000) as working cash.

Slicenhook operates on a just-in-time Inventory system, so it sells all Inventory and collects all sales immediately. That

means that at the end of the year, Slicenhook does not carry any Inventory or accounts receivable balances. During 2024,

Slicenhook has the following operating results:

Sales

Cost of goods sold

Interest income from tax-exempt bonds

Qualified dividend income from stock

Operating expenses

Depreciation (tax)

§179 on equipment

Equipment

Building

Interest expense on debt

$ 1,214,000

422,000

1,010

1,830

137,000

$ 39,000

92,000

35,000

166,000

131,000

The partnership is very successful in its first year. The success allows Slicenhook to use excess cash from operations to

purchase $48,000 of tax-exempt bonds (you can see the Interest income already reflected in the operating results). The

partnership also makes a principal payment on its loan from Big Bank In the amount of $333,000 and a distribution of

$100,000 to each of the partners on December 31, 2024.

The partnership continues its success in 2025 with the following operating results:

Sales

Cost of goods sold

Interest income from tax-exempt bonds

Qualified dividend income from stock

Operating expenses

Depreciation (tax)

Equipment

Building

Interest expense on debt

$ 1,288,000

442,000

1,010

1,830

154,000

$ 169,000

41,000

210,000

107,000

The operating expenses Include a $2,350 trucking fine that one of its drivers Incurred for reckless driving and speeding

and meals expense of $6,000.

By the end of 2025, Reed has had a falling out with Carrie and Doug and has decided to leave the partnership. He has

located a potential buyer for his partnership Interest, Indie Ruff. Indie has agreed to purchase Reed's Interest in Slicenhook

for $807,000 in cash and the assumption of Reed's share of Slicenhook's debt. Carrie and Doug, however, are not certain

that admitting Indle to the partnership is such a good idea. They want to consider having Slicenhook liquidate Reed's

Interest on January 1, 2026. As of January 1, 2026, Slicenhook has the following assets:

Cash

Tax Basis

$ 921,680

FMV

$ 921,680

40,000

Investment-tax exempts

Investment stock

Equipment-net of depreciation

Building-net of depreciation

Land

Total

48,000

67,000

333,000

1,179,000

515,000

$ 3,063,680

67,000

633,000

1,660,000

620,000

$ 3,941,680

Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership

Interest:

Cash

Investment stock

Equipment-$211,000 cost, net of depreciation

Total

Tax Basis

$ 529,000

67,000

111,000

$ 707,000

FMV

$ 529,000

67,000

211,000

$ 807,000

Slicenhook has not purchased or sold any equipment since its original purchase just after formation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Steve Reese is a well-known Interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership On January 1, 2022, O'Donnell Invests a building worth $102,000 and equipment valued at $40,000 as well as $38,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner In the beginning capital balances. To entice O'Donnell to join this partnership. Reese draws up the following profit and loss agreement: ⚫ O'Donnell will be credited annually with interest equal to 20 percent of the beginning capital balance for the year. ⚫ O'Donnell will also have added to his capital account 10 percent of partnership Income each year (without regard for the preceding Interest figure) cr $4,000, whichever is larger. All remaining Income is credited to Reese. Neither partner is allowed to withdraw funds from the partnership during 2022.…arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O'Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement: O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. O'Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. Neither partner is allowed to withdraw funds from the partnership during 2016.…arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O'Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement: • O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. • O'Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. Neither partner is allowed to withdraw funds from the partnership during…arrow_forward

- Rosa and Linda agreed to form a partnership on June 15, 2012 for the purpose of manufacturing and selling custom silver jewelry. Both are master crafters and have their own tools and equipment, which they will invest in the business. Rosa and Linda determined that their tools and equipment have fair market values of P90,000 and P120,000, respectively. They further resolved to invest sufficient cash such that each partner will have a beginning capital balance equal to P250,000. How much will be the total cash of the newly formed partnership?arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O’Donnell invests a building worth $52,000 and equipment valued at $16,000 as well as $12,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 20 percent of the beginning capital balance for the year. O’Donnell will also have added to his capital account 15 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. The partnership reported a net loss of $10,000 during the first year of its…arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2022, O’Donnell invests a building worth $100,000 and equipment valued at $52,000 as well as $18,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. O’Donnell will also have added to his capital account 15 percent of partnership income each year (without regard for the preceding interest figure) or $8,000, whichever is larger. All remaining income is credited to Reese. Neither partner is allowed to withdraw funds from the partnership during 2022.…arrow_forward

- Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2022, O'Donnell invests a building worth $130,000 and equipment valued at $140,000 as well as $60,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O'Donnell to join this partnership, Reese draws up the following profit and loss agreement: ⚫ O'Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year. • O'Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. ⚫ Neither partner is allowed to withdraw funds from the partnership during…arrow_forwardJim Bond, a plumber, has been working for Fleming’s Plumbing Supplies for several years. Based on his hard work and the fact that he recently married Ivan Fleming’s daughter, Jim has been invited to enter into a partnership with Fleming. The new partnership will be called Fleming and Bond’s Plumbing Supplies. The terms of the partnership are as follows: (a) Fleming will invest the assets of Fleming’s Plumbing Supplies, and thepartnership will assume all liabilities. The market values of the office and store equipment are estimated to be $18,000 and $8,000, respectively. All other values reported on the balance sheet (shown below) are reasonable approximations of market values. Fleming has no knowledge of any uncollectible accounts receivable.(b) Bond will invest $50,000 cash.(c) Fleming will draw a salary allowance of $50,000 per year, and Bond willreceive $30,000.(d) Each partner will receive 10% interest on the January 1 balance of his capital account.(e) Profits or losses remaining…arrow_forward2) Jim and Carol both work in the real estate market. One day, a great investment property came on the market, and they decided to pool their money to buy and renovate it. They plan to spend six weeks on the renovation, and they hope to make a nice profit when they turn around and sell it. Jim and Carol's partnership is an example of A) a limited partnership. B) a cooperative. C) an S corporation. D) a limited liability company. E) a joint venture.arrow_forward

- What is the JE on 12/31/2017 to admit Dunn to the partnership? Goodwill has been determined for the creation of the partnership on 1/1/2016. See screenshot.arrow_forwardJack and Tony are partners in a software engineering company. Jack and Tony have capital balances of $75,000 and $62,000 respectively. In 2020, the two partners made a profit of $240,000. How much should each receive from the profit in the absence of a partnership agreement? Jack will get…$ Tony will get…$arrow_forwardWhat alternatives are available to Wilkinson and Walker to deal with this situation, and what are the advantages and disadvantages of each?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning