Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help

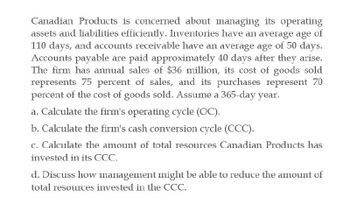

Transcribed Image Text:Canadian Products is concerned about managing its operating

assets and liabilities efficiently. Inventories have an average age of

110 days, and accounts receivable have an average age of 50 days.

Accounts payable are paid approximately 40 days after they arise.

The firm has annual sales of $36 million, its cost of goods sold

represents 75 percent of sales, and its purchases represent 70

percent of the cost of goods sold. Assume a 365-day year.

a. Calculate the firm's operating cycle (OC).

b. Calculate the firm's cash conversion cycle (CCC).

c. Calculate the amount of total resources Canadian Products has

invested in its CCC.

d. Discuss how management might be able to reduce the amount of

total resources invested in the CCC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Berry Manufacturing turns over its inventory 8 times each year, has an Average Payment Period of 35 days and has an Average Collection Period of 60 days. The firm’s annual sales are $3.5 million. Assume there is no difference in the investment per dollar of sales in inventory, receivable, and payables and that there is a 365-day year. A. Calculate the Firm’s Operating Cycle. B. Calculate the Firm’s Cash Conversion Cycle. C. Calculate the Firm’s Daily Cash Operating Expenditure.arrow_forwardSuppose that Dunn Industries has annual sales of $2.3 million, cost of goods sold of $1,650,000, average inventories of $1,116,000, and average accounts receivable of $750,000. Assume that all of Dunn’s sales are on credit.What will be the firm’s operating cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardNonearrow_forward

- Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets New funds $7 25 28 $ 60 45 Balance Sheet (in $ millions) $ 105 Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity X Answer is complete but not entirely correct. $ 11,900,000 X $ 20 7 13 $ 40 Owen's Electronics has an aftertax profit margin of 10 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the…arrow_forwardOwen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets Balance Sheet (in $ millions) Liabilities and Stockholders' Equity $ 2 Accounts payable 22 24 $ 48 43 Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings $91 Total liabilities and stockholders' equity $ 16 4 10 $30 Answer is complete but not entirely correct. New funds $ 8,075,000 > 12 17 32 $ 91 Owen's Electronics has an aftertax profit margin of 6 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to…arrow_forwardOwen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Cash Accounts receivable Inventory Current assets Fixed assets Total assets New funds Assets E 122 TOLCIE E S Balance Sheet (in $ millions) E $ 12 27 28 $ 67 45 N Owen's Electronics has an aftertax profit margin of percent and a dividend payout ratio of 40 percent. If sales grow by 30 percent next year, determine how many dollars of new funds are needed to finance the growth. Note: Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g., $1,234,567). $ 112 Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock…arrow_forward

- Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets $ 10 32 33 $ 75 New funds $118 Balance Sheet (in $ millions) Liabilities and Stockholdera Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity $18 7 11 $ 36 14 17 51 $118 TOUS REPOR Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 50 percent. STA U SLU KUTEN HOTEL If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not…arrow_forwardCamp Manufacturing turns over its inventory eight times each year, has an average payment period of 35 days, and has an average collection period of 60 days. The firm’s annual sales are $3.5 million. Assume there is no difference in the investment per dollar of sales in inventory, receivables, and payables and that there is a 365-day year. If the firm pays 14% for these resources, by how much would it increase its annual profits by favorably changing its current cash conversion cycle by 20 days?arrow_forwardWhat is the DSO?arrow_forward

- I need solutionarrow_forwardNeed answer the financial accounting questionarrow_forwardThe S&H construction company expects to have total sales next year totaling $15,300. In addition, the firm pays taxes at 35 percent and will owe $280,000 in interest expense. Based on last year’s operations the firm’s management predicts that its cost of goods sold will be 57 percent of sales and operating expenses will total 32 percent. What is your estimate of firm’s net income after taxes for the coming year? Complete the forma income statement below Round to the nearest dollar Pro-forma income statement Sales Cost of goods sold Gross profit Operating expenses Net operating income Interest expenses Earnings before taxes Taxes Net incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT