FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

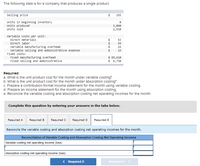

Transcribed Image Text:The following data is for a company that produces a single product.

selling price

24

193

Units in beginning inventory

Units produced

Units sold

3,090

2,910

variable costs per unit:

Direct materials

53

Direct labor

$

24

59

Variable manufacturing overhead

variable selling and administrative expense

Fixed costs:

15

13

Fixed manufacturing overhead

Fixed selling and administrative

$ 89,610

$ $,730

Requlred:

a. What Is the unit product cost for the month under varlable costing?

b. What is the unit product cost for the month under absorption costing?

c. Prepare a contribution format income statement for the month using varlable costing.

d. Prepare an Income statement for the month using absorption costing.

e. Reconcile the varlable costing and absorption costing net operating incomes for the month.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

Reconcile the variable costing and absorption costing net operating incomes for the month.

Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes

Variable costing net operating income (loss)

Absorption costing net operating income (loss)

< Required D

Required E

Transcribed Image Text:A company has two divisions: Divislon B and Division S. The following report is for the most recent operating perlod:

Division

Division B

Sales

variable expenses

Traceable fixed expenses

Common fixed expense

$228,000 $152,800

$ 59, 280 $ 31,920

$147,110 $ 65,360

$ 27,900 $ 18,600

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a. What Is Division B's break-even in sales dollars?

b. What Is Division S's break-even In sales dollars?

c. What is the company's overall break-even in sales dollars?

(For all requlrements, do not round Intermedlate calculatlons. Round your answer to the nearest whole dollar amount.)

a. Division B's break-even in sales dollars

b. Division S's break-even in sales dollars

c. Company's overall break-even in sales dollars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Divisional Income Statements The following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 20Y8: Cost of goods sold: Service department charges: Commercial Division $348,510 Commercial Division $47,520 Residential Division 171,510 Residential Division 29,710 Administrative expenses: Net sales: Commercial Division $63,370 Commercial Division $528,050 Residential Division 61,250 Residential Division 306,270 Prepare divisional income statements for Jersey Coast Construction Company. Jersey Coast Construction Company Divisional Income Statements For the Year Ended June 30, 20Y8 Commercial Division Residential Division Income from operations before service department charges $fill in the blank 2 $fill in the blank 3 Cost of goods sold fill in the blank 5 fill in the blank 6 Gross profit $fill in the blank 8 $fill in the blank 9 Administrative…arrow_forwardCost Department Allocations In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $34,760, and the Purchasing Department had expenses of $15,660 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Sales Number of employees: Weekly payroll (52 weeks per year) Monthly payroll Number of purchase requisitions per year Number of payroll checks: Weekly payroll x 52 Monthly payroll x 12 Total Residential $ 327,000 Support department allocations: Payroll Department Purchasing Department 175 32 2,300 Total Commercial $ 434,000 Required: a. Determine the total amount of payroll checks and purchase requisitions processed per year by the…arrow_forwardPlease do not give solution in image format and show all calculation thankuarrow_forward

- Profit Center Responsibility Reporting A-One Freight Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 20Y3. Revenues—Air Division $ 1,086,300 Revenues—Rail Division 1,307,900 Revenues—Truck Division 2,315,700 Operating Expenses—Air Division 688,400 Operating Expenses—Rail Division 778,400 Operating Expenses—Truck Division 1,400,400 Corporate Expenses—Shareholder Relations 165,200 Corporate Expenses—Customer Support 546,000 Corporate Expenses—Legal 262,400 General Corporate Officers’ Salaries 364,900 The company operates three service departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department…arrow_forwardPlease do not give solution in image format thankuarrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $6,300,000 $1,260,000 $ 340,200 20.00% Division B $10,300,000 $ 5,150,000 $ 968,200 18.80% Division C $9,400,000 $1,880,000 $ 249,100 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. I Margin Turnover ROI Division A 5.40 % times % Division B % 2.00 times :% Division C % times % 2. Compute the residual income (loss) for each division. (Loss amounts should be indicated by a minus sign. Roui Division A Division B Division C Average operating assets Required rate of return % % % Required operating income Actual operating income Required operating income (above) Residual income (loss) 3. Assume that each division is presented with an investment opportunity that would y a. If performance is being…arrow_forward

- Divisional income statements with support department allocations Horton Technology has two divisions. Consumer and Commercial and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: ACCT 102 Chapter 24 - Homework assignment take frame Teen Services Department 2770,000 292,000 Purchasing Department Other corporate administrative expenses Total expense The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows: Consumer Division Commercial Division Total Tech Services $1,519,500 260 410 computers 670 457,000 Purchasing 5,100 purchase orders 1,322,900…arrow_forwardi am confused for this question please provide correct answerarrow_forwardPerformance Eval - Decentralized Ops: The pictures contain all the information. Thanks!arrow_forward

- Severo S.A. of Sao Paulo, Brazil, is organized into two divisions. The company's contribution format segmented income statement (in terms of the Brazilian currency, the real, R) for last month is given below: Sales Variable expenses Contribution margin Traceable fixed expenses: Advertising Selling and administrative Depreciation Total traceable fixed expenses Divisional segment margin Common fixed expenses Operating income Sales Traceable fixed expenses: Total Company R 3,675,000 1,745,500 1,929,500 Traceable fixed expenses: R Advertising Selling and administrative Depreciation Variable expenses as a percentage of sales Total traceable fixed expenses 634,000 449,000 233,000 1,316,000 Common fixed expenses: Top management can't understand why the Leather Division has such a low segment margin when its sales are only 25% less than sales in the Cloth Division. As one step in isolating the problem, management has directed that the Leather Division be further segmented into product lines.…arrow_forward7)arrow_forwardService Department Charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $77,376, and the Purchasing Department had expenses of $39,530 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 826,000 $ 1,095,000 $ 2,514,000 Number of employees: Weekly payroll (52 weeks per year) 220 60 65 Monthly payroll 36 47 34 Number of purchase requisitions per year 2,800 2,000 1,900 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education