Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

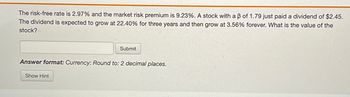

Transcribed Image Text:The risk-free rate is 2.97% and the market risk premium is 9.23%. A stock with a ẞ of 1.79 just paid a dividend of $2.45.

The dividend is expected to grow at 22.40% for three years and then grow at 3.56% forever. What is the value of the

stock?.

Submit

Answer format: Currency: Round to: 2 decimal places.

Show Hint

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- #1 The market price of a stock is $21.60 and it just paid a dividend of $1.06. The required rate of return is 11.49%. What is the expected growth rate of the dividend? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) unanswered not_submitted Attempts Remaining: Infinity %23arrow_forward1. HEJO company has the current stock price of $20 today. Use a 1 step binomial tree to estimate the price of a oneyear call on thisstock. Assume the price can increase or decrease by 10% in in the next year with equal likelihood. Risk free rate is 2%, the strike is $21. A. Find the hedge ratio(H), (make sure have the correct sign, this will be written out as a decimal B) Find the call's value or price today Note: Show the calculation without using excel.arrow_forwardAn analyst gathered the following information for a stock and market parameters: stock beta= 1.08; • expected return on the Market = 11.97%; • expected return on T-bills = 1.55%; • current stock Price = $9.01; • expected stock price in one year = $11.14; • expected dividend payment next year = $3.23. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forward

- Consider a stock that will pay out a dividends over the next 3 years of $1.4, $1.9, and $2.4, respectively. The price of the stock will be $51.81 at time 3. The interest rate is 13%. What is the current price of the stock? Enter your response below rounded to 2 DECIMAL PLACES.arrow_forward1. Calculate the value of a preferred stock with a fixed annual dividend of $2.45, assuming a discount rate of 9.5%. Solve the problem two different ways: first by using the algebraic formula for a constant dividend preferred stock, then by using the built-in Excel function PV. hint: Use the Preferred Stock example in the posted DDM Excel Examples file as a guide. Feel free to copy the worksheet and make the minor necessary changes to answer this question. 2. Calculate the value of a stock with an expected annual dividend of $2.00 next year and estimated annual dividend growth of 2% per year indefinitely. Assume a discount rate of 8%. Solve the problem two different ways: first by using the algebraic formula for the Gordon Growth Model, then by using Excel to calculate and sum the dividends and their respective present values for the next 150 years. hint: Use the PV Const Growth Dividend example in the posted DDM Excel Examples file as a guide. Feel free to copy the worksheet and make…arrow_forwardBoth a call and a put currently are traded on stock XYZ; both have strike prices of $50 and expirations of six months. Required: a. What will be the profit/loss to an investor who buys the call for $4 in the following scenarios for stock prices in six months? (Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) stock price profit/loss $ 40.00 $ 45.00 $ 50.00 $ 55.00 $ 60.00 b. What will be the profit/loss in each scenario to an investor who buys the put for $6? (Loss amounts should be indicated by a minus sign. Round your answers to 2 decimal places.)arrow_forward

- Stimpson Inc. preferred stock pays a $.50 annual dividend. What is the value of the stock if your required rate of return is .10? Instruction: Type your answer in dollars, and round to two decimal placesarrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. ABC Po 86 46 92 le 100 200 200 Rate of return P1 91 41 102 Q1 100 1.89 % 200 200 P2 91 41 51 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) 22 100 200 400arrow_forwardYou purchase 115 shares of stock for $53 a share. The stock pays a $7 per share dividend at year- end. What is the rate of return on your investment for these end-of-year stock prices? What is your real (inflation-adjusted) rate of return? Assume an inflation rate of 5%. (Round your answers to 2 decimal places. Use the minus sign for negative numbers If it is necessary.) a. End-of-year stock price = $48 Rate of return Real rate b. End-of-year stock price = $53 Rate of return Real rate c. End-of-year stock price = $60 Rate of return Real ratearrow_forward

- An analyst gathered the following information for a stock and market parameters: stock beta = 1.23; expected return on the Market = 9.32%; expected return on T-bills = 4.75%; current stock Price = $9.08; expected stock price in one year = $13.1; expected dividend payment next year = $3.8. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forwardA stock is currently priced at $35 and will move up by a factor of 1.18 or down by a factor of .85 each period over each of the next two periods. The risk-free rate of interest is 3 percent. What is the value of a put option with a strike price of $40? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) please show in excel! thank youarrow_forwardAssume a stock trades at $90, the volatility of the stock is 32%, and the risk-free interest rate is 3.7%. What is the Gamma of a $94 strike call option expiring in 217 days if the spot price of the stock increases by $1? Please answer to 2 decimal places. Answer: 0.26arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education