FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

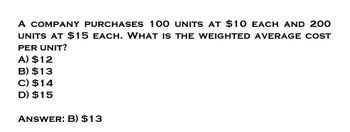

Transcribed Image Text:A COMPANY PURCHASES 100 UNITS AT $10 EACH AND 200

UNITS AT $15 EACH. WHAT IS THE WEIGHTED AVERAGE COST

PER UNIT?

A) $12

B) $13

C) $14

D) $15

ANSWER: B) $13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Yanks Ltd uses the following cost function: Y = $7000 + $8.50X. If the number of units produced in a month is 200, what would be the total cost?arrow_forwardhelp mearrow_forwardIf cost of goods sold is $520,000 and the gross profit rate is 20%, what is the gross profit? Select one: a. $2,600,000. b. $130,000. c. $ 520,000. d. $416,000.arrow_forward

- VC per unit when LAV is 100 units = $ 20FC per unit when LAV is 200 units = $ 10Required: Calculate each of the following:1. Total costs of production when LAV is 100 units = $2. Total costs of production when LAV is 200 units = $ 3. Total costs of production when LAV is 50 units $4. Total costs of production when LAV is 400 units = $5. Total costs of production when LAV is Zero units = 56. Unit cost when LAV is 500 units = $7. 8. Unit cost when LAV is 20 units = $9. Unit cost when LAV is 250 units = $10. Unit cost when LAV is 1 unit = $ Unit cost when LAV is Zero units = =arrow_forwardAssume that the linear cost and revenue models apply. An item costs $13 to make. If fixed costs are $1600 and profits are $5700 when 100 items are made and sold, find the revenue equation. (Let x be the number of items.)R(x) =arrow_forwardGladstorm Enterprises sells a product for $48 per unit. The varlable cost is $32 per unit, while fxed costs are $10,560. Determine the following: Round your answers to the nearest whole number. a. Break-even point in sales units units b. Break-even point in sales units if the selling price Increased to $62 per unit unitsarrow_forward

- please solve the question with calculationarrow_forwardA company has assessed the profitability of its three products as shown here: Product A Product B Product C Total Sales (units) 3,000 5,000 2,000 10,000 £ £ Price 15.00 10.00 5.00 Variable costs 6.00 4.00 3.00 Divisible fixed costs 2.00 1.00 0.50 Non-divisible fixed costs 2.00 2.00 2.00 Profit/(Loss) 5.00 3.00 (0.50) As a result of this, it has been suggested that Product C should be dropped. All other things being equal what would be the financial impact of dropping Product C? A B Profit would increase by £1,000. Profit would increase by £2,000. Profit would fall by £3,000. C D Profit would fall by £4,000. £arrow_forwardWhat is the economic order quantity?arrow_forward

- Unit operating expenses for an item costing $54 are estimated at 30% of cost, and the desired operating profit is 20% of cost a. Determine the selling price. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Selling price b. Determine the rate of markup on cost. (Do not round intermediate calculations and round your final answer to 1 decimal place) Markup on cost c. Determine the rate of markup on selling price (Do not round Intermediate calculations and round your final answer to 1 decimal place.) Markup on selling pricearrow_forwardXYZ Company sells a product for $45 per unit. The cost of one unit is $36. The estimated cost to complete a unit is $8, and the estimated cost to sell is $5. At what amount per unit should the product be reported, applying lower-of-cost-or-net realizable value? 0 37 Ⓒ 49 0 36 O 32arrow_forwarde If the sale price is 30% more than costs, and the profit for each sold unit is GHS 120, the cost price per unit is : A. GHS 360 B. GHS 172 OC. GHS 400 D. GHS 560arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education