Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

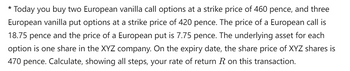

Transcribed Image Text:* Today you buy two European vanilla call options at a strike price of 460 pence, and three

European vanilla put options at a strike price of 420 pence. The price of a European call is

18.75 pence and the price of a European put is 7.75 pence. The underlying asset for each

option is one share in the XYZ company. On the expiry date, the share price of XYZ shares is

470 pence. Calculate, showing all steps, your rate of return R on this transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- shares in Landau plc are traded on the stock market and are currently valued at eu 5 per share. the expected anually compunded annual risk-free rate of interest is 8%. Assuming that the share price of landau plc will either fall in value by 20% or rise in value by 50% each year, calculate the value, according to the binomial option pricing model, of a european call option which entitles its holder to buy one share in landau plc for eu 8 in the three year's timearrow_forwardYou are given the following information: The current price to buy one share of XYZ stock is 500. The stock does not pay dividends. The risk-free interest rate, compounded continuously, is 6%. • A European call option on one share of XYZ stock with a strike price of K that expires in one year costs 66.59. • A European put option on one share of XYZ stock with a strike price of K that expires in one year costs 18.64. Using put-call parity, determine the strike price, K.arrow_forward5. Shares in Rugby plc, a non-dividend-paying company, are trading at £7.50. A one-year European call option on Rugby plc stock with strike price £8.00 has a risk-neutral probability of exercise equal to 40%. Explain what this implies about the risk-neutral probability of exercise for a one-year European put option on Rugby plc with strike price £8.00. *arrow_forward

- Today on August 18 Tesla Inc. stock (TSLA) trades at a spot price of $220 per share. A trader decides to buy a European call option contract (= 100 call options) on the stock with a strike price of $220 and maturity September 15 (i.e., in one month). The price of the European call option contract is $12 per option. (i) Under what circumstances does the trader make a gain on September 15? (ii) What is the maximum possible gain for the trader? (iii) What is the maximum possible loss for the trader? Provide short answers for (i). (ii), (iii).arrow_forwardBCD Company offer its investors option contracts to buy their shares at a price of P50. Currently, the value of their stocks in the market stands at P60. The 52-week high of the share price is P83 and its 52-week low is P47. The treasury bill issued by the government yields 8.25% currently. What’s the probability for the up move?arrow_forwardAn NDP (non-dividend-paying) stock is trading at 100. A 1-year at-the-money European call on the stock is trading at 13 and the ly atm European put is trading at 10. Compute the ly forward price of the stock.arrow_forward

- Nonearrow_forwardThe price of a European call option on a non-dividend-paying stock with a strike price of $14.50 is $1.55. The underlying stock's price is $14.00, the continuously compounded risk-free rate (all maturities) is 6.5% and the time to maturity is nine months. What is the price of a one-year European put option on the stock with a strike price of $13? $1.42 $1.36 $2.09 $1.55arrow_forwardThe price of a (non-dividend-paying) stock is $100 and the price of a 3-month European put option on the stock with a strike price of $100 is $5. The risk-free rate is 6% per annum. What is the price of a 3-month European call option with a strike price of $100?arrow_forward

- A one-month European call option on a non-dividend-paying stock is currently selling for $1. The stock price is $47, the strike price is $50, and the risk-free rate is 6% per annum (continuously compounded). What is the time value of a one-month European put on the same stock with the same strike price? A. $3.00 B. $3.75 C. $0.75 D. $0.00arrow_forwardJPS plc's current share price is £3.63. An investor is wondering whether to buy shares in JPS or warrants in the company. The warrant has a duration of one year and allows the purchase of 20 JPS shares at an exercise price of £4.10. The cost of the warrant is £5.70. If the share price for JPS is £4.50 in a year's time what are the corresponding returns for buying JPS's shares and warrants on JPS's shares? JPS plc paid no dividend over this periodarrow_forwardThe price of a non-dividend-paying stock is $50 and the price of a 4-month European call option on the stock with a strike price of $50 is $3. The risk-free rate is 4% per annum. What is the price of a 4-month European put option with same strike price? Pt = 3.3378 Pt = 2.3378 O None of the above. O Pt = 1.3378arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education