FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide Required answer

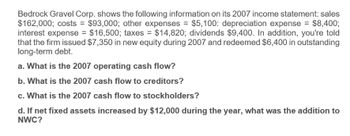

Transcribed Image Text:Bedrock Gravel Corp. shows the following information on its 2007 income statement: sales

$162,000; costs = $93,000; other expenses = $5,100: depreciation expense = $8,400;

interest expense = $16,500; taxes = $14,820; dividends $9,400. In addition, you're told

that the firm issued $7,350 in new equity during 2007 and redeemed $6,400 in outstanding

long-term debt.

a. What is the 2007 operating cash flow?

b. What is the 2007 cash flow to creditors?

c. What is the 2007 cash flow to stockholders?

d. If net fixed assets increased by $12,000 during the year, what was the addition to

NWC?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need Answerarrow_forwardSquare Hammer Corporation shows the following information on its 2018 income statement: Sales = $196,000; Costs = $84,000; Other expenses = $5,100; Depreciation expense = $9,000; Interest expense = $13,300; Taxes = $29,610; Dividends = $10,300. In addition, you're told that the firm issued $7,100 in new equity during 2018 and redeemed $8,700 in outstanding long-term debt. a. What is the 2018 operating cash flow? Operating cash flow b. What is the 2018 cash flow to creditors? Cash flow to creditorsarrow_forwardTerry's Markets has sales of $684,000, costs of $437,000, interest paid of $13,800, total assets of $712,000, and depreciation of $109,400. The tax rate is 21 percent and the equity multiplier is 1.6. Please use the Dupont Identity to compute the return on equity.arrow_forward

- General Accountingarrow_forwardNightwish Corporation shows the following information on its 2021 income statement: Sales $336,000; Costs = $20,600; Interest expense = $14,200; Taxes = $21,275; Dividends = $21,450. In addition, you're told that the firm issued $7,100 in new equity during 2021 and redeemed $5,400 in outstanding long-term debt. $194,700; Other expenses = $9,800; Depreciation expense = %3D a. What is the 2021 operating cash flow? (Do not round intermediate calculations.) b. What is the 2021 cash flow to creditors? (Do not round intermediate calculations.) c. What is the 2021 cash flow to stockholders? (Do not round intermediate calculations.) d. If net fixed assets increased by $53,200 during the year, what was the addition to NWC? (Do not round intermediate calculations.) a. Operating cash flow b. Cash flow to creditors c. Cash flow to stockholders d. Addition to NWCarrow_forwardACME Corp’s balance sheet reported that it had $650,000 in liabilities and $275,000 in equity. On the income statement the company had revenues of $867,030 and expenses (excluding depreciation) of $356,240. Depreciation was $103,456 and interest expense of $52,423. Assuming a 40% tax rate, what was the company's return on assets?arrow_forward

- Tibbs Inc. had the following data for the year ending 12/31/12: Net income = $400; Net operating profit after taxes (NOPAT) = $450; Total assets = $2,600; Short-term investments = $200; Stockholders' equity = $1,600; Total debt = $1,000; and Total operating capital = $2,200. What was its return on invested capital (ROIC)? Group of answer choices 14.32% 22.50% 16.36% 20.45% 18.41%arrow_forwardTibbs Inc. had the following data for the most recent year: Net income = $300; Net operating profit after taxes (NOPAT) = $380; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,300. What was its return on invested capital (ROIC)? Select the correct answer. a. 16.92% b. 16.52% c. 17.12% d. 16.72% e. 16.32%arrow_forwardBaby Camels Inc. had the following data for the year ending 12/31/12: Net income = $1,500; EBIT $3,225; Tax Rate = 45%; Total assets = $4,900; Short-term investments = $600; = Stockholders' equity = $2,000; Total debt = $1,900; and Total operating capital = $4,475. What was its return on invested capital (ROIC)? O 30.61% 33.52% 39.64% 65.82% ○ 72.07%arrow_forward

- Question: Schwert Corp. shows the following information on its 2007 income statement: Sales Costs Other expenses $145,000 $86,000 $4,900 Depreciation expense $7,000 Interest expense Taxes Dividends $15,000 $12,840 $8,700 In addition, you're told that the firm issued $6,450 in new equity during 2007 and redeemed $6,500 in outstanding long-term debt. What is the 2007 cash flow to creditors?arrow_forwardBrown Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 25%. How much was the firm's earnings before taxes (EBT)?arrow_forwardBarnes' Brothers has the following data for the year ending 12/31/12: Net income = $550; Net operating profit after taxes (NOPAT) = $650; Total assets = $2,700; Short-term investments = $100; Stockholders' equity = $2,000; Total debt = $750; and Total operating capital = $2,300. Barnes' weighted average cost of capital is 11%. What is its economic value added (EVA)? Group of answer choices $357.30 $317.60 $397.00 $436.70 $277.90arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education