FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

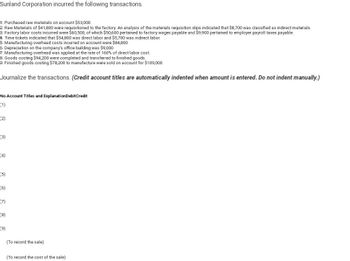

Transcribed Image Text:Sunland Corporation incurred the following transactions.

1. Purchased raw materials on account $53,000.

2. Raw Materials of $41,800 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $8,700 was classified as indirect materials.

3. Factory labor costs incurred were $60,500, of which $50,600 pertained to factory wages payable and $9,900 pertained to employer payroll taxes payable.

4. Time tickets indicated that $54,800 was direct labor and $5,700 was indirect labor.

5. Manufacturing overhead costs incurred on account were $84,800.

6. Depreciation on the company's office building was $9,000.

7. Manufacturing overhead was applied at the rate of 160% of direct labor cost.

8. Goods costing $94,200 were completed and transferred to finished goods.

9. Finished goods costing $78,200 to manufacture were sold on account for $109,000.

Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No.Account Titles and Explanation Debit Credit

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(To record the sale)

(To record the cost of the sale)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- This information relates to Monty Co. 1. 2. 3. 4. 5. (a) (b) On April 5, purchased merchandise from Martinez Company for $45,000, on account, terms 4/10, net/30, FOB shipping point. On April 6, paid freight costs of $1,150 on merchandise purchased from Martinez Company. On April 7, purchased equipment on account for $32,800. On April 8, returned $3,900 of the April 5 merchandise to Martinez Company. On April 15, paid the amount due to Martinez Company in full. Assume that Monty Co. paid the balance due to Martinez Company on May 4 instead of April 15. Prepare the journal entry to record this payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Creditarrow_forwardCurrent Attempt in Progress On May 1, 2025, Jackson Inc. entered into a contract to deliver one of its specialty mowers to Wildhorse Landscaping Co. The contract requires Wildhorse to pay the contract price of $895 in advance on May 15, 2025. Wildhorse pays Jackson on May 15, 2025, and Jackson delivers the mower (with cost of $557) on May 31, 2025.arrow_forwardDescribed below are certain transactions of Splish Corporation. The company uses the periodic inventory system. On February 2, the corporation purchased goods from Martin Company for $67,500 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. 1. 2. 3. On April 1, the corporation bought a truck for $47,000 from General Motors Company, paying $5,000 in cash and signing a one-year, 10% note for the balance of the purchase price. On May 1, the corporation borrowed $82,400 from Chicago National Bank by signing a $91,040 zero-interest-bearing note due one year from May 1. 4. On August 1, the board of directors declared a $307,900 cash dividend that was payable on September 10 to stockholders of record on August 31.arrow_forward

- Please do not give solution in image format ?arrow_forwardKaranarrow_forwardOn August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Sheridan Ltd. Accounts payable $2,330 Accounts receivable 4,470 Accumulated depreciation-equipment 1,990 Cash 6,190 Common shares 11,800 Deferred revenue 1,370 Equipment 11,000 Interest receivable 22 Note receivable, due October 31, 2021 4,400 Retained earnings 8,162 Salaries payable 1,540 Supplies 1,110 During August, the following summary transactions were completed. Aug. 1 Paid $410 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent $400. (Hint: Use the Prepaid Rent account.) 6 Received $3,450 cash from customers in payment of accounts. 10 Paid $3,360 for salaries due employees, of which $1,820 is for August and $1,540 is for July salaries payable. 13 Received $3,850 cash for services performed…arrow_forward

- Please dont use any AI. It's strictly prohibited.arrow_forwardBlossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forward

- Journalize the transactions on the "Journal Entry data" tab. Because Chart of Account numbers are not provided, post-reference information is not required. Journal entries should be prepared in proper form. Refer to the "Unadjusted TB Data tab" for proper account titles. The journal must have date, description, credit and debit. Also must be a total of 64 journal entries. And must find the total.arrow_forwardSubject : - Accountarrow_forwardDo not give answer in imagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education