Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

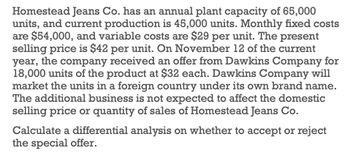

Transcribed Image Text:Homestead Jeans Co. has an annual plant capacity of 65,000

units, and current production is 45,000 units. Monthly fixed costs

are $54,000, and variable costs are $29 per unit. The present

selling price is $42 per unit. On November 12 of the current

year, the company received an offer from Dawkins Company for

18,000 units of the product at $32 each. Dawkins Company will

market the units in a foreign country under its own brand name.

The additional business is not expected to affect the domestic

selling price or quantity of sales of Homestead Jeans Co.

Calculate a differential analysis on whether to accept or reject

the special offer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forwardCountry Jeans Co. has an annual plant capacity of 65,600 units, and current production is 46,300 units. Monthly fixed costs are $41,400, and variable costs are $25 per unit. The present selling price is $34 per unit. On November 12 of the current year, the company received an offer from Miller Company for 16,100 units of the product at $26 each. Miller Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Country Jeans Co. Question Content Area a. Prepare a differential analysis dated November 12 on whether to reject (Alternative 1) or accept (Alternative 2) the Miller order. If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential AnalysisReject Order (Alt. 1) or Accept Order (Alt. 2)November 12 RejectOrder(Alternative 1) AcceptOrder(Alternative 2)…arrow_forwardWestern Jeans Co. has an annual plant capacity of 2,000,000 units, and current production is 1,920,000 units. Monthly fixed costs are $400,000, and variable costs are $9 per unit. The present selling price is $15 per unit. On July 6 of the current year, the company received an offer from Childs Company for 50,000 units of the product at $13 each. Childs Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Western Jeans Co. Question Content Area a. Prepare a differential analysis dated July 6 on whether to reject (Alternative 1) or accept (Alternative 2) the Childs order. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential AnalysisReject (Alt. 1) or Accept (Alt. 2) OrderJuly 6 Line Item Description Reject Order(Alternative 1) Accept Order(Alternative 2) Differential Effects(Alternative 2) Revenues $Revenues…arrow_forward

- Account Expert accept it and solvearrow_forwardDivision Y has asked Division X of the same company to supply it with 6,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $41 per unit. Division X has the capacity to produce 26,400 units of part L763 per year. Division X expects to sell 23,760 units of part L763 to outside customers this year at a price of $43.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $33 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 6,600 parts this year from Division X to Division Y? Note: Round your final…arrow_forwardDivision Y has asked Division X of the same company to supply it with 5,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $36 per unit. Division X has the capacity to produce 22,400 units of part L763 per year. Division X expects to sell 20,160 units of part L763 to outside customers this year at a price of $37.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $28 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 5,600 parts this year from Division X to Division Y? (Round your final answers…arrow_forward

- Division Y has asked Division X of the same company to supply it with 8,400 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $50 per unit. Division X has the capacity to produce 33,600 units of part L763 per year. Division X expects to sell 30,240 units of part L763 to outside customers this year at a price of $54.40 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $42 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 8,400 parts this year from Division X to Division Y? (Round your final answers…arrow_forwardAdiwele Ltd has a financial year end of 31 March. The entity manufactures Compact Discs for resale. The manufacturing cost per compact disc is R2 per unit. Finished units of the compact disc are sold at R2.5 per unit. On 31 March 2021, Adiwele Ltd had 100 500 units of compact discs in stock. To sell this products Adiwele Ltd will incur the following costs: Sales commission of 20 cents per unit, Additional designing costs of 25 cents per unit, Advertising and packaging costs of 23 cents per unit, Salaries for administrative staff of R6 000 per month. Adiwele Ltd measures inventory at lower of cost and net realisable value as per IAS 2, Inventories according to IFRS at year end. What is the value of the closing inventory on 31 March 2021 as per IAS 2? 1.251 250 2. 201 000 3. 208 035 4. 136 035 5. 244 215arrow_forwardDivision Y has asked Division X of the same company to supply it with 9,000 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $53 per unit. Division X has the capacity to produce 36,000 units of part L763 per year. Division X expects to sell 32,400 units of part L763 to outside customers this year at a price of $58.00 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a varlable cost of $45 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 9,000 parts this year from Division X to Division Y? (Round your final answers…arrow_forward

- Caldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Caldwell buys 100, 100 units at an average unit cost of $11 and sells them at an average unit price of $21. The firm also has fixed operating costs of $250,100 for the year. Caldwell's customers are demanding a 11% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 3% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 690 and can decrease the cost of each shipment by $4 with minor changes in its operations. Any further cost savings must come from reengineering the warehousing processes. What is the maximum cost (i.e., target cost) for warehousing if the firm desires to earn the same amount of profit next…arrow_forwardCaldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Caldwell buys 100,900 units at an average unit cost of $19 and sells them at an average unit price of $29. The firm also has fixed operating costs of $250,900 for the year. Caldwell's customers are demanding a 19% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 14% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 770 and can decrease the cost of shipment by $12 with minor changes in its operations. Any further cost savings must come from reengineering the warehousing processes. What is the maximum cost (i.e., target cost) for warehousing if the firm desires to earn the same amount of profit next year?arrow_forwardMelrose can sell 68,000 units of Product C to regular customers next year. If Moore Company offers to buy the special order units at P95 per unit, the effect of accepting the special order for 7,000 units on Melrose's net operating income for next year will be a: The Melrose Company produces a single product, Product C. Melrose has the capacity to produce 70,000 units of Product C each year. If Melrose produces at capacity, the per unit costs to produce and sell one unit of Product C are as follows: Direct materials P20 Direct labor P17 Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense | Fixed selling expense P13 P14 P12 P8 The regular selling price of one unit of Product C is P100. A special order has been received by Melrose from Moore Company to purchase 7,000 units of Product C during the upcoming year. If this special order is accepted, the variable selling expense will be reduced by 75%. Total fixed manufacturing overhead and fixed selling…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College