Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

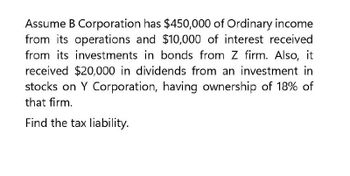

Transcribed Image Text:Assume B Corporation has $450,000 of Ordinary income

from its operations and $10,000 of interest received

from its investments in bonds from Z firm. Also, it

received $20,000 in dividends from an investment

stocks on Y Corporation, having ownership of 18% of

that firm.

Find the tax liability.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume B Corporation has $450,000 of Ordinary income from its operations and $10,000 of interest received from its investments in bonds from Z firm. Also, it received $20,000 in dividends from an investment in stocks on Y Corporation, having ownership of 18% of that firm. Find any deductions from the information provided above.(10)(Account)arrow_forwardfind the tax liabilityarrow_forwardHaricot Corporation and Pinto Corporation both have operating profits of $135 million. Haricot is financed solely by equity, while Pinto has issued $185 million of 6% debt. If the corporate tax rate is 21%: Required: a. How much tax does each company pay? b. What is the total payout to investors (debtholders plus shareholders) of each company? Complete this question by entering your answers in the tabs below. Required A Required B How much tax does each company pay? Note: Enter your answer in dollars not in millions. Haricot Pinto Tax Amountarrow_forward

- Haricot Corporation and Pinto Corporation both have operating profits of $195 million. Haricot is financed solely by equity, while Pinto has issued $245 million of 6% debt. If the corporate tax rate is 21%: Required: a. How much tax does each company pay? b. What is the total payout to investors (debtholders plus shareholders) of each company? Complete this question by entering your answers in the tabs below. Required A Required B How much tax does each company pay? Note: Enter your answer in dollars not in millions. Tax Amount Haricot Pintoarrow_forwardABC is all-equity financed and has net sales of $217,800, taxable income of $32,600, a return on assets of 11.5 percent, a tax rate of 21 percent, and total debt of $63,700. What are the values for the three components of the DuPont identity? a. 10.24 percent; 1.0282; .7156 b. 11.82 percent; .9725; 1.3975 O c. 11.82 percent: .9725; 7156 O d. 11.82 percent; 1.0282; 1.3975 e. 10.24 percent; 1.0282; 1.3975arrow_forwardCompany Z has $105,000 of taxable income from its operations, $7,000 of interest income, and $24,000 of dividend income from preferred stock it holds in other corporations. Its corporate tax r is 25%. What is Company Z's tax liability? Assume a 50% dividend exclusion for taxes on dividends. Oa. $26,250 O b. $31,000 c. $34,000 d. $32,250 e. $28,000arrow_forward

- Assume that a corporation has $100,000 of taxable income from operations plus $5,000 of interest income and $10,000 of dividend income. What is the company’s federal tax liability?arrow_forwardThe following information available from Petra+ Corporation: ROA Tax rate Total assets (include only $2 million financed by debts(12%) and $4 million owners' equity Management of Petra Co. wants to expand its operations with additional $4 million. It has two alt- First alternative: issue $2 million bonds (12 %) and the others by issue ordinary shares. . Second alternative: issue $4 million bonds (12%). Assume ROA remains unchanged. Then answer the following question (1-3): 1. ROCE before expansion, is: 2. ROCE if use fist alternative, is: 3. ROCE if use second alternative, is: O 9% 30% $6 millions Oarrow_forward20) A C corporation earns $8.30 per share before taxes and the company pays a dividend of $2.00 per share. The corporate tax rate is 39%, the personal tax rate on dividends is 18%, and the personal tax rate on non-dividend income is 36%. What is the after-tax amount an individual would receive from the dividend? A) $1.49 B) $1.28 C) $1.22 D) $1,64arrow_forward

- Quantitative Problem: Andrews Corporation has income from operations of $223,000. In addition, it received interest income of $22,300 and received dividend income of $31,100 from another corporation. Finally, it paid $11,600 of interest income to its bondholders and paid $46,800 of dividends to its common stockholders. The firm's federal tax rate is 21%. What is the firm's federal income tax? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardMerritt stone works is all - equity financed and has net sales of $217,800, taxable income of $32,600 a return on assets of 11.5percent, a tax rate of 21 percent and rotal debt of $63, 700. What are the value for the three components of the DuPont Identity?arrow_forwardHaricot Corporation and Pinto Corporation both have operating profits of $155 million. Haricot is financed solely by equity, while Pinto has issued $205 million of 5% debt. If the corporate tax rate is 21%:Required:How much tax does each company pay? What is the total payout to investors (debtholders plus shareholders) of each company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning