Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the company's ROS?

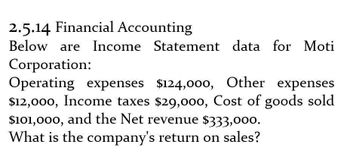

Transcribed Image Text:2.5.14 Financial Accounting

Below are Income Statement data for Moti

Corporation:

Operating expenses $124,000, Other expenses

$12,000, Income taxes $29,000, Cost of goods sold

$101,000, and the Net revenue $333,000.

What is the company's return on sales?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardWhat is the gross profit margin?? General accountingarrow_forward2.5.14 Financial Accounting Below are Income Statement data for Moti Corporation: Operating expenses $124,000, Other expenses $12,000, Income taxes $29,000, Cost of goods sold $101,000, and the Net revenue $333,000. What is the company's return on sales?arrow_forward

- What is the net income from the following statement?arrow_forwardFind the ROS?arrow_forwardEdison Company reported the following for the current year: $ 84,000 59,000 21,080 63,000 77,080 Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Profit Margin Ratio Compute the return on total assets. Return On Total Assets Numerator: 7 7 7 Return On Total Assets Denominator: = Return On Total Assets Return on total assets II =arrow_forward

- Edison Company reported the following for the current year: $ 84,000 59,000 21,000 63,000 77,000 Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Return On Total Assets Profit Margin Ratio Compute the profit margin ratio. Numerator: 1 1 1 Profit Margin Ratio Denominator:arrow_forwardWhat is the gross margin? General accountingarrow_forwardUse the following information to construct an income statement. Interest Expense Cost of Goods Sold Other Operating Expenses $350,196 $11,519,888 $244,807 Sales Depreciation Expense Flat Tax Rate $19,244,808 $467,723 21% What was the firms Net Profit Margin? (answer in decimal form and round to three decimal places; 7.6% = .076)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning