EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

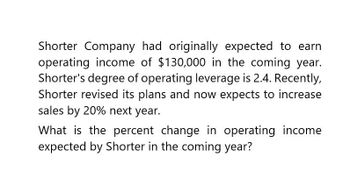

Transcribed Image Text:Shorter Company had originally expected to earn

operating income of $130,000 in the coming year.

Shorter's degree of operating leverage is 2.4. Recently,

Shorter revised its plans and now expects to increase

sales by 20% next year.

What is the percent change in operating income

expected by Shorter in the coming year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose the company has just the opposite news and now expects unit sales for August, September, and October to be double (200%) the original estimates. What effect will this have on the company’s net income and borrowing? Explain your findings.arrow_forwardData on Wentz Inc. for last year are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average. If this were done, by how much would payables increase? Use a 365-day year. Cost of goods sold = $74,000 Payables = $5,000 Payables Deferral Period (PDP) = 24.66 Benchmark Payables Deferral Period = 34.00 Please explain process and show calculations.arrow_forwardA product has sales of $7M this year, but sales are expected to decline at 10% per year until it is discontinued after year 5. If the firm’s interest rate is 15%, calculate the PW of the revenues.arrow_forward

- The Frozen North Construction Company would like to forecast its minimum volume of work (turnover) in order to “break even” (i.e., cover its corporate overheads) for the coming year. The company’s previous year’s corporate overheads were $900,000. The company anticipates 22% inflation and 6% growth in the firm for the coming year. It also expects to achieve a gross margin of 13% on its projects, based on old experience. The company defines gross margin as a percentage of revenue (i.e., selling price). Determine the minimum volume of work, which will allow the Frozen North Company to break even at the end of the coming year.arrow_forwardConsider the following scenario: Blue Hamster Manufacturing Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Blue Hamster is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 65% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Blue Hamster expects to pay $200,000 and $2,280,656 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Blue Hamster, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Blue Hamster Manufacturing Inc. Income Statement for Year Ending December…arrow_forwardConsider the following scenario: Green Caterpillar Garden Supplies Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Green Caterpillar expects to pay $100,000 and $1,759,500 of preferred and common stock dividends, respectively. A. Complete the Year 2 income statement data for Green Caterpillar, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Green Caterpillar…arrow_forward

- Consider the following scenario: Green Caterpillar Garden Supplies Inc.'s Income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before Interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Green Caterpillar expects to pay $100,000 and $1,759,500 of preferred and common stock dividends, respectively. Complete the Year 2 Income statement data for Green Caterpillar, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Net sales Less: Operating costs, except depreciation…arrow_forwardRam Company had $1,000,000 of sales with a CM ratio of 30% and fixed expenses of $250,000 this year. Assume that the company’s sales will increase by $150,000 next year. If there is no change in fixed expenses, by how much will net operating income increase? a) 45,000 b) 60,000 c) 30,000 d) 15,000arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 1.Calculate the payback period for both products in years and months, not as a decimal. Please present answer to nearest half a month.arrow_forward

- The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $68 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 68 Variable costs (80% of revenue) 1,440 Depreciation 80 Interest (8% of beginning-of-year debt) 24 Taxable income 188 Taxes (at 40%) 75 Net income $ 113 Dividends $ 75 Addition to…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 60 Variable costs (80% of revenue) 1,440 Depreciation 80 Interest (8% of beginning-of-year debt) 24 Taxable income 196 Taxes (at 40%) 78 Net income $ 118 Dividends $ 79 Addition to…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company's policy is to pay out two- thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019 (Figures in $ thousands) Revenue $1,800 Fixed costs Variable costs (80% of revenue) Depreciation Interest (8% of beginning-of-year debt) Taxable income Taxes (at 40%) 60 1,440 80 24 196 78 Net income 118 Dividends Addition to retained earnings $ 79 $ 39 BALANCE SHEET, YEAR-END (Figures in $ thousands) 2019 Assets Net working capital Fixed assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning