Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please solve this accounting problem

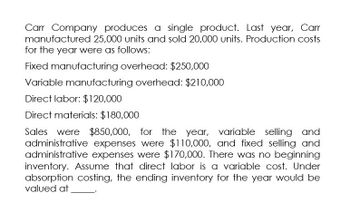

Transcribed Image Text:Carr Company produces a single product. Last year, Carr

manufactured 25,000 units and sold 20,000 units. Production costs

for the year were as follows:

Fixed manufacturing overhead: $250,000

Variable manufacturing overhead: $210,000

Direct labor: $120,000

Direct materials: $180,000

Sales were $850,000,

$850,000, for the year, variable selling and

administrative expenses were $110,000, and fixed selling and

administrative expenses were $170,000. There was no beginning

inventory. Assume that direct labor is a variable cost. Under

absorption costing, the ending inventory for the year would be

valued at

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardLast year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was a. 55,500 b. 92,500 c. 66,500 d. 39,900arrow_forwardOrinder Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 275,800, direct labor cost was 153,000, and overhead cost was 267,300. There were 25,000 units produced. Unit manufacturing cost (rounded to the nearest cent) is a. 28.40 b. 27.98 c. 34.95 d. 27.55arrow_forward

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardLast year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was Refer to the information in 2.24. The gross margin percentage for last year was a. 12.57% b. 55.67% c. 28.95% d. 38.33%arrow_forwardNatur-Gro, Inc., manufactures composters. Based on past experience, Natur-Gro has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 264,000 + 1.42X, where X equals number of composters. Last year, Natur-Gro produced 30,000 composters. Actual overhead costs for the year were as expected. Total overhead for per unit was a. 1.42 b. 8.80 c. 11.63 d. 10.22arrow_forward

- Kildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.arrow_forwardColonels uses a traditional cost system and estimates next years overhead will be $480,000, with the estimated cost driver of 240,000 direct labor hours. It manufactures three products and estimates these costs: If the labor rate is $25 per hour, what is the per-unit cost of each product?arrow_forwardBobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forward

- SmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardDuring the week of May 10, Hyrum Manufacturing produced and shipped 16,000 units of its aluminum wheels: 4,000 units of Model A and 12,000 units of Model B. The cycle time for Model A is 1.09 hours and for Model B is 0.47 hour. The following costs and production hours were incurred: Required: 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Assume that Model A is responsible for 40% of the materials cost. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.arrow_forwardMoleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning