Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Question

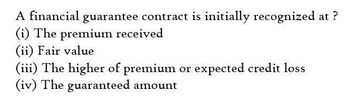

Transcribed Image Text:A financial guarantee contract is initially recognized

(i) The premium received

(ii) Fair value

(iii) The higher of premium or expected credit loss

(iv) The guaranteed amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide answerarrow_forward_____ is a contract that involves compensation for specific potential future losses in exchange for periodic payments and that provides for the transfer of the risk of a loss, from one entity to another, in exchange for a premium. a.Spot contract b.Insurance c.Hedging d. Forward contractarrow_forwardCounterparty credit risk is a function of the probability of default, exposure at default, and loss given default. Assuming that the individual exposure at default with a counterparty is fixed, which of the following statements is correct? A. The probability of default can be mitigated by collateral, and exposure at default can be mitigated by netting. B. The probability of default can be mitigated by netting, and exposure at default can be mitigated by collateral. C. Loss given default can be mitigated by collateral, and exposure at default can be mitigated by netting. D. Loss given default can be mitigated by netting, and exposure at default can be mitigated by collateral.arrow_forward

- A funding component is O the total funding required for a specified decision point O a long-term source of capital O a collateral agreement, such as pledging an asset as security for a mortgage bond O an ancillary requirement on a loan that affects its risk, such as a restrictive covenantarrow_forwardLoans and receivable should be measured subsequent to initial recognition at * a. Amortized cost using the straight line method b. Fair value c. Fair value plus transaction cost d. Amortized cost using the effective interest methodarrow_forwardContingent liabilities are obligations that may or may not materialize.arrow_forward

- The indenture is a contract between the issuer and lenders that does all the following EXCEPT ______. a. specify the manner in which the principal must be repaid b. give management's expectations about return of the proceeds c. list any restrictive covenants d. detail the nature of the debt issuearrow_forwardAn obligation that is contingent on the occurrence of a future event should be reported in the statement of financial position as a liability if: a. The amount of the obligation can be reasonably estimated. b. The future event is likely to occur. c. The occurrence of the future event is at least reasonably possible and the amount is known d. The occurrence of the future event is probable and the amount can be reasonably estimated.arrow_forwardFor most long-term liabilities, an important consideration is that they are properly authorized. True or False?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning