Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

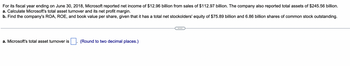

Transcribed Image Text:For its fiscal year ending on June 30, 2018, Microsoft reported net income of $12.96 billion from sales of $112.97 billion. The company also reported total assets of $245.56 billion.

a. Calculate Microsoft's total asset turnover and its net profit margin.

b. Find the company's ROA, ROE, and book value per share, given that it has a total net stockolders' equity of $75.89 billion and 6.86 billion shares of common stock outstanding.

a. Microsoft's total asset turnover is

(Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Requirements of the question and the values we have to determine

VIEW Step 2: First, we will calculate total assets turnover

VIEW Step 3: Now, we will calculate net profit margin

VIEW Step 4: Now, we will calculate Return on Assets (ROA)

VIEW Step 5: Now, we will calculate the Return on Equity (ROE)

VIEW Step 6: Now, we will calculate the book value per share

VIEW Solution

VIEW Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please calculate the verticle and horizontal analysis of the Income statement. Consolidated Statements of Earnings (USD $) 12 Months Ended In Millions, except Per Share data, unless otherwise specified 12/31/2020 Vertical Analysis 12/31/2019 Vertical Analysis Horizontal Analysis Income Statement [Abstract] NET SALES $83,176 $78,812 Cost of Sales 54,222 51,422 GROSS PROFIT 28,954 27,390 Operating Expenses: Selling, General and Administrative 16,834 16,597 Depreciation and Amortization 1,651 1,627 Total Operating Expenses 18,485 18,224 OPERATING INCOME 10,469 9,166 Interest and Other (Income) Expense: Interest and Investment Income -337 -12 Interest Expense 830 711 Other 0 0 Interest and Other, net 493 699 EARNINGS BEFORE PROVISION FOR INCOME TAXES 9,976 8,467 Provision for Income Taxes 3,631 3,082 NET EARNINGS $6,345 $5,385…arrow_forwardIn its 2014 annual report, Campbell Soup Company reports beginning- of-the-year total assets of $8,113 million, end-of-the-year total assets of $8,323 million, total sales of $8,268 million, and net income of $807 million. a. Compute Campbell ?s asset turnover. b. Compute Campbell ?s profit margin on the sale. c. Compute Campbell?s return on an asset using (1) asset turnover and profit margin and (2) net income. (1) Assets turnover and profit margin (2) Net income Return on assets % %arrow_forwardThe following amounts were taken from the financial statements of Concord Corporation: 2017 2016 Total assets $818000 $1020000 Net sales 726000 655000 Gross profit 376000 332000 Net income 118000 130000 Weighted average number of 90200 80000 common shares outstanding Market price of common stock $42 $36 The return on assets for 2017 is 12%. 13%. 14%. 6%.arrow_forward

- Please givearrow_forwardCompute the component percentages for Trixy Magic's income statement below. (Enter your answers as a percentage rounded to 2 decimal place (l.e. 0.1234 should be entered as 12.34). Enter all answers as positive values.) TRIXY MAGIC, INC. Consolidated Statements of Earnings (In millions) Fiscal Years Ended on Fiscal 2018 % Sales Fiscal 2017 % Sales Fiscal 2016 % Sales Net sales 48,232 100.00 % $. 48,290 100.00 % 46,938 100.00 % Cost of sales 31,748 34.17 31,567 34.63 30,741 34.51 Gross margin 16,484 65.83 16,723 65.37 16,197 65.49 Expenses: Selling, general, and administrative 11,087 10,525 9,750 Depreciation 1,559 1,368 1,173 Interest-net 284 195 159 12,930 0.00 12,088 2.83 11,082 0.00 Total expenses Pre-tax earnings 3,554 65.83 4,635 62.54 5,115 65.49 1,324 1,710 1,899 Income tax provision S. 2,230 65.83 % 2,925 62.54 % 3,216 65.49 % Net earnings Prev 1 of 3 Next %24 %24 %24 %24arrow_forward(Comprehensive Income) Roxanne Carter Corporation reported the following for 2017: net sales $1,200,000, cost of goods sold $750,000, selling and administrative expenses $320,000, and an unrealized holding gain on available-for-sale securities $18,000. InstructionsPrepare a statement of comprehensive income, using (a) the one statement format, and (b) the two statement format. (Ignore income taxes and earnings per share.)arrow_forward

- Calculate the P/R for (WMT) as of November 14, 2017, when the company's stock price closed at $91.09.2 The company's profit for the fiscal year ending January 31, 2017, was US$13.64 billion, and its number of shares outstanding was 3.1 billion.arrow_forwardComparative financial statement data for Blossom Company and Oriole Company, two competitors, appear below. All balance sheet data are as of December 31, 2022. Net sales. Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities Net cash common by operating activities Capital expenditures Dividends paid on common stock Weighted-average common shares outstanding Blossom Company Oriole Company 2022 Net Income $2,592,000 1,692,000 407,520 9,980 $ 122,500 496,600 766,000 95,500 157,020 198,720 129,600 51,840 80,000 2022 $892,800 489,600 141,120 4,240 51,840 213,840 201,160 (a) Compute the net income and earnings per share for each company for 2022. (Round Earnings per share to 2 decimal places, eg $2.78) Earnings per share 48,600 58,470 51,840 28,800 21,600 50,000arrow_forwardSuppose that in April 2019, Nike Inc. had sales of $36,367 million, EBITDA of $5,229 million, excess cash of $5,238 million, $3,804 million of debt, and 1,583.2 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Maximum Minimum P 23.99 +81% - 45% Print Price Book 7.46 + 193% - 83% Done Enterprise Value Sales 2.17 + 96% - 80% Enterprise Value EBITDA 19.98 + 73% - 81% Xarrow_forward

- The income statement of a corporation shows the following balance in Sales Revenue for the years 2017, 2016, and 2015. 2017: $676,000 2016: $625,000 2015: $610,000 Performing horizontal analysis on Sales Revenue would result in what percentage change for 2017? (Round to two decimal places.) 8% 108% 2% 11%arrow_forwardThe statements of comprehensive income for Alicante plc. London plc. and Madrid plc. for the year ended 31 October 2020 are as follows: Statements of comprehensive income for the year ended 31 October 2020 Alicante London Madrid £ 000 £ 000 £ 000 Sales 135,000 77,000 66,500 Cost of sales 45,000 32,000 24,000 Gross profit 90,000 45,000 42,500 Expenses 23,500 26,600 37,000 Dividends received 6,850 N/A 3,000 Profit before tax 73,350 18,400 8,500 Corporate Taxation 20,350 8,750 3,500 Profit for the year 53,000 9,650 5,000 Dividends paid in year 26,000 5,250 2,000 The following information is also relevant: Alicante plc. acquired 60% of the shares in London plc. on 1 November 2016 for a cash consideration of £51,500,000. The balance on the retained earnings of London plc. was £45,000,000 and the balance on the general reserve of London plc. was £20,000,000 on that date. Alicante plc. also acquired 30% of the shares in Madrid plc. on 1 November…arrow_forward(Market value analysis) Lei Materials' balance sheet lists total assets of $1.35 billion, $196 million in current liabilities, $421 million in long-term debt, $733 million in common equity, and 52 million shares of common stock. If Lei's current stock price is $50.89, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education