FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

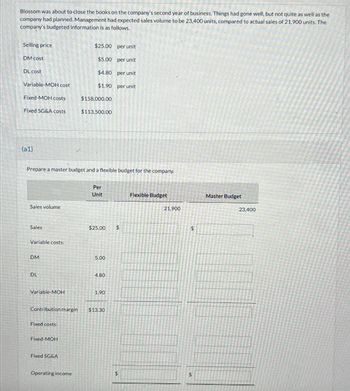

Transcribed Image Text:Blossom was about to close the books on the company's second year of business. Things had gone well, but not quite as well as the

company had planned. Management had expected sales volume to be 23,400 units, compared to actual sales of 21,900 units. The

company's budgeted information is as follows.

Selling price

DM cost

DL cost

Variable-MOH cost

Fixed-MOH costs

Fixed SG&A costs

(a1)

Sales volume

Prepare a master budget and a flexible budget for the company.

Sales

Variable costs:

DM

DL

Variable-MOH

Fixed costs:

Fixed-MOH

$25.00

per unit

$5.00 per unit

$4.80 per unit

$1.90

per unit

Fixed SG&A

$158,000.00

$113.500.00

Operating income

Per

Unit

$25.00

Contribution margin $13.30

5.00

4.80

1.90

$

$

Flexible Budget

21,900

$

$

Master Budget

23,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 1 Margin of safety (in dollars) 2. Margin of safety percentage 27 $ 12 $ 12,300 978 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 1234 should be entered as 12.34).)arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales. Flexible Budget 100,000 80,000 90,000 Sales $3,580,000 $fill in the blank 1 $fill in the blank 2 Cost of Goods Sold Direct Material $900,000 $fill in the blank 3 $fill in the blank 4 Direct Labor 1,100,000 fill in the blank 5 fill in the blank 6 Variable Manufacturing Overhead 240,000 fill in the blank 7 fill in the blank 8 Fixed Manufacturing Overhead 70,000 fill in the blank 9 fill in the blank 10 Cost of Goods Sold $2,310,000 $fill in the blank 11 $fill in the blank 12 Gross Profit $1,270,000 $fill in the blank 13 $fill in the blank 14 Variable Sales and Administrative Expenses 100,000 fill in the blank 15 fill in the blank 16 Fixed Sales and Administrative Expenses 940,000 fill in the blank…arrow_forward

- Amanda Manufacturing Company prepared the following static budget income statement: $ 476,000.00 (336,000.00) 140,000.00 (66,000.00) $ 74,000.00 Revenues Variable Costs Contribution Margin Fixed Costs Net Income The budgeted costs were based on a planned sales volume of 14,000 units. Actual production was 7,800 units. The amount of net income based on a flexible budget of 7,800 units would have been Multiple Choice $6.200.00 $12,000.00. Show Transcribed Text O $270,000.00 O $6,200.00. O O $12,000.00. $270,000.00. $4,200.00. J Carrow_forwardDuring the current year, Cullumber Corporation expects to produce 10,000 units and has budgeted the following: net income $350,000; variable costs $1,290,000; and fixed costs $110,000. It has invested assets of $1,650,000. What was the company's budgeted ROI? What was its budgeted markup percentage using a total cost approach? Budgeted ROI per unit Budgeted markup percentage $ %arrow_forwardAs a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, you've been asked to do some what-if analyses. Following is the budgeted Information regarding the coming year: Selling price per unit Variable cost per unit Fixed costs (per year) Required: $ 100.00 60.00 1,113,040 1. What is the breakeven volume, in units and dollars, for the coming year? 2. Assume that the goal of the company is to earn a pretax (operating) profit of $316,000 for the coming year. How many units would the company have to sell to achieve this goal? 3. Assume that of the $60 variable cost per unit the labor-cost component is $27. Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is…arrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And please explain proper steps by Step.arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 30 Variable expense per unit $ 19 Fixed expense per month $ 9,570 Unit sales per month 1,020 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 30 $ 12 $ 15,840 1,030 Required: 1. What is the company's margin of safety? Note: Do not round Intermediate calculations. 2. What is the company's margin of safety as a percentage of its sales? Note: Round your percentage answer to 2 decimal places (1.e. .1234 should be entered as 12.34). 1. Margin of safety (in dollars) 2. Margin of safety percentage %6arrow_forward

- Haresharrow_forwardGig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales Selling price per unit Cost per unit Variable selling and administrative expense (per unit) Fixed selling and administrative expense (per year) Interest expense for the year Required: Prepare the company's budgeted income statement for the year. Gig Harbor Boating Budgeted Income Statement 580 $ 2,010 $ 1,470 $45 $ 200,000 $ 17,000arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month Required: 1. What is the company's margin of safety? $ 27 $ 13 $ 12,040 1,010 Note: Do not round intermediate calculations. 2. What is the company's margin of safety as a percentage of its sales? Note: Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34). 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education