Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

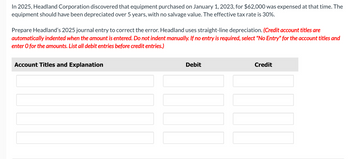

Transcribed Image Text:In 2025, Headland Corporation discovered that equipment purchased on January 1, 2023, for $62,000 was expensed at that time. The

equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%.

Prepare Headland's 2025 journal entry to correct the error. Headland uses straight-line depreciation. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In 2025, Teal Corporation discovered that equipment purchased on January 1, 2023, for $40,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Prepare Teal's 2025 journal entry to correct the error. Teal uses straight-line depreciation. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardIn 2020, Pina Corporation discovered that equipment purchased on January 1, 2018, for $47,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Pina uses straight-line depreciation. Prepare Pina's 2020 journal entry to correct the error. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardfix the last two boxes in red and replace the numbers with correct calculationsarrow_forward

- In 2025, Sandhill Company discovered an error while preparing its 2025 financial statements. A building constructed at the beginning of 2024 costing $1299900 has not been depreciated. The estimated useful life of the building is 30 years with no salvage value. Straight-line depreciation is used. Sandhill properly included depreciation on its tax return also using straight-line depreciation. Income tax payable was also reported correctly at a tax rate of 20%. Income before depreciation expense in 2025 was $400000. What was the impact on the following accounts at the start of 2025? Accumulated Depreciation was understated by $86660 and Retained Earnings was overstated by $34664. O Accumulated Depreciation was understated by $43330 and Retained Earnings was overstated by $34664. O Accumulated Depreciation was overstated by $43330 and net income was understated by $43330. O Accumulated Depreciation was understated by $43330 and net income was overstated by $43330.arrow_forwardIn 2025, Ivanhoe Company discovered an error while preparing its financial statements. A building constructed at the beginning of 2024 costing $1350000 has not been depreciated. The estimated useful life of the building is 30 years with no salvage value. Straight- line depreciation is used. Ivanhoe also used straight-line depreciation for tax purposes and properly included depreciation on its tax return. Income tax payable was also reported correctly at a tax rate of 20%. Income before tax and depreciation expenses in 2025 was $450000 What would be the 2025 net income if depreciation had been recorded properly? $324000 O $414000 Ⓒ$405000 $450000 eTextbook and Mediaarrow_forwardIn 2023, Carla Vista Corporation, which follows IFRS, discovered that equipment purchased on January 1, 2021, for $152,200 was expensed in error at that time. The equipment should have been depreciated over five years, with no residual value. The tax rate is 30%. Prepare a single journal entry for 2023 to correct the error and record 2023 depreciation. Assume income and capital cost allowance was reported accurately for tax purposes in all years. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Equipment Deferred Tax Liability Depreciation Expense Accumulated Depreciation - Equipment Retained Earnings Debit 152200 30440 Credit 27396 91320 54792arrow_forward

- In 2026, after the 2025 financial statements were issued, internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2021. The machine’s useful life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, prepare the journal entry PKE will use to correct the error.arrow_forwardIn 2021, internal auditors discovered that PKE Displays, Inc., had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2018. The machine’s useful life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, what journal entry will PKE use to correct the error?arrow_forwardIn 2024, internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2021. The machine’s useful life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, prepare the journal entry PKE will use to correct the error (before adjusting and closing entries). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

- In 2024, internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $300,000 cost of a machine purchased on January 1, 2021. The machine’s useful life was expected to be four years with no residual value. Straight-line depreciation is used by PKE. Ignoring income taxes, prepare the journal entry PKE will use to correct the error (before adjusting and closing entries). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardIn 2017, Bailey Corporation discovered that equipment purchased on January 1, 2015, for $50,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Prepare Bailey’s 2017 journal entry to correct the error. Bailey uses straight-line depreciationarrow_forwardMorrow Computer Company acquired a circuit board stamping machine for $760,000 on December 31, 2019. The general accountant incorrectly coded the invoice as repair expense. The equipment would normally be depreciated straight-line over 5 years with no salvage value. Morrow discovered the errror on December 31, 2022, before closing the books for 2022. Prepare the correcting entry for this transaction, ignoring income taxes. (Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, 2022 (Correcting Entry)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT