Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

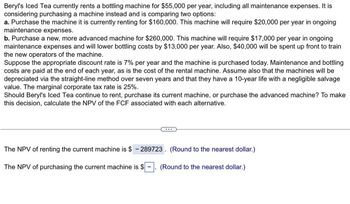

Transcribed Image Text:Beryl's Iced Tea currently rents a bottling machine for $55,000 per year, including all maintenance expenses. It is

considering purchasing a machine instead and is comparing two options:

a. Purchase the machine it is currently renting for $160,000. This machine will require $20,000 per year in ongoing

maintenance expenses.

b. Purchase a new, more advanced machine for $260,000. This machine will require $17,000 per year in ongoing

maintenance expenses and will lower bottling costs by $13,000 per year. Also, $40,000 will be spent up front to train

the new operators of the machine.

Suppose the appropriate discount rate is 7% per year and the machine is purchased today. Maintenance and bottling

costs are paid at the end of each year, as is the cost of the rental machine. Assume also that the machines will be

depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage

value. The marginal corporate tax rate is 25%.

Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? To make

this decision, calculate the NPV of the FCF associated with each alternative.

The NPV of renting the current machine is $ -289723. (Round to the nearest dollar.)

The NPV of purchasing the current machine is $ -

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $48,000 and a remaining useful life of four years. It can be sold now for $58,000. Variable manufacturing costs are $46,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is four years. Machine A Machine B Purchase price $ 116,000 $ 128,000 Variable manufacturing costs per year 21,000 13,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A.(b) Compute the income increase or decrease from replacing the old machine with Machine B.(c) Should Lopez keep or replace its old machine?(d) If the machine should be replaced, which new machine should Lopez purchase? (c) Should Lopez keep or replace its old machine?(d) If the machine should be replaced, which new machine should Lopez purchase? Compute the income increase or…arrow_forwardAxdew Limited is considering whether to manufacture an improved, more expensive version of their current line of best-selling lava lamps. Axdew currently spends $15,000 per year on maintenance and $80,000 on full-time salaries for staff. Maintenance costs are expected to remain the same but an additional labourer will need to be hired at an annual cost of $30,000. Manufacture of the newer version will require re-tooling of its existing machinery at a cost of $40,000. Axdew paid consultants a fee of $30,000 for a feasibility study to determine the viability of the new product. Which of the costs discussed above need to be considered by management in deciding whether to proceed with the new product? Justify your answer.arrow_forwardKiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corporation. The machine can be used for 15 years and then sold for $20,000 at the end of its useful life. Lollie has presented Kiddy with the following options: 1. Buy machine. The machine could be purchased for $170,000 in cash. All maintenance costs, which approximate $15,000 per year, would be paid by Kiddy. 2. Lease machine. The machine could be leased for a 15-year period for an annual lease payment of $35,000 with the first payment due immediately. All maintenance costs will be paid for by the Lollie Corporation and the machine will revert back to Lollie at the end of the 15-year period. Required: Assuming that a 12% interest rate properly reflects the time value of money in this situation and that all maintenance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations. Note:…arrow_forward

- The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $960,000, and it would cost another $22,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $451,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $12,500. The sprayer would not change revenues, but it is expected to save the firm $331,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight- line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. a. What is the Year-0 net cash flow? $ b. What are the net operating cash flows in Years 1, 2, and 3? Year 1:$ Year 2:$ Year 3:$ c. What is the additional Year-3 cash flow (i.e, the…arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $53,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $255,000. This machine will require $17,000 per year in ongoing maintenance expenses and will lower bottling costs by $12,000 per year. Also, $38,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The corporate tax rate is 28%. Should Beryl's Iced Tea continue…arrow_forwardshobhaarrow_forward

- QRW Corp, needs to replace an old machine with a new, more efficient model. The new machine being considered will result in an increase in camings before interest and taxes of $70,000 per year. The purchase price is $200,000, and it would cost an additional $10,000 to properly install the machine. In addition, to properly operate the machine, inventory must be increased by S10,000. This machine has an expected life of 10 years, with no salvage value. Assume that a straight-line depreciation method being used and that this machine is being depreciated down to zero, the marginal tax rate is 34%, and a required rate of return of 15%. (i) Solve for the value of the initial outlay associated with this project. (ii) Solve for the value of annual after-tax cash flows for this project from 1 through 9arrow_forward1.arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $52,000 per year, including all maintenance expenses. It is considering purchasing a machine instead and is comparing two options: a. Purchase the machine it is currently renting for $160,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $265,000. This machine will require $17,000 per year in ongoing maintenance expenses and will lower bottling costs by $15,000 per year. Also, $35,000 will be spent up front to train the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the cost of the rental machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The marginal corporate tax rate is 25%. The NPV of renting…arrow_forward

- Amazon is considering using high capacity drones that would make its product deliveries more efficient. For this project, $113,000 would need to be spent right away to buy the required fleet of drones. The drones will be losing their economic value in equal amount each year, fully over their 5-year economic lives. Once the drones' economic life is over, they would all be sold for $8,500 selling price to a new owner, and Amazon would then immediately purchase the same but brand-new drones for the same price as what it paid for the initial fleet of drones. When those drones' life is over, they would again be sold and, again, brand-new ones would be purchased - all for the same prices as for the initial drones, and so on, over and over. Additional information: • Amazon expects $9,200 in annual operating costs. • All future cash flows are year-end cash flows. ● Amazon pays 25 percent tax rate on all taxable income. Amazon requires an annual discount rate of 9 percent, and the rate is not…arrow_forwardBeryl's Iced Tea currently rents a bottling machine for $53,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: a. Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $265,000. This machine will require $18,000 per year in ongoing maintenance expenses and will lower bottling costs by $15,000 per year. Also, $35,000 will be spent upfront training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over 7 years and that they have a 10-year life with a negligible salvage value. The corporate tax rate is 30%. Should Beryl's Iced Tea continue to…arrow_forwardSheffield Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost $57,270. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,300. At the end of eight years, the company will sell the truck for an estimated $28,200. Traditionally, the company has used a general rule that it should not accept a proposal unless it has a payback period that is less than 50% of the asset's estimated useful life. Chris Jackson, a new manager, has suggested that the company should not rely only on the payback approach but should also use the net present value method when evaluating new projects. The company's cost of capital is 8%. ► (a) Calculate the cash payback period and net present value of the proposed investment. (If the net present value is negative, use either a negative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education