Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide correct solution

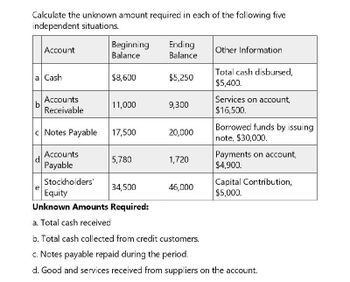

Transcribed Image Text:Calculate the unknown amount required in each of the following five

independent situations.

Account

Beginning

Balance

Ending

Other Information

Balance

Total cash disbursed,

a Cash

$8,600

$5,250

$5,400.

Accounts

Services on account,

b

11,000

9,300

Receivable

$16,500.

Borrowed funds by issuing

c Notes Payable

17,500

20,000

note, $30,000.

Accounts

Payments on account,

5,780

1,720

Payable

$4,900.

Stockholders'

Capital Contribution,

34,500

46,000

Equity

$5,000.

Unknown Amounts Required:

a. Total cash received

b. Total cash collected from credit customers.

c. Notes payable repaid during the period.

d. Good and services received from suppliers on the account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- In reviewing the Accounts Receivable, the Net Cash Realizable Value is __ before a write off of $1500. What is the Net Cash Realizable Value after the write off?a. $16,000b. $1500c. $17300d. $14500arrow_forwardCalculate the unknown amount required in each of the following five independent situations. The answer to situation (a) is given as an example: Account Beginning Balance Ending Balance Other Information a. Cash $7,000 $5,250 Total cash disbursed, $5,400. b. Accounts Receivable 11,000 9,300 Services on account, $16,500. c. Notes Payable 17,500 23,000 Borrowed funds by issuing a note, $30,000. d. Accounts Payable 2,500 1,720 Payments on account, $3,900. e. Stockholders’ Equity 29,000 46,000 Capital Contribution, $7,000. Unknown Amounts Required a. Total cash received $3,650 b. Total cash collected from credit customers Answer c. Notes payable repaid during the period Answer d. Good and services received from suppliers on account Answer e. Net income, assuming that no dividends were paid Answerarrow_forwardCalculate the cash discount and the net amount due the transaction (in $). Amount ofInvoice Terms ofSale CashDiscount NetAmount Due $15,660.00 2/10, n/45 $ $arrow_forward

- Reconciliation of Heaven Company’s bank account atMay 31 is:Balance per bank statement 2,100,000Deposits in transit 300,000Checks outstanding ( 30,000)Correct cash balance 2,370,000Balance per book 2,372,000Bank service charge ( 2,000)Correct cash balance 2,370,000June data are as follows:BankTotal credits P1,620,000Total debits 2,300,000Collection by bank (P400,000Note plus interest)420,000NSF check 10,000Balance 1,420,000BooksDeposits recorded 1,800,000Checks recorded 2,360,000Balance 1,810,000 The deposits in transit on June 30 amount toa. P120,000 c. P900,000b. P480,000 d. P 0arrow_forwardI need to calculate the horizontal and vertical analysis for the following image that is attached.arrow_forwardWhat will be the journal entry to record the issue of note of $30,000 to a creditor who has agreed to pay the amount on the specified terms as per the note agreement? а. Ref. Debit(in S) Credit(in S) 30,000 Date Description |Notes Payable Cash |To record the issue of note against the amount due) $ 30,000 b. Date Description Ref. Debit(in $) | Credit(in S) |Notes Payable Accounts Payable |To record the issue of note against the amount due) 30,000 $ 30,000 с. |Ref. Debit(in S) Credit(in S)_ 30,000 Date Description |Accounts Payable Notes Payable |To record the issue of note against the amount due) 30,000 d. |Ref. Debit(in $) Credit(in $) 30,000 Description Date Accounts Payable Cash |(To record the issue of note against the amount due) 30,000arrow_forward

- Consider the three independent situations below (amounts are $ in millions): Situation SalesRevenue Accounts ReceivableIncrease (Decrease) Cash Receivedfrom Customers 1. 2. 3. 200 200 200 -0- 30 (30) ? ? ? Required: 1. Calculate cash received from customers. 2. Prepare the summary journal entry for each situation.arrow_forwardWhich of the following is the correct journal entry to convert a $6,300 account payable to a note payable? Cash $6,300 Notes Payable $6,300 Notes Receivable $6,300 Notes Payable $6,300 Notes Payable $6,300 Cash $6,300 Accounts Payable $6,300 Notes Payable $6,300arrow_forwardSubject:-- general accountingarrow_forward

- Bank Reconciliation Activity The accounting records and bank statement of Entity A shows the following information: (The attached picture) Additional Information:a. The payments of P2,000 and P50,000 shown on the bank statement pertain to the cost of checkbook requested from the bank and the monthly amortization of a bank loan,respectively. The loan payment includes payment for interest of P8,000. b. Deposits shown on the bank statement but not on the cash ledger represent collections of accounts receivable. Requirements:1. Prepare the bank reconciliation.2. Prepare the journal entries to record the adjusting entries on the books of Entity A.arrow_forwardExplain in detail pleasearrow_forwardThe accompanying table, Data table Date Deposit (Withdrawal) Date Deposit (Withdrawal) 1/1/20 $8,000 1/1/22 $3,272 1/1/21 $(6,540) 1/1/23 $5,255 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) , shows a series of transactions in a savings account. The account pays 5% simple interest, and the account owner withdraws interest as soon as it is paid. Calculate the following: a. The account balance at the end of each year. (Assume that the account balance at December 31, 2019, is zero.) b. The interest earned each year. c. The true rate of interest that the investor earns in this account. Question content area bottom Part 1 a. The account balance at the end of 2020 is $8,0008,000. (Round to the nearest dollar.) Part 2 The account balance at the end of 2021 is $1,9531,953. (Round to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you