Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Sasha company allocates the estimated solve this accounting questions

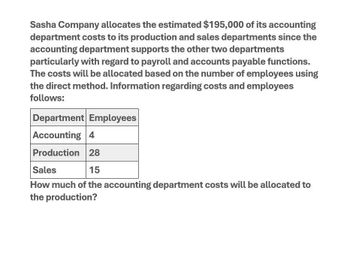

Transcribed Image Text:Sasha Company allocates the estimated $195,000 of its accounting

department costs to its production and sales departments since the

accounting department supports the other two departments

particularly with regard to payroll and accounts payable functions.

The costs will be allocated based on the number of employees using

the direct method. Information regarding costs and employees

follows:

Department Employees

Accounting 4

Production 28

Sales

15

How much of the accounting department costs will be allocated to

the production?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sasha Company allocates the estimated $192,400 of its accounting department costs to its production and sales departments since the accounting department supports the other two departments particularly with regard to payroll and accounts payable functions. The costs will be allocated based on the number of employees using the direct method. Information regarding costs and employees follows: Department Employees Accounting 4 Production 37 Sales 16 How much of the accounting department costs will be allocated to the production?arrow_forwardBluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Employees Transactions Department direct costs Required A Administration 37,000 $363,000 Required: a. Allocate the cost of the service departments to the operating departments using the direct method. b. Allocate the cost of the service departments to the operating departments using the step method. Start with Administration. c. Allocate the cost of the service departments to the operating departments using the reciprocal method. Complete this question by entering your answers in the tabs below. Required B Required C From Accounting Domestic International 26 47 22,000 $141,000 $955,000 Department costs Administration allocation Accounting allocation Total cost Allocate the cost…arrow_forwardBluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Administration Accounting domestic International Employees – 21 36 43 Transactions 32,000 – 21,000 84,000 Department direct costs 360,000 140,000 $ 935,000 $ 3,730,000 Required: a. Allocate the cost of the service departments to the operating departments using the direct method.b. Allocate the cost of the service departments to the operating departments using the step method. Start with Administration.c. Allocate the cost of the service departments to the operating departments using the reciprocal method.arrow_forward

- Management at C. Pier Press has decided to allocate costs of the paper’s two support departments (administration and human resources) to the two revenue-generating departments (advertising and circulation). Administration costs are to be allocated on the basis of dollars of assets employed; human resources costs are to be allocated on the basis of number of employees. The following costs and allocation bases are available: Department Direct Costs Number of Employees Assets Employeed Administration $1,094,100 14 $541,940 Human resources 689,780 11 408,380 Advertising 1,340,920 17 1,067,360 Circulation 1,893,640 36 2,618,420 Totals $5,018,440 78 $4,636,100 a. Using the direct method, allocate the support department costs to the revenue-generating departments. Amount allocated to Advertising: $______ Amount allocated to Circulation: $______ b. Using your answer to (a), what are the total costs of the revenue-generating departments after the allocations? Advertising total…arrow_forwardRenata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Materials Personnel Manufacturing Packaging Employees Square Feet Asset Values $ 7,900 4,740 45,820 20,540 $ 79,000 38 19 76 57 64,750 9,250 92,500 18,500 Total 190 185,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Cost Allocation Base $ 84,400 Number of employees 69,000 Square feet occupied 32,000 Asset values $ 185,400 Insurance Total Allocate each of the three indirect expenses to the four departments. Supervision Cost to be Allocated Allocation Base Percent of Allocation Base Allocated Cost expenses Department Numerator Denominator % of Total Materials Personnel Manufacturing Packaging Totals Cost to be Allocated Utilities Allocation Base Percent of Allocation Base Allocated Cost Department Numerator Denominator % of Total…arrow_forwardRenata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Square Feet Asset Values Employees Materials 26 30,000 $ 9,300 Personnel 13 12,000 2,480 Manufacturing Packaging 52 66,000 37,820 39 12,000 12,400 Total 130 120,000 $ 62,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Insurance Total Cost $ 82,700 Number of employees Allocation Base 52,000 Square feet occupied 23,500 Asset values $ 158,200 Allocate each of the three indirect expenses to the four departments.arrow_forward

- Koehl Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Administrative and Facilities, and two operating departments, Assembly and Wholesaling. Service Departments Operating Department Assembly wholesaling $ 185,580 Administrative Facilities $ 19,440 $ 71,340 $ 392,950 Departmental costs Employee hours Space occupied 2,000 1,000 14,000 2,000 4,000 22,000 2,000 39,000 Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied. The total Wholesaling Department cost after the allocations of service department costs is closest to: Multiple Choice $403.990 $396,430 $403,642 $402,601arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forwardBluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Administration Accounting Domestic International Employees — 25 15 60 Transactions 50,000 — 10,000 40,000 Department direct costs $ 61,000 $ 22,500 $ 155,000 $ 593,000 BluStar estimates that the cost structure in its operations is as follows. Administration Accounting Domestic International Variable costs $ 23,500 $ 5,200 $ 114,500 $ 425,000 Fixed costs 37,500 17,300 40,500 168,000 Total costs $ 61,000 $ 22,500 $ 155,000 $ 593,000 Avoidable fixed costs $ 9,750 $ 4,000 $ 18,000 $ 114,000 Required: a. If BluStar outsources the Administration Department, what is…arrow_forward

- Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs From: Service department costs HR Total $ IT 0 20 $ 156,800 Required: Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. IT HR 1,585 0 $ 249,030 0 $ Publishing 2,536 30 $ 433,400 Cost Allocation To: HR 0 Publishing LA Binding 2,219 50 $ 398,500 0 $ Binding 0arrow_forwardManagement at C. Pier Press has decided to allocate costs of the paper’s two support departments (administration and human resources) to the two revenue-generating departments (advertising and circulation). Administration costs are to be allocated on the basis of dollars of assets employed; human resources costs are to be allocated on the basis of number of employees. The following costs and allocation bases are available: Department Direct Costs Number of Employees Assets Employed Administration $390,750 5 $193,550 Human resources 246,350 4 145,850 Advertising 478,900 6 381,200 Circulation 676,300 13 935,150 Totals $1,792,300 28 $1,655,750 a. Using the direct method, allocate the support department costs to the revenue-generating departments.Total service costs allocated to Advertising: Answer 1 Total service costs allocated to Circulation: Answer 2 b. Using your answer to (a), what are the total costs of the revenue-generating departments after…arrow_forwardInterdepartment Services: Step Method Jane Cooper's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. Copper's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $15,600 $6,400 15 $ 33,500 $ 24,400 $40,000 24 12 12 $ 12,000 $6,600 $ 21,200 $26,100 $ 16,200 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 0 % % (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning