FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

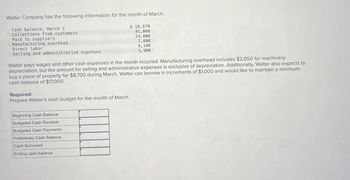

Transcribed Image Text:Walter Company has the following information for the month of March:

Cash balance, March 1

Collections from customers

Paid to suppliers

Manufacturing overhead

Direct labor

Selling and administrative expenses

$ 18,870

45,000

24,000

7,800

9,100

5,900

Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $2,050 for machinery

depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to

buy a piece of property for $8,700 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum

cash balance of $17,000.

Required:

Prepare Walter's cash budget for the month of March.

Beginning Cash Balance

Budgeted Cash Receipts

Budgeted Cash Payments

Preliminary Cash Balance

Cash Borrowed

Ending cash balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Bubba Manufacturing Company provided the following information for the fiscal year to June 30, 2020: Inventories 01/07/2019 30/06/2020 Direct Materials $72,000 $65,000 Work-in-Process 107,000 128,000 Finished Goods 149,500 141,700 Other information: Office cleaner’s wages 4,500 Sales Revenue 1,031,000 Raw materials purchased 235,000 Factory wages 239,700 Indirect materials 23,500 Delivery truck driver’s wages 15,400 Indirect labor 9,500 Depreciation on factory plant & equipment 32,000 Insurance1 60,000 Depreciation on delivery truck 7,250 Utilities2 118,750 Administrative salaries 41,250 Special Design Costs 5,000 Selling expenses 9,000 Sales Comm ission 2% of gross profit 1 Of the total insurance, 66⅔% relates to the factory facilities & 33⅓% relates to general & administrative costs. 2 Of the total utilities, 80% relates to the…arrow_forwardVinubhaiarrow_forwardWalter Company has the following information for the month of March: $ 17,520 40,450 23,100 Cash balance, March 1 Collections from customers Paid to suppliers Manufacturing overhead Direct labor Selling and administrative expenses Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $1,600 for machinery depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to buy a piece of property for $7.800 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum cash balance of $10,000. Required: Prepare Walter's cash budget for the month of March. 6,900 8,650 5,000 Beginning Cash Balance Budgeted Cash Receipts Budgeted Cash Payments Preliminary Cash Balance Cash Borrowed Ending cash balance 4arrow_forward

- Using the following information. a. Beginning cash balance on March 1, $81,000. b. Cash receipts from sales, $305.000. c. Cash payments for direct materials, $130.000. d. Cash payments for direct labor. $79,000. e. Cash payments for overhead, $38.00. f. Cash payments for sales commissions, $7000 g. Cash payments for interest, $130 (1% of beginning loan balance of $13,000) h. Cash repayment of loan, $13.000. Prepare a cash budget for March for Gado Company. GADO COMPANY Cash Budget March Total cash available Less: Cash payments for Total cash payments $4 Loan activity Loan balance, end of month %24 K Prev earcharrow_forwardKnight Company reports the following costs and expenses in May. Factory utilities $ 10,500 Direct labor $69,000 Depreciation on factory equipment 12,650 sales salaries 47,000 Depreciation on delivery trucks 4,000 Property taxes on factory building 2,000 Indirect factory labor 48,900 Repairs to office equipment 1,500 Indirect materials 80, 800 Factory repairs 2,000 Direct materials used 137,000 Advertising 15,000 Factory manager's salary 8,000 Office supplies used 2,600 Instruction: From the information, determine the total amount of: Manufacturing overhead. Product costs. Period costs.arrow_forwardThe accounts of JB Hi-FI Inc. showed the following balances at the beginning of March: Account Debit Raw Materials Inventory $40,000 Work-in-Process Inventory 34,000 Finished Goods Inventory 50,000 Manufacturing Overhead 23,000 During the month, direct materials amounting to $21,000 and indirect materials amounting to $5,000 were transferred to production. What is the ending balance in the Raw materials Inventory account following these two transactions? Group of answer choices $10,000 $14,000 $28,000 $61,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education