Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

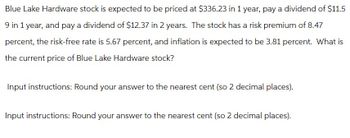

Transcribed Image Text:Blue Lake Hardware stock is expected to be priced at $336.23 in 1 year, pay a dividend of $11.5

9 in 1 year, and pay a dividend of $12.37 in 2 years. The stock has a risk premium of 8.47

percent, the risk-free rate is 5.67 percent, and inflation is expected to be 3.81 percent. What is

the current price of Blue Lake Hardware stock?

Input instructions: Round your answer to the nearest cent (so 2 decimal places).

Input instructions: Round your answer to the nearest cent (so 2 decimal places).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are thinking of buying a stock priced at $98 per share. Assume that the risk-free rate is about 4.7% and the market risk premium is 5.5%. If you think the stock will rise to $122 per share by the end of the year, at which time it will pay a $1.74 dividend, what beta would it need to have for this expectation to be consistent with the CAPM? The beta is (Round to two decimal places.)arrow_forwardA stock is currently priced at $63 and has an annual standard deviation of 43 percent. The dividend yield of the stock is 5.2 percent, and the risk - free rate is 5.2 percent. What is the value of a call option on the stock with a strike price of $60 and 48 days to expiration? (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Call option $arrow_forwardYou are given the following information about the stock of Company ABC: Share price $80 risk free rate of interest is 6%, time to expiration is 6 months, annualised standard deviationis 0.5 and exercise price is $85. Calculate the appropriate call value of the stock according to the Black-Scholes option pricing formula. (Show your workings in full) Calculate an appropriate put premium. (Show your workings in full)arrow_forward

- Please answer both questions attached below in the image.arrow_forwardA stock is currently priced at $61 and has an annual standard deviation of 41 percent. The dividend yield of the stock is 2.8 percent, and the risk-free rate is 4.8 percent. What is the value of a call option on the stock with a strike price of $58 and 52 days to expiration? (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Call option $arrow_forwardSuppose you have portfolio of four stocks Stock A, B, C and D, Total investment in these stocks is equal to 2019331015 $, Beta of these stocks is 1.5, (0.5), 1.25, and 0.75 and proportion invested is 22%, 20%, 30%, and remaining in D. If the Risk free rate is 6% and market rate of return is 15%. Calculate a) Investment in each stock. b) Market premium c) Required Rate of return for each stock. d) Required rate of return of Portfolio. e) If expected rate of return of stock A is 10%, what do you think if it is overvalued or undervalued.arrow_forward

- Your purchase $8,000 of Viking stock and $7,000 of Saint stock. Viking's beta is 0.63 and Saint's beta is 1.28. If the expected return for the overall stock market is 12.0% and the T-Bill yield is 3.1%, what is your portfolio's expected return? Enter your answer as a decimal showing four decimal places. For example, if your answer is 8.25%, enter .0825.arrow_forwardYour broker has recommended that you purchase stock in Alacan, Inc. She estimates that the 1-year target price is $76.00, and Alacan consistently pays an annual dividend of $17.00. Analysts estimate that the stock has a beta of 0.91. The current risk-free rate is 2.70% and the market risk premium (RM - RF) is 9.50%. Assuming that CAPM holds, what is the intrinsic value of this stock?arrow_forwardThe risk-free rate is 2.97% and the market risk premium is 9.23%. A stock with a ẞ of 1.79 just paid a dividend of $2.45. The dividend is expected to grow at 22.40% for three years and then grow at 3.56% forever. What is the value of the stock?. Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forward

- You are given the following information regarding four stocks in a portfolio: Company # of Shares Price ($) 2020 Price ($) 2021 ELITE 40,000 3.11 2.99 FTNA 5,000 30.37 34.10 GWEST 55,000 2.05 1.80 TTECH 20,000 5.55 4.60 Assuming 2020 is the base year with an index value of 500: i. Compute a price-weighted index of these four stocks for 2021. ii. Compute a value-weighted index of these four stocks for 2021. What is the percentage change in the value of the index from 2020 to 2021? iii. Compute the un-weighted index of these four stocks for 2019. What is the percentage change in the value of the index from 2020 to 2021arrow_forwardYou are given the following information concerning options on a particular stock: Stock price= Exercise price= Risk-free rate= Maturity= Standard deviation= $83 Intrinsic value=$ $80 6% per year, compounded continuously 6 months 47% per year (a)What is the intrinsic value of the call option? (Please keep two digits after the decimal point.) (b)What is the time premium of the call option? (Please keep two digits after the decimal point.) Time premium of the call option=$arrow_forwardAn analyst gathered the following information for a stock and market parameters: stock beta= 1.08; • expected return on the Market = 11.97%; • expected return on T-bills = 1.55%; • current stock Price = $9.01; • expected stock price in one year = $11.14; • expected dividend payment next year = $3.23. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT