Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is imact of this transaction?

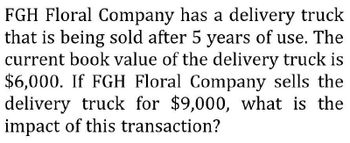

Transcribed Image Text:FGH Floral Company has a delivery truck

that is being sold after 5 years of use. The

current book value of the delivery truck is

$6,000. If FGH Floral Company sells the

delivery truck for $9,000, what is the

impact of this transaction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Grummet Company is acquiring a new wood lathe with a cash purchase price of $80,000. The Wood Master Industries (the manufacturer) has agreed to accept $23,500 at the end of each of the next 4 years. Based on this deal, how much interest will Grummet pay over the life of the loan?A. $94,000B. $80,000C. $23,500D. $14,000arrow_forwardKiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corp. The machine can be used for 10 years and then sold for $10,000 at the end of its useful life. Lollie has presented Kiddy with the following options: 1. Buy machine. The machine could be purchased for $160,000 in cash. All maintenance and insurance costs, which approximate $5,000 per year, would be paid by Kiddy. 2. Lease machine. The machine could be leased for a 10-year period for an annual lease payment of $25,000 with the first payment due immediately. All maintenance and insurance costs will be paid for by the Lollie Corp. and the machine will revert back to Lollie at the end of the 10-year period. Required: Assuming that a 12% interest rate properly reflects the time value of money in this situation and that all maintenance and insurance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore…arrow_forwardGrummet Company is acquiring a new wood lathe with a cash purchase price of $80,000. The Wood Master Industries (the manufacturer) has agreed to accept $23,500 at the end of each of the next 4 years. Based on this deal, how much interest will Grummet pay over the life of the loan? A. $94,000 B. $80,000 C. $23,500 D. $14,000arrow_forward

- XYZ Construction Inc. wants to purchase a new pick-up truck. The price for the new truck is $43,040. The dealer allows XYZ to trade-in the old truck for $7,162. XYZ can payback the remaining balance through a 4-year payment plan. Given the agreed interest rate is 3%: How much is the monthly payment?arrow_forwardXYZ Construction Inc. wants to purchase a new pick-up truck. The price for the new truck is $43, 688. The dealer allows XYZ to trade - in the old truck for $5,224. XYZ can payback the remaining balance through a 4-year payment plan. Given the agreed interest rate is 3%: How much is the monthly payment?arrow_forwardKiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corporation. The machine can be used for 11 years and then sold for $16,000 at the end of its useful life. Lollie has presented Kiddy with the following options: 1. Buy machine. The machine could be purchased for $166,000 in cash. All maintenance costs, which approximate $11,000 per year, would be paid by Kiddy. 2. Lease machine. The machine could be leased for a 11-year period for an annual lease payment of $31,000 with the first payment due immediately. All maintenance costs will be paid for by the Lollie Corporation and the machine will revert back to Lollie at the end of the 11-year period. Required: Assuming that a 11% interest rate properly reflects the time value of money in this situation and that all maintenance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations. Note:…arrow_forward

- Want Correct answer for this question so please provide itarrow_forwardBramble Corp. is purchasing new equipment with a cash cost of $312000 for an assembly line. The manufacturer has offered to accept $67900 payment at the end of each of the next six years. How much interest will Bramble Corp. pay over the term of the loan? O $95400. O $312000. O $67900. O $407400.arrow_forwardKiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corporation. The machine can be used for 10 years and then sold for $28,000 at the end of its useful life. Lollie has presented Kiddy with the following options: Buy machine. The machine could be purchased for $178,000 in cash. All maintenance costs, which approximate $23,000 per year, would be paid by Kiddy. Lease machine. The machine could be leased for a 10-year period for an annual lease payment of $43,000 with the first payment due immediately. All maintenance costs will be paid for by the Lollie Corporation and the machine will revert back to Lollie at the end of the 10-year period. Required: Assuming that a 9% interest rate properly reflects the time value of money in this situation and that all maintenance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations. Note:…arrow_forward

- Kiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corporation. The machine can be used for 15 years and then sold for $20,000 at the end of its useful life. Lollie has presented Kiddy with the following options: 1. Buy machine. The machine could be purchased for $170,000 in cash. All maintenance costs, which approximate $15,000 per year, would be paid by Kiddy. 2. Lease machine. The machine could be leased for a 15-year period for an annual lease payment of $35,000 with the first payment due immediately. All maintenance costs will be paid for by the Lollie Corporation and the machine will revert back to Lollie at the end of the 15-year period. Required: Assuming that a 12% interest rate properly reflects the time value of money in this situation and that all maintenance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations. Note:…arrow_forwardiSooky has a spotter truck with a book value of $52,000 and a remaining useful life of 5 years. At the end of the five years the spotter truck will have a zero salvage value. The market value of the spotter truck is currently $38,000. iSooky can purchase a new spotter truck for $132,000 and receive $32,200 in return for trading in its old spotter truck. The new spotter truck will reduce variable manufacturing costs by $26,200 per year over the five-year life of the new spotter truck. The total increase or decrease in income by replacing the current spotter truck with the new truck (ignoring the time value of money) is: Multiple Choice $32,200 decrease $32,200 increase $31,200 decrease $132,000 decrease $31,200 increasearrow_forwardiSooky has a spotter truck with a book value of $59,000 and a remaining useful life of 5 years. At the end of the five years the spotter truck will have a zero salvage value. The market value of the spotter truck is currently $41,500. iSooky can purchase a new spotter truck for $139,000 and receive $32,900 in return for trading in its old spotter truck. The new spotter truck will reduce variable manufacturing costs by $26,900 per year over the five- year life of the new spotter truck. The total increase or decrease in income by replacing the current spotter truck with the new truck (ignoring the time value of money) is: Multiple Choice $28,400 decrease $32,900 decrease $139,000 decrease $32.900 increase $28,400 increasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT