FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

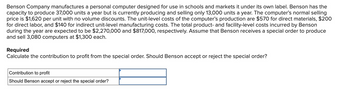

Transcribed Image Text:Benson Company manufactures a personal computer designed for use in schools and markets it under its own label. Benson has the

capacity to produce 37,000 units a year but is currently producing and selling only 13,000 units a year. The computer's normal selling

price is $1,620 per unit with no volume discounts. The unit-level costs of the computer's production are $570 for direct materials, $200

for direct labor, and $140 for indirect unit-level manufacturing costs. The total product- and facility-level costs incurred by Benson

during the year are expected to be $2,270,000 and $817,000, respectively. Assume that Benson receives a special order to produce

and sell 3,080 computers at $1,300 each.

Required

Calculate the contribution to profit from the special order. Should Benson accept or reject the special order?

Contribution to profit

Should Benson accept or reject the special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forwardFutura Company purchases the 69,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $10.40 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company’s chief engineer is opposed to making the starters because the production cost per unit is $11.60 as shown below: Per Unit Total Direct materials $ 5.00 Direct labor 2.20 Supervision 1.90 $ 131,100 Depreciation 1.30 $ 89,700 Variable manufacturing overhead 0.70 Rent 0.50 $ 34,500 Total product cost $ 11.60 If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $131,100) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space…arrow_forwardFutura Company purchases the 71,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $12.70 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $12.90 as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $ 6.00 3.00 1.50 1.30 0.70 0.40 $12.90 Total $ 106,500 $ 92,300 $ 28,400 If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $106,500) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $84,000 per period.…arrow_forward

- InteliSystems manufactures an optical switch that it uses in its final product. InteliSystems incurred the following manufacturing costs when it produced 70,000 units last year as shown in the chart below: InteliSystems does not yet know how many switches it will need this year; however, another company has offered to sell InteliSystems the switch for $8.50 per unit. If InteliSystems buys the switch from the outside supplier, the manufacturing facilities that will be idle cannot be used for any other purpose; yet none of the fixed costs are avoidable. Requirements 1. Given the same cost structure, should InteliSystems make or buy the switch? Show your analysis. 2. Now, assume that InteliSystems can avoid $105,000 of fixed costs a year by outsourcing production. In addition, because sales are increasing, InteliSystems needs 75,000 switches a year rather than 70,000 switches. What should the company do now? 3. Given the last scenario, what is the most InteliSystems would be willing to…arrow_forwardThe Fraser Paper Company produces large rolls of white paper weighing 1,000 kilograms for wholesalers for $1,500 each. The wholesalers then cut the paper into standard-sized sheets and package it in 2-kilogram packages. These packages are sold to printers for $4 per package. There is no waste in the cutting process. Fraser Paper currently produces 5 million kilograms of paper annually at a fixed cost of $1 million and a variable cost of $0.80 per kilogram. If Fraser bypassed the wholesalers and cut its own paper for sale directly to printers, Fraser would have to add equipment and personnel with an annual fixed cost of $650,000. Incremental variable costs would be $0.10 per kilogram. Required: 1-a. Calculate the annual profit from further processing. (Enter your answer in whole dollars, not in millions.) Annual profit/loss 1-b. Should Fraser cut its own paper or continue to sell to wholesalers? O Continue to sell to wholesalers O Cut the paper themselvesarrow_forwardFutura Company purchases the 68.000 starters that it installs in its standard line of farm tractors from a supplier for the price of $11.00 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $11.60 as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $5.00 2.80 1.70 1.00 0.20 0.40 $11.60 Total $ 115,600 $ 68,000 $ 27,200 If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $115,600) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $84,000 per period.…arrow_forward

- Riders, Ltd. is a manufacturer that produces motorized scooters. Currently, it is producing the motor used to power the scooter, but is considering buying the motor from an outside supplier. The manufacturing costs for Riders to make 20,000 motors are as follows: Cost per motor Direct material $28.50 Direct labor $13.25 Overhead $18.00 An outside supplier offers to supply Riders with all the motors it needs at $55.00 per unit. If Riders buys the motors from the supplier, it will still incur 80% of its overhead costs. Based on the above information, the financial advantage (disadvantage) of buying the 20,000 motors from the outside supplier is: a. ($265,000) b. None of the other answers are correct c. $95,000 d. ($193,000) e. $23,000arrow_forwardFutura Company purchases the 71,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $12.70 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $12.90 as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $ 6.00 3.00 1.50 1.30 0.70 0.40 $ 12.90 Total If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $106,500) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $84,000 per period. Depreciation is due to obsolescence…arrow_forwardLakeside Inc. produces a product that currently sells for $60 per unit. Current production costs per unit include direct materials, $16; direct labor, $18; variable overhead, $11; and fixed overhead, $11. Product engineering has determined that certain production changes could refine the product quality and functionality. These new production changes would increase material and labor costs by 20% per unit. Lakeside has received an offer from a nonprofit organization to buy 9,200 units at $46 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. Increase in operating incomearrow_forward

- A small shop in Bulacan fabricates portable threshers for palay producers in the locality. The shop can produce each thresher at a labor cost of P1,800. The cost of materials for each unit is P2,500. The variable costs amount to P650 per unit, while fixed charges incurred per annum totals P69,000. If the portable threshers are sold at P7,800 per unit, how many units must be produced and sold per annum to break-even? Support your answer with computations and also by graphical solution.arrow_forwardAlpesharrow_forwardFinch Modems has excess production capacity and is considering the possibility of making and selling paging equipment. The following estimates are based on a production and sales volume of 1,600 pagers. Unit-level manufacturing costs are expected to be $26. Sales commissions will be established at $1.60 per unit. The current facility- level costs, including depreciation on manufacturing equipment ($66,000), rent on the manufacturing facility ($56,000), depreciation on the administrative equipment ($13,800), and other fixed administrative expenses ($74,950), will not be affected by the production of the pagers. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new product (pagers) on the basis of the number of units of product made (i.e., 5,600 modems and 1,600 pagers). Required a. Determine the per-unit cost of making and selling 1,600 pagers. (Do not round intermediate calculations. Round your answer to 3 decimal places.)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education