Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide correct answer not use ai.general accounting

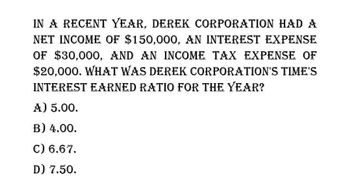

Transcribed Image Text:IN A RECENT YEAR, DEREK CORPORATION HAD A

NET INCOME OF $150,000, AN INTEREST EXPENSE

OF $30,000, AND AN INCOME TAX EXPENSE OF

$20,000. WHAT WAS DEREK CORPORATION'S TIME'S

INTEREST EARNED RATIO FOR THE YEAR?

A) 5.00.

B) 4.00.

C) 6.67.

D) 7.50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardGive me answer for this questionarrow_forwardIn the recent year Hill Corporation had net income of $140,000, interest expense of $40,000, and tax expense of $20,000. What was Hill Corporation's times interest earned ratio for the year? Select one: О а. 4.0 O a. ОБ. 3.5 Ob. 3.0 d. 5.0arrow_forward

- Need help for this questionarrow_forwardProvide correct answer for this questionarrow_forwardSprout Company reported the following on the company's income statement in two recent years: Current Year Prior Year Interest expense $510,000 $480,000 Income before income tax expense 5,610,000 6,720,000 a. Determine the times interest earned ratio for the current year and the prior year. Current year Prior Year b. Is the times interest earned ratio improving or declining?arrow_forward

- In recent year Palestine Corporation had a net income of $12,500, interest expense of $2,500, and a times interest earned of 9. What was Palestine Corporation’s income before taxes for the year?arrow_forwardLast year, Emmy Company had a net income of P170,000, income tax expense of P37,000, and interest expense of P24,000. Emmy’s times-interest-earned ratio was closest to * Choices: 9.63. 6.24. 8.63. 7.08.arrow_forwardNational Company's net income last year was P65,000 and its interest expense was P15,000. Total assets at the beginning of the year were P630,000 and total assets at the end of the year were P650,000. The company's income tax rate was 25%. The company's return on total assets (based on adjusted net income) for the year was closest to?arrow_forward

- Loomis, Inc. reported the following on the company’s income statement in two recent years: Please see the image for details: a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place.b. Is this ratio improving or declining?arrow_forward.arrow_forward. Great Products, Inc. reported the following on the company’s income statement in two recent years:Current Year Prior YearInterest Expense $270,000 $250,000Income before income tax expense 4,212,000 3,450,000a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place. b. Is the times interest earned ratio improving or declining?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning