FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

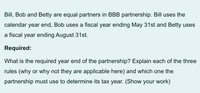

Transcribed Image Text:Bill, Bob and Betty are equal partners in BBB partnership. Bill uses the

calendar year end, Bob uses a fiscal year ending May 31st and Betty uses

a fiscal year ending August 31st.

Required:

What is the required year end of the partnership? Explain each of the three

rules (why or why not they are applicable here) and which one the

partnership must use to determine its tax year. (Show your work)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Amit is a limited partner in Reynolds Partnership. This year, Amit's Schedule K-1 from Reynolds reflected $50,000 of ordinary income, $1,000 of interest income, and a cash distribution of $35,000. Amit's marginal tax rate is 37 percent. Amit qualifies for the QBI deduction, without regard to the wage or taxable income limitations. Required: Calculate the tax cost of Amit's partnership earnings this year.arrow_forwardDesiree and Company, a general professional partnership had a gross income of P450,000 and expenses of P125,000 in 2018. The following data pertains to the two (2) individual partners: Amount advanced from partnership income Share in profit and loss ratio Gross income (other business) Expenses (other business) Dividend from domestic company Interest on bank deposit Status Number of dependent children The income tax payable by the partnership is - a. P 0 b. Exempt c. 104,000 d. 113,750 Desiree P 40,000 40% 260,000 65,000 8,500 Married 2 Desiderio P 60,000 60% 3,000 Single nonearrow_forwardI need some help with F, G pleasearrow_forward

- Rochelle is a limited partner in Megawatt Partnership. For 2021, her schedule K-1 from the partnership reported the following share of partnership items: Ordinary income: $25,000 Section 1231 loss: (3,000) Nondeductible expense: 1,000 Cash distribution: 5,000 Required: a. Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI deduction. b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in Megawatt.arrow_forwardProvide tablearrow_forwardTax Drill - Tax Year of a Partnership Indicate the required sequencing of rules in determining a partnership's required taxable. a. Principal partners' tax year. Applied first. b. Majority partners' tax year rule. Applied second. c. The least aggregate deferral tax year rule. Applied third.arrow_forward

- SEE ATTACHEDarrow_forwardJefferson has a capital balance of $65,000 and devotes full time to a partnership. Washington has a capital balance of $45,000 and devotes half time to the partnership. If no other information is available regarding distributions, how should net income be divided?arrow_forwardHaresharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education