Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

pd

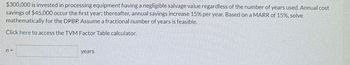

Transcribed Image Text:$300,000 is invested in processing equipment having a negligible salvage value regardless of the number of years used. Annual cost

savings of $45,000 occur the first year: thereafter, annual savings increase 15% per year. Based on a MARR of 15%, solve

mathematically for the DPBP. Assume a fractional number of years is feasible.

Click here to access the TVM Factor Table calculator.

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardProject A requires a $315,000 initial investment for new machinery with a five-year life and a salvage value of $35,500. Project A is expected to yield annual income of $23,900 per year and net cash flow of $78,750 per year for the next five years.Compute Project A’s accounting rate of return. *please help correct the answerarrow_forwardPlease show all your workarrow_forward

- You have been given the following information on a project. It has a 5-year lifetime The initial investment in the project will be $25 million, and the investment will be depreciated straight line, down to a salvage value of $10 million at the end of the fifth year. The revenues are expected to be $20 million next year and to grow 10% a year after that for the remaining 4 years. The cost of goods sold, excluding depreciation, is expected to be 50% of revenues. The tax rate is 40%. The project will require a $1 million increase in working capital. If the cost of capital is 12% what is the NPV and IRR? (Ans. $10,413,439.23 and 24.56%)arrow_forwardAn investment of 80,200 returned 20,000 per year over a five year useful life and then have a salvage value equal to its annual revenue. Annual operations and maintenance cost is 16,500 and the company is expecting a 20% MARR. Determine the payout period and the rate of return on the investment.arrow_forwardReclamation of a gravel pit is expected to begin 9 years from today with estimated end of year costs of 1.5 million dollars each year at the end of years 9, 10, 11 and 12. Part A What amount would the company need to invest or escrow today (time zero) to cover the future liabilities of 1.5 million in years 9, 10, 11, & 12? Other opportunities exist to invest available capital elsewhere and earn 10% per year compounded annually. Part B What amount would your company need to invest each year for the next 8 years (Years 1-8) to pay for the future liabilities of 1.5 million in years 9, 10, 11, & 12? Assume the same nominal 10% interest rate.arrow_forward

- A firm undertakes a five-year project that requires an initial capital investment of $125,000. The project is then expected to provide cash flow of $15,000 per year for the first two years, $55,000 in the third and fourth years, and $16,000 in the fifth year. The project has an end-of-life salvage value of $7,000.arrow_forwardDetermine the ROR, AW, and PP of the following engineering project when the MARR is 20% per year. Is the project acceptable? Engineering Project Details Investment cost $60,000 Expected life 7 years Annual receipts $15,000 Annual expenses $2,675.40 a. The Rate of Return of the project is ? Write the answer in percentage value, up to 2 decimal places. b. How much is the cash flow excess? Roundoff answer to the whole number. c. The payback Period is Write the answer in two decimal places.arrow_forwardAn injection-molding machine has a first cost of $1,050,000 and a salvage value of $225,000 in any year. The maintenance and operating cost is $235,000 with an annual gradient of $75,000. The MARR is 10%. What is the most economic life?arrow_forward

- Please solve and provide the steps for the problem provided belowarrow_forwardBlue Spruce Company is considering investing in new equipment that will cost $1,433,000 with a 10-year useful life. The new equipment is expected to produce annual net income of $25,300 over its useful life. Depreciation expense, using the straight-line rate, is $143.300 per year. Compute the cash payback period. (Round answer to 1 decimal place, e.g. 15.2.) Cash payback period yearsarrow_forwardAnswer the question. A challenger asset with a maximum useful life of 6 years has a first cost of $43,000 and an estimated annual operating cost of $6250. The market value is expected to decrease by $6450 each year for the next 6 years. If the MARR is 10% per year, fill in blanks below to correctly represent the equation for calculating the EUAC at the end of year 2. (HINT: skip $ and comma symbols) EUAC2 = 43,000 ( 10%, 2) + (43,000 - 6450*2) ( 10%,2)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT