FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

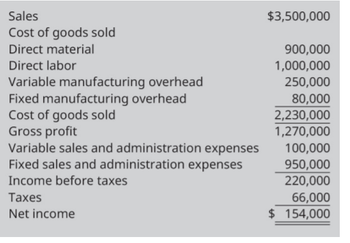

Before the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget to 85,000 units of sales. What is net income at 85,000 units of sales?

A) ($33,500)

B) $22,750

C) $66,500

D) ($21,000)

Transcribed Image Text:Sales

Cost of goods sold

Direct material

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Cost of goods sold

Gross profit

Variable sales and administration expenses

Fixed sales and administration expenses

Income before taxes

Taxes

Net income

$3,500,000

900,000

1,000,000

250,000

80,000

2,230,000

1,270,000

100,000

950,000

220,000

66,000

$ 154,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 2 Meals Company is a startup company producing and delivering boxed meals to tailgate parties. The company operates four months, September through December, during a fiscal year. Assume there are zero costs during the ensuing eight months. The company owner has forecasted the following sales and financial data for the upcoming fiscal year: Meal boxes sold 20,000 total boxes; the sales forecast for the meals sold by month follows: Forecast 5,000 5,000 8,000 2,000 September October November Meal box sales price Food cost Wages December $5.00 $2.00 per box Food preparer Owner $10 per hour; 0.05 hours per box $20,000 salary $1,000 + $0.10 per box $3.50 per gallon 20 miles per gallon 400 total miles driven delivering meals $4,000 $6,000 Utilities Fuel Facilities Miscellaneous Required (a) Prepare an annual budget for the fiscal year Annual Budget $ Revenue Expenses Total Expenses NOI 7arrow_forwardLincoln Corporation used the following data to evaluate their current operating system. The company sells items for $19 each and used a budgeted selling price of $19 per unit. Actual Budgeted Units sold 48,000 units 39,000 units Variable costs $167,000 $152,000 Fixed costs $41,000 $50,000 What is the static-budget variance of revenues? A) $171,000 favorable B) $171,000 unfavorable C) $6,000 favorable D) $9,000 unfavorablearrow_forwardFrancis and Company has planned a cash budget for the third quarter of 2004. The cash balance on July 1, 2004 is expected to be an overdraft of $82,000. Extracts from the sales and purchases budgets are as follows: Budgeted Budgeted Purchases Month Sales $800,000 $900,000 May $600,000 $550,000 $450,000 $500,000 June July August September $750,000 $650,000 $800,000 All sales are on credit and an analysis of the records shows that debtors settle according to the following pattern, in accordance with the credit terms 5/30, n90: i) 50% in the month of sale 30% in the month following sale 20% the following month i1) All purchases are on credit and past experience shows that 80% are settled in the month of purchase in order to take advantage of a 10% prompt settlement discount. The balance will be disbursed in the month after purchase. The credit terms of the suppliers - 10/30, n60. Wages and salaries are expected to be $1,800,000 per annum and are paid iii) monthly. Fixed operating…arrow_forward

- Before the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales. Flexible Budget 100,000 80,000 90,000 Sales $3,580,000 $fill in the blank 1 $fill in the blank 2 Cost of Goods Sold Direct Material $900,000 $fill in the blank 3 $fill in the blank 4 Direct Labor 1,100,000 fill in the blank 5 fill in the blank 6 Variable Manufacturing Overhead 240,000 fill in the blank 7 fill in the blank 8 Fixed Manufacturing Overhead 70,000 fill in the blank 9 fill in the blank 10 Cost of Goods Sold $2,310,000 $fill in the blank 11 $fill in the blank 12 Gross Profit $1,270,000 $fill in the blank 13 $fill in the blank 14 Variable Sales and Administrative Expenses 100,000 fill in the blank 15 fill in the blank 16 Fixed Sales and Administrative Expenses 940,000 fill in the blank…arrow_forwardGibson Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. Note: Round your final answers to the nearest whole dollar amount. Division First Quarter Second Quarter Third Quarter Fourth Quarter Cummings Division $ 160,000 Springfield Division 390,000 Douglas Division 260,000 Required A Required B >arrow_forwardThe actual information pertains to the third quarter. As part of the budgeting process, the Duck Decoy Department of Paralith Incorporated had developed the following static budget for the third quarter. Duck Decoy is in the process of preparing the flexible budget and understanding the results. Actual Results Flexible Budget Static Budget Sales volume (in units) 19,000 18,000 Sales revenues $240,000 $ $233,000 Variable costs 141,000 183,000 Contribution margin 99,000 50,000 Fixed costs 41,000 34,000 Operating profit $58,000 $ $16,000 The flexible budget will report ________ for the fixed costs. Do not give answer in image formatearrow_forward

- During the current year, Cullumber Corporation expects to produce 10,000 units and has budgeted the following: net income $350,000; variable costs $1,290,000; and fixed costs $110,000. It has invested assets of $1,650,000. What was the company's budgeted ROI? What was its budgeted markup percentage using a total cost approach? Budgeted ROI per unit Budgeted markup percentage $ %arrow_forward3. Before the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales. Sales $3,500,000 Cost of goods sold Direct material 900,000 Direct labor 1,000,000 Variable manufacturing overhead Fixed manufacturing overhead Cost of goods sold Gross profit Variable sales and administration expenses Fixed sales and administration expenses 250,000 80,000 2,230,000 1,270,000 100,000 950,000 Income before taxes 220,000 Таxes 66,000 Net income $ 154,000arrow_forwardZaria Inc. provides the following budgeted data for producing 10,000 units of one of its products in its static budget for the next quarter: Sales per unit $60 Variable costs per unit $40 Fixed costs for the quarter $20,000 What would be the amount of operating income to be reported in the flexible budget prepared at a volume of 12,000 units? Group of answer choices $620,000 $216,000 $220,000 $300,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education