FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

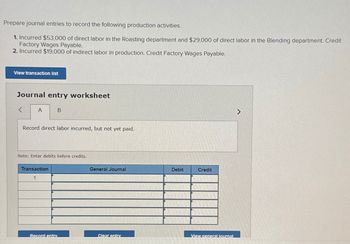

Transcribed Image Text:Prepare journal entries to record the following production activities.

1. Incurred $53,000 of direct labor in the Roasting department and $29,000 of direct labor in the Blending department. Credit

Factory Wages Payable.

2. Incurred $19,000 of indirect labor in production. Credit Factory Wages Payable.

View transaction list

Journal entry worksheet

<

A

B

Record direct labor incurred, but not yet paid.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- accarrow_forwardInfo in images 2. Post your entries to T-accounts. (Don’t forget to enter the beginning inventory balances above.) Accounts Receivable Sales Beg. Bal. Beg. Bal. End. Bal. End. Bal. Raw Materials Cost of Goods Sold Beg. Bal. Beg. Bal. End. Bal. End. Bal. Work in Process Manufacturing Overhead Beg. Bal. Beg. Bal. End. Bal. End. Bal. Finished Goods Advertising Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal. Accumulated Depreciation Utilities Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal. Accounts Payable Salaries Expense Beg. Bal.…arrow_forwardRequired information [The following information applies to the questions displayed below] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,000 14,500 7,250 27,000 19,000 17,650 22,000 5,300 9,000 21,000 9,450 Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper 4,780 33,000 50,000 Prepare the income statement for Garcon Company. GARCON COMPANY Income Statement For Year Ended Naramhar 11 195,030 20,000 13,200 Pepper Company $ 16,450 19,950 9,000 22,750 35,000 13,300 16,000 7,200 12,000 43,000 10,860…arrow_forward

- 3. Prepare journal entries for the month of April to record the above transactions. View transaction list View journal entry worksheet No 2 3 4 5 6 7 Transaction b. C. d. e. 1. 9. Direct materials used Direct labor used Cash Indirect labor Indirect labor Cash Factory overhead Overapplied overhead Underapplied overhead Factory building Cash Utilities expense Utilities payable General Journal Debit Creditarrow_forwardUse the following information for a manufacturer to compute cost of goods manufactured and cost of goods sold: (Click the icon to view account balances.) (Click the icon to view other information.) Data table Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Print Beginning S 21,000 $ 44,000 14.000 Done Ending 32,000 30,000 23,000 - X ... Data table Other information: Purchases of direct materials Direct labor Manufacturing overhead Print S Done 71,000 84.000 45,000 - Xarrow_forwardPrepare journal entries to record the following production activities. 1. Transferred completed goods from the Assembly department to finished goods inventory. The goods cost $143,000. 2. Sold $451,000 of goods on credit. Their cost is $166,000. View transaction list Journal entry worksheet O O Carrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease help me with show all calculation thankuarrow_forward0 jor pro se Used Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Data table Direct Materials Used: Direct Materials Used Print Other information: Depreciation, plant building and equipment Direct materials purchases Insurance on plant Sales salaries Repairs and maintenance-plant Indirect labor Direct labor Administrative expenses Manufacturing Overhead: Cost of Goods Manufactured Beginning Ending $ Done Total Manufacturing Overhead Total Manufacturing Costs incurred during the Year Total Manufacturing Costs to Account For Requirements 1. Use the information to prepare a schedule of cost of goods manufactured. 2. What is the unit product cost if Clark manufactured 4,380 lamps for the year? 57,000 $ 22,000 103,000 67,000 50,000 52,000 $ 4 Clark, Corp. Schedule of Cost of Goods Manufactured Year Ended December 31, 2024 11,000 155,000 23,000 43,000 13,000 40,000 125,000 53,000 - Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education