FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

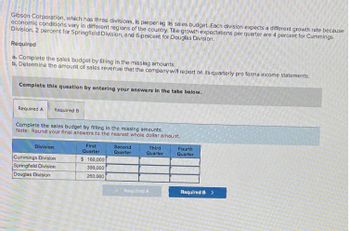

Transcribed Image Text:Gibson Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because

economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings

Division, 2 percent for Springfield Division, and 6 percent for Douglas Division.

Required

a. Complete the sales budget by filling in the missing amounts.

b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Complete the sales budget by filling in the missing amounts.

Note: Round your final answers to the nearest whole dollar amount.

Division

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Cummings Division

$ 160,000

Springfield Division

390,000

Douglas Division

260,000

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 11,000 2nd Quarter 12,000 3rd Quarter 4th Quarter 13,000 Budgeted unit sales 14,000 The selling price of the company's product is $18.00 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70,200. The company expects to start the first quarter with 1,650 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,850 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2.…arrow_forwardShaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $6.30 per customer served. Wages and salaries should be $22,300 per month plus $0.90 per customer served. Supplies should be $0.80 per customer served. Insurance should be $5,950 per month. Miscellaneous expenses should be $4,400 per month plus $0.20 per customer served. The company reported the following actual results for October: Customers served Revenue. Wages and salaries Supplies Insurance Miscellaneous expense Required: Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Customers served Revenue Expenses: Wages and salaries Supplies Insurance 22,750 $ 177,300 $ 40,725 $…arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 24 Variable expense per unit $ 17 Fixed expense per month $ 5,950 Unit sales per month 1,000 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).) 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forward

- Executive officers of Fanning Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two different sources. Source of Estimate Sales manager Marketing consultant Fanning's past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 20 percent of the next quarter's expected cost of goods sold as the current quarter's ending inventory. This year's ending inventory is $25,000. Next year's ending inventory is budgeted to be $26,000. Required a. Prepare an inventory purchases budget using the sales manager's estimate. b. Prepare an inventory purchases budget using the marketing consultant's estimate. Complete this question by entering y Assessment Tool iFrame tabs below. Show Transcribed Text First Quarter Second Quarter $ 383,000 $ 304,000 527,000 470,000 Sales Required A Required B Required A Prepare y purchases budget using the sales manager's estimate. Note: Round…arrow_forwardStuart Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. Note: Round your final answers to the nearest whole dollar amount. Division First Quarter Second Third Quarter Quarter Fourth Quarter Cummings Division $ 100,000 Springfield Division 400,000 Douglas Division 220,000arrow_forwardIt is budgeting time for Rod Co. The following assumptionswere agreed upon for the next year after strategic planning,which covered a five-year horizon: 1. Sales are estimated tobe at 70,000 units at its national selling price of P126. 2.Sales discounts are given to various customers at differentrates, and the net to gross ratio is at 93%. 3. Markup onmerchandise is at 45% of the invoice cost. Beginninginventory is P80,900 and is expected to be reduced byP15,000 at the end of the period. 4. Selling andadministrative expenses are expected to be 15% of grosssales. 5. Depreciation is computed at P500,000. 6. Seventy-five percent (75%) of sales are on credit. Doubtful accountsexpense is estimated to be 1.5% of credit sales. Required:What is the budgeted income statement for Rod Co.arrow_forward

- The manager of the Dallas Division of Walking Tours of America is preparing the budget for 2021. At this point, she has determined that average total assets for 2021 will equal $4,000,000. She is evaluated on the amount of residual income generated by her division. Assume variable costs in Dallas Division are expected to equal 60% of total sales and fixed costs are expected to equal $400,000 in 2021. 1. Compute the sales level that would generate a 20% return on investment. 2. Assuming the rate of return is 15%, determine the level of sales that would generate $200,000 of residual income.arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ $ $ 7,920 1,030 27 18 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forwardExecutive officers of Munoz Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two different sources. Source of Estimate Sales manager Marketing consultant First Quarter $ 388,000 517,000 Complete this question by entering your answers in the tabs below. Sales Munoz's past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 20 percent of the next quarter's expected cost of goods sold as the current quarter's ending Inventory. This year's ending Inventory is $35,000. Next year's ending Inventory is budgeted to be $36,000. Required a. Prepare an Inventory purchases budget using the sales manager's estimate. b. Prepare an Inventory purchases budget using the marketing consultant's estimate. Required A Required B Prepare an inventory purchases budget using the sales manager's estimate. Note: Round your final answers to nearest whole dollar amount. Total inventory…arrow_forward

- Stuart Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. Determinarrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 29 $ 13 $ 14,080 1,030 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 1234 should be entered as 12.34).) 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forwardKramer Enterprises reports year-end information from 2022 as follows: Sales (160,000 units) $960,000 Cost of goods sold 640,000 Gross margin 320,000 Operating expenses 260,000 Operating income $60,000 Kramer is developing the 2023 budget. In 2023 the company would like to increase selling prices by 8%, and as a result expects a decrease in sales volume of 10%. All other operating expenses are expected to remain constant. What is budgeted sales for 2023? A) $1,036,800 B) $1,066,666 C) $933,120 D) $864,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education