Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Don't use Ai

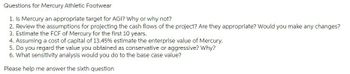

Transcribed Image Text:Questions for Mercury Athletic Footwear

1. Is Mercury an appropriate target for AGI? Why or why not?

2. Review the assumptions for projecting the cash flows of the project? Are they appropriate? Would you make any changes?

3. Estimate the FCF of Mercury for the first 10 years.

4. Assuming a cost of capital of 13.45% estimate the enterprise value of Mercury.

5. Do you regard the value you obtained as conservative or aggressive? Why?

6. What sensitivity analysis would you do to the base case value?

Please help me answer the sixth question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The management of Kawneer North America is considering investing in a new facility and the following cash flows are expected to result from the investment: A. What is the payback period of this uneven cash flow? B. Does your answer change if year 10s cash inflow changes to $500,000?arrow_forwardA. Estimate the free cash flow to the firm for each of the 4 years. B. Compute the payback (using free cash flows) period for investors in the firm. C. Compute the net present value and internal rate of return to investors in the firm.Would you accept the project? Why or why not? D. How will you incorporate this information in your existing analysis? Compute the newFCF side costs and benefits. Calculate the new NPV and IRR. Would you accept the project? Using A, B C with the first picture.arrow_forwardEach of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,950,000 and will last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $280,000. She estimates that the return from owning her own shop will be $45,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a…arrow_forward

- 4. Middleton Classics would like to test the sensitivity of the estimates used for the input data to compute the net present value and internal rate of return on this investment. Ignore the payback period and the accounting rate of return. Consider a, b, and c below independently by holding everything else constant: a. What is the minimum cost of the investment (to the nearest $100) needed for the owner to accept it? b. Reset cost to $500,000. What is the minimum salvage value (to the nearest $100) needed for the owner to accept it? c.Reset salvage value to $25,000. What is the minimum annual cash flow (to the nearest $100) needed for the owner to accept it? How sensitive to changes in the input data is the decision to accept or reject this investment? Do you have to change the estimates a lot or just a little to make the investment acceptable? Comment on the results of each of these analyses.arrow_forwardCan you answer these in Excel (and show any calculation formulas). See the attached image for the information. 1. What is the payack period, NPV, IRR? 2. What happens to the NPV and IRR if initial capital goes up 30%? 3. How much would the selling price have to increase to compensate for 30% in capital costs to the original level in 1.? 4. What is your recomendation?arrow_forwardEconomics a) What is FW of Machine A? b) What is FW of Machine B? c) What is FW of Machine C?arrow_forward

- solve and show your solution and explanations.arrow_forwardYou are considering an investment in a clothes distributer. The company needs $105,000 today and expects to repay you $120,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 17%. What does the IRR rule say about whether you should invest? What is the IRR of this investment oppurtunity? The IRR of this investment opppurtunity is ____%arrow_forwardAssume that the capital requirement of "Purchase new equipment" in Year 3 is 3000. Suppose that if basic research is carried out, the advertising campaign must also be conducted. Add this constraint to your model and find the new optimal solution. What is the optimal revenue?arrow_forward

- Plss show complete steps thanks. All parts it is one question only or I'll dislike. I will like for complete ans. With formulaarrow_forwardA company is considering three alternative Investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Complete this question by entering your answers in the tabs below. a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will It accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Required A Required B Compute the net present value of each project. Potential Projects Project A Present value of net cash flows Initial investment Net present value Required C Project E Project C $10,685 (10,000)arrow_forwardA firm is considering two investment projects, Y and Z. These projects are NOT mutually exclusive. Assume the firm is not capital constrained. The initial costs and cashflows for these projects are: 0 1 2 3 Y -40,000 17,000 17,000 15,000 Z -28,000 12,000 12,000 20,000 Using a discount rate of 9% calculate the net present value for each project. What decision would you make based on your calculations? How would your decision change if the discount rate used for calculating the net present value is 15%? Calculate an approximate IRR for each project. Assume the hurdle rate is 9%. What decision would you make based on your calculations? Calculate the payback period for each project. The company looks to select investment projects paying back in 2 years. What decision would you make based on your calculations? Critically discuss Net Present Value (NPV), Internal Rate of Return (IRR) and payback period as criteria for investment appraisal.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College