FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can I get some help with these practice questions please this is all the information I revieved regarding the practice quesitons.

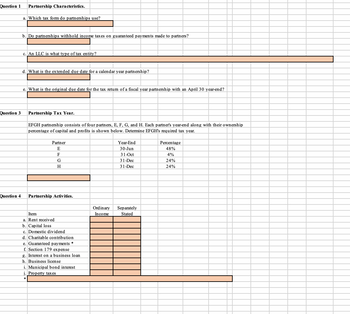

Transcribed Image Text:Question 1 Partnership Characteristics.

Question 3

Question 4

a. Which tax form do partnerships use?

b. Do partnerships withhold income taxes on guaranteed payments made to partners?

c. An LLC is what type of tax entity?

d. What is the extended due date for a calendar year partnership?

e. What is the original due date for the tax return of a fiscal year partnership with an April 30 year-end?

Partnership Tax Year.

EFGH partnership consists of four partners, E, F, G, and H. Each partner's year-end along with their ownership

percentage of capital and profits is shown below. Determine EFGH's required tax year.

Partner

E

F

G

H

Partnership Activities.

Item

a. Rent received

b. Capital loss

c. Domestic dividend

d. Charitable contribution

e. Guaranteed payments *

f. Section 179 expense

g. Interest on a business loan

h. Business license

i. Municipal bond interest

j. Property taxes

*

Year-End

30-Jun

31-Oct

31-Dec

31-Dec

Ordinary Separately

Income

Stated

Percentage

48%

4%

24%

24%

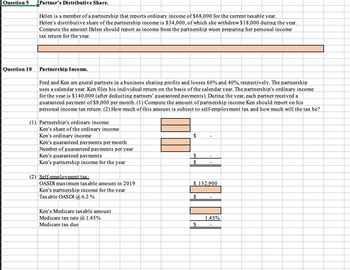

Transcribed Image Text:Question 5 Partner's Distributive Share.

Question 10

Helen is a member of a partnership that reports ordinary income of $68,000 for the current taxable year.

Helen's distributive share of the partnership income is $34,000, of which she withdrew $18,000 during the year.

Compute the amount Helen should report as income from the partnership wuen preparing her personal income

tax return for the year.

Partnership Income.

Fred and Ken are gneral partners in a business sharing profits and losses 60% and 40%, respectively. The partnership

uses a calendar year. Ken files his individual return on the basis of the calendar year. The partnership's ordinary income

for the year is $140,000 (after deducting partners' guaranteed payments). During the year, each partner received a

guaranteed payment of $8,000 per month. (1) Compute the amount of partnership income Ken should report on his

personal income tax return. (2) How much of this amount is subject to self-employment tax and how much will the tax be?

(1) Partnership's ordinary income

Ken's share of the ordinary income

Ken's ordinary income

Ken's guaranteed payments per month

Number of guaranteed payments per year

Ken's guaranteed payments

Ken's partnership income for the year

(2) Self-employment tax:

OASDI maximum taxable amount in 2019

Ken's partnership income for the year

Taxable OASDI @ 6.2 %

Ken's Medicare taxable amount

Medicare tax rate @ 1.45%

Medicare tax due

$

$

$

$ 132,900

$

$

1.45%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prior to accepting a project, what should an auditor keep in mind? Explain.arrow_forwardDraw out a trial balance using the above trasnsactions . Thank you .arrow_forwardCan you further explain this to me to better understand the concept on what I'm supposed to do and what formulas I need to apply.arrow_forward

- Give an example where researchers have used an event study and what did they find? Was it consistent with the EMH?arrow_forward1. What is a case and how to defining the Case and Creating Problem Statements? 2. What is Background of the Problem and Problem Statement?arrow_forwardexplain the importance of developing a baselinebudget for a project.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education