Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

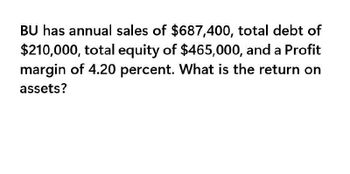

What is the return on assets? General accounting

Transcribed Image Text:BU has annual sales of $687,400, total debt of

$210,000, total equity of $465,000, and a Profit

margin of 4.20 percent. What is the return on

assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TJ's has annual sales of $813,200, total debt of $171,000, total equity of $396,000, and a profit margin of 5.78 percent. What is the return on assets? A) 8.29 percent B) 6.48 percent C) 9.94 percent D) 7.78 percent E) 8.02 percentarrow_forwardon the pro forma income statement sales are expected to increase by 23%. If the net margin is expected to increase by 18% and net profit last year was 100 million, what is the net profit projected to be? A) 118 million. B)123 million. C )158 million D) 141 millionarrow_forwardToby’s has a profit margin of 8.6 percent, a return on assets of 14.5 percent, and a debt to equity ratio of 1.4. What is the return on equity?arrow_forward

- Global Corp. expects sales to grow by 7% next year. Using the percent of sales method and the data provided in the given tables LOADING... , forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 26%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Income Statement Net Sales 185.3Costs Except Depreciation -175.4EBITDA 9.9Depreciation and Amortization -1.2EBIT 8.7Interest Income (expense) -7.7Pretax Income 1Taxes (26%) -0.3Net Income 0.7 Balance Sheet Assets Cash 23.4Accounts…arrow_forwardHere and Gone, Inc., has sales of $21,332,097, total assets of $12,393,090, and total debt of $2,713,037. If the profit margin is 9 percent, what is net income?arrow_forwardLadders, Inc. has a net profit margin of 5.2% on sales of $50.6 million. It has book value of equity of $38.1 million and total book liabilities of $30.9 million. What is Ladders' ROE? ROA? Note: Assume the value of Interest Expense is equal to zero. What is Ladders' ROE? Ladders' ROE is enter your response here %. (Round to two decimal places.) Part 2 What is Ladders' ROA? Ladders' ROA is enter your response here %. (Round to two decimal places.)arrow_forward

- The Optical Scam Company has forecast a sales growth rate of 20 percent for next year. Current assets, fixed assets, and short-term debt are proportional to sales. The current financial statements are shown here: Sales Costs Taxable income Taxes Net income Dividends Addition to retained earnings Current assets Fixed assets Total assets Assets Current assets Fixed assets INCOME STATEMENT Total assets $ 7,230,000 18,390,000 $ 1,149,982 1,724,853 Assets b-2. External financing needed c. Sustainable growth rate $ 25,620,000 a. Calculate the external funds needed for next year using the equation from the chapter. Note: Do not round intermediate calculations. External financing needed b-1. Prepare the firm's pro forma balance sheet for next year. Note: Do not round intermediate calculations. BALANCE SHEET Short-term debt Long-tern debt Common stock Accumulated retained earnings $ 30,500,000 26,077,300 $ 4,422,700 1,547,945 $ 2,874,755 Liabilities and Equity Total equity Total liabilities and…arrow_forward(B) Based on the following information, how much does the company need in external funds for the upcoming fiscal year? The company has Sales $ 5,700, Costs 4,200, Current assets 3,900, Fixed assets 8,100, Current liabilities 2,200, Long-term debt 3,750, and Equity 6,050. Sales increase 15% for the upcoming fiscal year. Payout ratio is 40% and Tax rate is 34%.arrow_forwardA company has the following items for the fiscal year 2020: Revenue = 10 million EBIT = 4 million Net income = 2 million Total Equity = 15 million Total Assets = 30 million Calculate the company’s net profit margin, asset turnover, equity multiplier and ROEarrow_forward

- Operating profit margin is 8.65%. Sales to assets ratio is 3.20. Assets are 630,000. Equity is $430,000. Interest payments are 43,000. Tax rate is 40%. What is the net income????arrow_forwardIF a corporation earns $270,000 and the payout ratio ( proportion distributed) is 30 percent, what is the change in returned earnings?arrow_forwardThe Burger Hut has sales of $29 million, total assets of $43 million, and total debt of $13 million. The profit margin is 11 percent. What is the return on assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you