Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Blue Peak Industries began the year 2023 with.... Please answer the financial accounting question

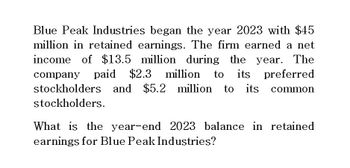

Transcribed Image Text:Blue Peak Industries began the year 2023 with $45

million in retained earnings. The firm earned a net

income of $13.5 million during the year. The

company paid $2.3 million to its preferred

stockholders and $5.2 million to its common

stockholders.

What is the year-end 2023 balance in retained

earnings for Blue Peak Industries?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- a. Sales for 2018 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciationand amortization were 11% of net fixed assets, interest was $8,575,000, thecorporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Giventhis information, construct the firm’s 2018 income statement.b. Construct the statement of stockholders’ equity for the year ending December 31, 2018,and the 2018 statement of cash flows.c. Calculate 2017 and 2018 net operating working capital (NOWC) and 2018 free cashflow (FCF). Assume the firm has no excess cash.d. If Laiho increased its dividend payout ratio, what effect would this have on corporatetaxes paid? What effect would this have on taxes paid by the company’s shareholders?e. Assume that the firm’s after-tax cost of capital is 10.5%. What is the firm’s 2018 EVA?f. Assume that the firm’s stock price is $22 per share and that at year-end 2018 the firmhas 10 million shares outstanding. What is the firm’s MVA at year-end 2018?arrow_forwardSquare Hammer Corporation shows the following information on its 2018 income statement: Sales = $196,000; Costs = $84,000; Other expenses = $5,100; Depreciation expense = $9,000; Interest expense = $13,300; Taxes = $29,610; Dividends = $10,300. In addition, you're told that the firm issued $7,100 in new equity during 2018 and redeemed $8,700 in outstanding long-term debt. a. What is the 2018 operating cash flow? Operating cash flow b. What is the 2018 cash flow to creditors? Cash flow to creditorsarrow_forwardAt December 31, 2022, Cracker Company reported Retained Earnings of $20,000,000. In 2023, Cracker determined that 2021 amortization expense was understated by $1,500,000. In 2023, net income was $6,900,000 and dividends declared were $2,250,000. The company’s tax rate is 20%. Cracker issues comparative income statements and statements of stockholder’s equity for 2022, and 2023. Which of the following statements is true regarding the reporting for this error on Cracker Company’s comparative statements of stockholders’ equity? Answer a. The beginning balance of 2022 retained earnings will be increased for the correction of the error by $1,500,000. b. No adjustment to retained earnings for 2022 or 2023 is necessary because the error occurred in 2021. c. The beginning balance of 2022 retained earnings will be decreased for the correction of the error by $1,200,000. d. The beginning balance of 2023 retained earnings will be decreased for the correction of the…arrow_forward

- Pager Corporation began 2021 with retained earnings of $200 million. Revenues during the year were $530 million, and expenses totaled $320 million. Pager declared dividends of $60 million. What was the company's ending balance of retained earnings? To answer this question, prepare Pager's statement of retained earnings for the year ending 31Dec,2021 Prepare the statement of retained earnings.arrow_forwardIn 2021, Jake's Jamming Music, Inc., announced an ROA of 8.65 percent, ROE of 15.40 percent, and profit margin of 15.1 percent. The firm had total assets of $10.4 million at year-end 2021. Calculate the 2021 value of net income available to common stockholders for Jake’s Jamming Music, Inc. (Enter your answer in dollars. Round your answer to the nearest whole dollar.) Net Income = _________ Calculate the 2021 common stockholders’ equity for Jake’s Jamming Music, Inc. (Enter your answer in dollars not in millions and round to the nearest whole dollar.) Common Stockholders' Equity = _______ Calculate the 2021 net sales for Jake’s Jamming Music, Inc. (Enter your answer in dollars not in millions and round to the nearest whole dollar.) Net Sales = __________arrow_forwardAmazon.com, Inc. is preparing its financial statements for the fiscal year ending December 31, 2023. The company's preliminary income statement shows net sales of $514 billion, cost of sales of $320 billion, operating expenses of $160 billion, and other income of $2 billion. Amazon's effective tax rate for the year is 21%. The company had 10.2 billion weighted average shares outstanding during the year and 10.3 billion shares outstanding at year-end. Calculate Amazon's basic earnings per share (EPS) for the fiscal year 2023, and determine if it has improved from the previous year when the basic EPS was $1.25. The Walt Disney Company is evaluating its financial performance for the fiscal year ending September 30, 2023. The company reported total revenues of $82.7 billion, cost of revenues of $52.3 billion, and operating expenses of $21.5 billion. Disney's interest expense for the year was $1.2 billion, and its effective tax rate was 25%. The company had 1.83 billion weighted average…arrow_forward

- For the year ended December 31, 2019, Settles Inc. earned an ROI of 9.9%. Sales for the year were $17 million, and the average asset turnover was 3.3. Average stockholders' equity was $2.3 million. Required: a. Calculate Settles Inc.'s margin and net income. b. Calculate Settles Inc.'s return on equity.arrow_forwardWirefree Corporation began 2021 with retained earnings of $290 million. Revenues during the year were $440 million, and expenses totaled $340 million. Wirefree declared dividends of $62 million. What was the company's ending balance of retained earnings? To answer this question, prepare Wirefree's statement of retained earnings for the year ended December 31, 2021, complete with its proper heading. Prepare the statement of retained earnings. (Enter all amounts in millions. Enter a net loss with a minus sign or parentheses. Include a subtotal after the "Add" line of the statement.)arrow_forwardA firm's year-end retained earnings balances are $670,000 and $780,000, for 2018 and 2019 respectively. The firm paid $10,000 in dividends in 2019. The firm's net profit after taxes in 2019 was $110,000 -$100,000 $100,000 -$110,000arrow_forward

- For its fiscal year ending on June 30, 2018, Microsoft reported net income of $12.96 billion from sales of $112.97 billion. The company also reported total assets of $245.56 billion. a. Calculate Microsoft's total asset turnover and its net profit margin. b. Find the company's ROA, ROE, and book value per share, given that it has a total net stockolders' equity of $75.89 billion and 6.86 billion shares of common stock outstanding. a. Microsoft's total asset turnover is (Round to two decimal places.)arrow_forwardKingbird Corporation has retained earnings of $710,000 at January 1, 2020. Net income during 2020 was $1,592,500, and cash dividends declared and paid during 2020 totaled $79,100. Prepare a retained earnings statement for the year ended December 31, 2020. (List items that increase retained earnings first.) KINGBIRD CORPORATIONRetained Earnings Statementchoose the accounting period December 31, 2020For the Year Ended December 31, 2020For the Quarter Ended December 31, 2020 select an opening name Cash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31RevenuesTotal ExpensesTotal Revenues $enter a dollar amount select between addition and deduction AddLess: select an item Cash DividendsExpensesNet…arrow_forwardFor the year ended December 31, 2022, Settles Incorporated earned an ROI of 7.2%. Sales for the year were $11 million, and average asset turnover was 1.8. Average stockholders' equity was $3.1 million. Required: a. Calculate Settles Incorporated's margin and net income. Note: Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000. b. Calculate Settles Incorporated's return on equity. Note: Round your answer to 1 decimal place. a. Margin a. Net income b. Return on equity %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning