FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

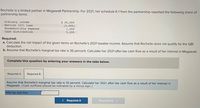

Rochelle is a limited partner in Megawatt Partnership . For 2021, her schedule K-1 from the partnership reported the following share of partnership items:

Ordinary income: $25,000

Section 1231 loss: (3,000)

Nondeductible expense: 1,000

Cash distribution: 5,000

Required:

a. Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI deduction.

b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in Megawatt.

Transcribed Image Text:Rochelle is a limited partner in Megawatt Partnership. For 2021, her schedule K-1 from the partnership reported the following share of

partnership items:

Ordinary income

Section 1231 loss

Nondeductible expense

$ 25,000

(3,000)

1,000

5,000

Cash distribution

Required:

a. Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI

deduction.

b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in Megawatt.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the

QBI deduction.

Net impact on taxable income

< Required A

Required B

>

Transcribed Image Text:Rochelle is a limited partner in Megawatt Partnership. For 2021, her schedule K-1 from the partnership reported the following share of

partnership items:

Ordinary income

Section 1231 loss

$ 25,000

Nondeductible expense

Cash distribution

(3,000)

1,000

5,000

Required:

a. Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI

deduction.

b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in Megawatt.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in

Megawatt. (Cash outflows should be indicated by a minus sign.)

After-tax cash flow

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The PDQ Partnership earned ordinary income of $150,000 in 2018. The partnership has three equal partners, Pete, Donald, and Quint. Quint, who is single, uses the standard deduction, and has other income of $15,000 (not connected with the partnership) in 2018. He receives a $30,000 distribution from the partnership during the year. What is Quint's taxable income in 2018? Assume that the partnership is not eligible for the QBI deduction.arrow_forwardAlice is a limited partner in Axel Partnership. Her share of the partnership's current ordinary business income was $100,000. She received a $60,000 cash distribution from the partnership on December 1. Alice qualifies for the QBI deduction, without regard to the wage or taxable income limitations. Assuming that Alice's marginal tax rate is 37%, calculate her after-tax cash flow from the partnership this year. Hint: the correct answer should be $30,400arrow_forwardThis answer is wrong . please give me the right answer.arrow_forward

- Shirley contributes property to a new partnership with a value of $1,000,000 and a basis of $400,000 that is secured by a $500,000 nonrecourse note. Under the terms of the partnership agreement, Shirley will be allocated 25% of all profits. The partnership agreement also states that "excess nonrecourse liabilities" will be allocated to partners according to profit ratios. How much of the nonrecourse liability will be allocated to Shirley? please dont provide answer in images thank youarrow_forwardJanie owns a 30 percent interest in Chang Partnership. Chang has W-2 wages of $20,000 and qualified property of $900,000 in 2020. a.When computing the W-2 wages limitation, what is the amount of wages that will be allocated to Janie? $_____ b. What is the amount of qualified property that will be allocated to Janie? $_____arrow_forwardIn 2021, Lena invests $30,000 for a 20% limited partnership interest in an activity in which she is NOT a material participant. Lena's share of the partnership losses is $40,000 in 2021. Her income consists of income from her medical practice in the amount of $250,000 and $4,000 from another passive activity.(a) How much loss from the activity is allowable under the at-risk rules? (b) How much loss from the activity isarrow_forward

- Nonearrow_forwardHh1. Accountarrow_forwardIn 2020, Fred invested $155,000 in a general partnership. Fred's interest is not considered to be a passive activity. If his share of the partnership losses is $108,500 in 2020 and $75,950 in 2021, how much can he deduct in each year? Fred can deduct $fill in the blank 1 in 2020 and $fill in the blank 2 in 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education