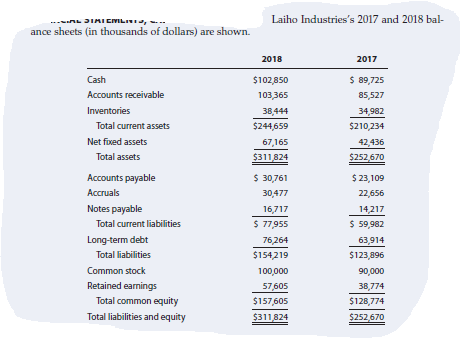

a. Sales for 2018 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation

and amortization were 11% of net fixed assets, interest was $8,575,000, the

corporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Given

this information, construct the firm’s 2018 income statement.

b. Construct the statement of

and the 2018 statement of cash flows.

c. Calculate 2017 and 2018 net operating

flow (FCF). Assume the firm has no excess cash.

d. If Laiho increased its dividend payout ratio, what effect would this have on corporate

taxes paid? What effect would this have on taxes paid by the company’s shareholders?

e. Assume that the firm’s after-tax cost of capital is 10.5%. What is the firm’s 2018 EVA?

f. Assume that the firm’s stock price is $22 per share and that at year-end 2018 the firm

has 10 million shares outstanding. What is the firm’s MVA at year-end 2018?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The _________ is the internal rate of return a firm must earn on its investment in order to maintain the market value of its stock. a. gross profit margin b. IRR c. Cost of Capital d. net profit margin A snapshot from Violet Flowers Ltd.'s financial information reveals the following for years 2018 and 2019: Item 2018 2019 Long Term Debt $4,600,000 $4,900,000 Interest expense $600,500 $870,000 Dividends $400,000 $590,000 Common Stock $1,740,000 $1,815,000 Additional paid-in surplus $4,200,000 $4,500,000 Violet Flowers' FCF for 2019 was: a. $300,000 b. $515,000 c. $785,000 d. $270,000arrow_forwardassistarrow_forwardGM has the following balances at Dec31,2021: Operating Assets $ 1,200,000 Financial Assets 800,000 Operating Liabilities 200,000 Financial liabilities 1,400,000 Operating Income 200,000 Tax Rate % 40 Net Income 110,000 Preferred Stock dividends 10,000 Required: Calculate the following (use 2021 ending balances only): Return on Net Operating Assets – RNOA Return on Common Equity – ROCE Justify and analyze your findings in required (1)arrow_forward

- Presented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021. 2021 2020 Sales $314,000 $272,000 Cost of sales 200,000 147,000 Gross profit 114,000 125,000 Еxpenses 94,500 52,700 Net income $19,500 $72,300 Retained earnings (Jan. 1) $116,900 $70,700 Net income 19,500 72,300 Dividends (27,000 ) (26,100 ) Retained earnings (Dec. 31) $109,400 $116,900 The follawing additional information is provided: In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2020 for $98,000 with an estimated useful life of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of 2020.) 1. In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for 2021 is correctly stated. 2. Prepare the revised…arrow_forward- What are the firm’s current ratios for 2018 and 2019?arrow_forward. Moody Instruments had retained earnings of $300,000 at December 31, 2017. Netincome for 2018 totaled $200,000, and dividends declared for 2018 were $55,000. How muchretained earnings should Moody report at December 31, 2018?a. $500,000b. $445,000c. $300,000d. $355,000arrow_forward

- SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $365,700 in 2023 and $335,800 in 2022 Equity and Liabilities share capital-connen (137, 700 shares issued) Retained earnings (ote 1) Accrued liabilities sotes payable (current) Accounts payable Total egrity and liabilities Return on equity Note 1 Cash dividends were paid at the rate of $1 per share in 2022 and 52 per shore in 2023 Required: 1. Calculate the return on common there equity for 2022 and 2023. (Assurne total equity was $1,454,000 at December 31, 2021) (Round your answers to 1 decimal piace) 2022 23.4 $1,417,500 $1,417,500 417,700 10,300 22,700 59,500 2023 225 111,300 6,500 65,500 179,000 $1,937,700 $1,979,200 2. Calculate the book value per shares for 2022 and 2023 (Round your answers to 2 decimal places) 2022 XX S1254 S 13.31arrow_forward1. During 2021, Target Corporation had: Revenue of $623,000 Cost of Goods Sold of $250,000 Operating expenses of $68,000 Interest expense of $4,000 Depreciation Expense of $13,000 During the year Target Corporation paid: 50% of net income in dividends 21% in corporate taxes a. Prepare a multi-step income statement on Sheet 1 of your spreadsheet. Include the dividend and additions to Retained Earnings below the income statement. b. Calculate Target's Operating Cash Flow beneath the Income Statement. 2. The following data refers to the 2021 year-end account balances for Target. However, the Retained Earnings balance is as of 12/31/2020. The accounts are listed in alphabetical order. $ Accounts Payable 25,000 Accounts Receivable 16,000 Accumulated Depreciation 175,000 Cash 44,000 Common Stock 120,000 Fixed Assets (gross) 390,000…arrow_forwardGodoarrow_forward

- For its fiscal year ending on June 30, 2018, Microsoft reported net income of $12.96 billion from sales of $112.97 billion. The company also reported total assets of $245.56 billion. a. Calculate Microsoft's total asset turnover and its net profit margin. b. Find the company's ROA, ROE, and book value per share, given that it has a total net stockolders' equity of $75.89 billion and 6.86 billion shares of common stock outstanding. a. Microsoft's total asset turnover is (Round to two decimal places.)arrow_forwardC Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forwardG. C. Murphey’s 2016 financial statements show average shareholders’ equity of $20,412 million, net income of $5,040 million, and average total assets of $86,700 million.How much is G. C. Murphey’s return on assets for the year? Question 21 options: A) 4.77% B) 5.81% C) 11.42% D) 24.69%arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education