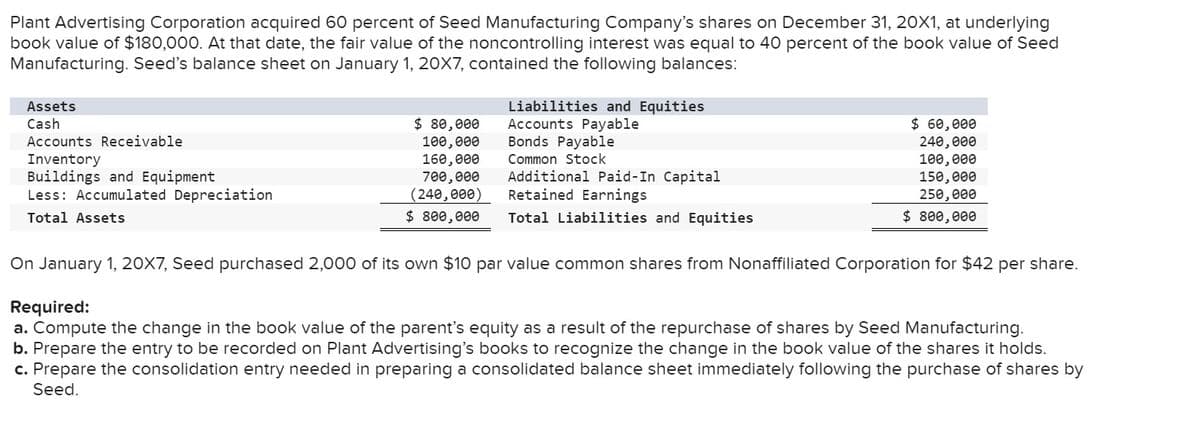

Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Company's shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Seed Manufacturing. Seed's balance sheet on January 1, 20X7, contained the following balances: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Liabilities and Equities $ 80,000 Accounts Payable 100,000 Bonds Payable 160,000 Common Stock 700,000 (240,000) Additional Paid-In Capital Retained Earnings $ 800,000 Total Liabilities and Equities $ 60,000 240,000 100,000 150,000 250,000 $ 800,000 Total Assets On January 1, 20X7, Seed purchased 2,000 of its own $10 par value common shares from Nonaffiliated Corporation for $42 per share. Required: a. Compute the change in the book value of the parent's equity as a result of the repurchase of shares by Seed Manufacturing. b. Prepare the entry to be recorded on Plant Advertising's books to recognize the change in the book value of the shares it holds. c. Prepare the consolidation entry needed in preparing a consolidated balance sheet immediately following the purchase of shares by Seed.

Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Company's shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Seed Manufacturing. Seed's balance sheet on January 1, 20X7, contained the following balances: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Liabilities and Equities $ 80,000 Accounts Payable 100,000 Bonds Payable 160,000 Common Stock 700,000 (240,000) Additional Paid-In Capital Retained Earnings $ 800,000 Total Liabilities and Equities $ 60,000 240,000 100,000 150,000 250,000 $ 800,000 Total Assets On January 1, 20X7, Seed purchased 2,000 of its own $10 par value common shares from Nonaffiliated Corporation for $42 per share. Required: a. Compute the change in the book value of the parent's equity as a result of the repurchase of shares by Seed Manufacturing. b. Prepare the entry to be recorded on Plant Advertising's books to recognize the change in the book value of the shares it holds. c. Prepare the consolidation entry needed in preparing a consolidated balance sheet immediately following the purchase of shares by Seed.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

Vishnu

Transcribed Image Text:Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Company's shares on December 31, 20X1, at underlying

book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Seed

Manufacturing. Seed's balance sheet on January 1, 20X7, contained the following balances:

Assets

Cash

Accounts Receivable

Inventory

Buildings and Equipment

Less: Accumulated Depreciation

Liabilities and Equities

$ 80,000

Accounts Payable

100,000

Bonds Payable

160,000

Common Stock

700,000

(240,000)

Additional Paid-In Capital

Retained Earnings

$ 800,000

Total Liabilities and Equities

$ 60,000

240,000

100,000

150,000

250,000

$ 800,000

Total Assets

On January 1, 20X7, Seed purchased 2,000 of its own $10 par value common shares from Nonaffiliated Corporation for $42 per share.

Required:

a. Compute the change in the book value of the parent's equity as a result of the repurchase of shares by Seed Manufacturing.

b. Prepare the entry to be recorded on Plant Advertising's books to recognize the change in the book value of the shares it holds.

c. Prepare the consolidation entry needed in preparing a consolidated balance sheet immediately following the purchase of shares by

Seed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning