Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

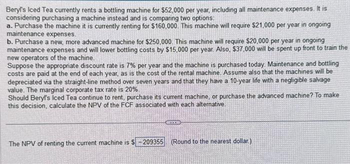

Transcribed Image Text:Beryl's Iced Tea currently rents a bottling machine for $52,000 per year, including all maintenance expenses. It is

considering purchasing a machine instead and is comparing two options:

a. Purchase the machine it is currently renting for $160,000. This machine will require $21,000 per year in ongoing

maintenance expenses.

b. Purchase a new, more advanced machine for $250,000. This machine will require $20,000 per year in ongoing

maintenance expenses and will lower bottling costs by $15,000 per year. Also, $37,000 will be spent up front to train the

new operators of the machine.

Suppose the appropriate discount rate is 7% per year and the machine is purchased today. Maintenance and bottling

costs are paid at the end of each year, as is the cost of the rental machine. Assume also that the machines will be

depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage

value. The marginal corporate tax rate is 20%.

Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? To make

this decision, calculate the NPV of the FCF associated with each alternative.

ALEXID

The NPV of renting the current machine is $-209355 (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- DJDC Machinery has been making a part for its industrial rotary gear shaving machine. The engineers are asked to investigate alternative ways of obtaining the part, as the unit cost for the part currently is not competitive in the marketplace. DJDC needs 25,000 parts per year for the next three years. At that point, any capital equipment could be sold. DJDC tax rate is 40%, and its interest rate is 12%.• Option A: Continue to produce the part with the old machine. The machine has been fully depreciated. The current machine could be sold for $6,000 in three years. Making the part with the old machine involves the following: Variable costs for the part are $4 for direct materials, $3 for direct labor, and $2 for variable manufacturing overhead.• Option B: Purchase the part from outside for $13 per part, including shipping.• Option C: Replace the old machine with the new model. The newer model would cost $55,000 and would depreciate. The new machine, if purchased, could be sold for…arrow_forwardBackyard boys is considering the purchase of a new toy-making machine that will increase revenues by $50,000 a year and annual costs by $10,000. The new machine will replace an outdated machine with a current book vale of $10,000 but if scrapped now can only be sold for $6,000.The new machine will cost $100,000 with shipping and installation fees of $10,000. The machine will be depreciated via 5-year MACRS schedule (20.0%, 32.0%, 19.2%, 11.5%, 11.5%, 5.8%). The firm estimates that the new machine can be sold at the end of its five-year life for $20,000. The new machine will necessitate an investment of $30,000 in working capital that will be fully recovered at the end of the project. Tipping Toys has a 10% cost of capital and a corporate tax rate of 40%.What is the IRR of the project?14.85%arrow_forwardSuper Apparel wants to replace an old machine with a new one. The new machine would increase annual revenue by $200,000 and annual operating expenses by $80,000. The new machine would cost $400, 000. The estimated useful life of the machine is 10 years with zero salvage value. i. Compute the Accounting Rate of Return (ARR) of the machine using the above information. ii. Should Super Apparel purchase the machine if management wants an Accounting Rate of Return (ARR) of 19% on all capital investments? Hint: Use Average Income or Profit after deducting tax, depreciation, and operating expenses.arrow_forward

- Pharoah Inc. produces modern light fixtures that sell for $160 per unit. The firm's management is considering purchasing a high- capacity manufacturing machine. If the high-capacity machine is purchased, then the firm's annual cash fixed costs will be $71,000 per year, variable costs will be $80 per unit, and annual depreciation and amortization expenses will equal $20,000. If the machine is not purchased, annual cash fixed costs will be $15,000, variable costs will be $130 per unit, and annual depreciation and amortization expenses will equal $11,000. What is the minimum level of unit sales necessary in order for EBIT with the high-capacity machine to be higher than EBIT without that machine? Minimum level of sales required unitsarrow_forwardBeryl's Iced Tea currently rents a bottling machine for $52,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $150,000. This machine will require $24,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $255,000. This machine will require $20,000 per year in ongoing maintenance expenses and will lower bottling costs by $15,000 per year. Also, $38,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 7% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The corporate tax rate is 25%. Should Beryl's Iced Tea continue…arrow_forwardDifend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $170,000. The new machine will cost $360,000 and an additional cash investment in working capital of $170,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $130,000 in additional cash inflows during the first year of acquisition and $290,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life. What is the net present value of the investment, assuming the required rate of…arrow_forward

- Kiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corporation. The machine can be used for 15 years and then sold for $20,000 at the end of its useful life. Lollie has presented Kiddy with the following options: 1. Buy machine. The machine could be purchased for $170,000 in cash. All maintenance costs, which approximate $15,000 per year, would be paid by Kiddy. 2. Lease machine. The machine could be leased for a 15-year period for an annual lease payment of $35,000 with the first payment due immediately. All maintenance costs will be paid for by the Lollie Corporation and the machine will revert back to Lollie at the end of the 15-year period. Required: Assuming that a 12% interest rate properly reflects the time value of money in this situation and that all maintenance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations. Note:…arrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $960,000, and it would cost another $22,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $451,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $12,500. The sprayer would not change revenues, but it is expected to save the firm $331,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight- line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. a. What is the Year-0 net cash flow? $ b. What are the net operating cash flows in Years 1, 2, and 3? Year 1:$ Year 2:$ Year 3:$ c. What is the additional Year-3 cash flow (i.e, the…arrow_forwardYour boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster [ BT ] costs $22 per unit, and has an estimated useful life of four years. The toaster requires batteries once a week yielding an annual operating cost of $96 per year; salvage value of both toaster and batteries is $12. The alternative is to purchase an electric toaster [ ET ] that will last seven years and costs $150. The estimated annual electric bill for this toaster is $60, and it has an expected salvage value of $15. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 38% and a WACC of 13%. If toaster BT's annual battery costs decrease by $4 and ET's toaster cost decrease by $4 which toaster would you recommend now? a. BT: AEC $61.39 b. BT: AEC $60.81 c. ET: AEC $60.81 d. ET: AEC $61.39 e. none of themarrow_forward

- Cal Construction Company must choose between two types of cranes. Crane X costs $600,000, will last for 5 years, and will require $60,000 in maintenance each year. Crane Y costs $800,000 and will last for 7 years and will require $30,000 in maintenance each year. Maintenance costs for cranes X and Y are incurred at the end of each year. The appropriate discount rate is 10% per year. Which machine should the company purchase? Crane X as EAC is $218,278.49 Crane X as EAC is $827,447.21 Crane Y as EAC is $946,052.56 Crane Y as EAC is $194,324.40arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $53,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $255,000. This machine will require $17,000 per year in ongoing maintenance expenses and will lower bottling costs by $12,000 per year. Also, $38,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The corporate tax rate is 28%. Should Beryl's Iced Tea continue…arrow_forwardshobhaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education