Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

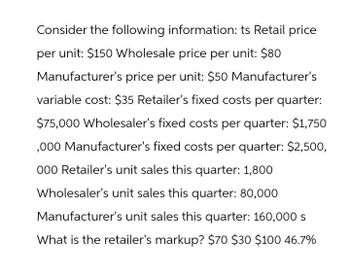

Transcribed Image Text:Consider the following information: ts Retail price

per unit: $150 Wholesale price per unit: $80

Manufacturer's price per unit: $50 Manufacturer's

variable cost: $35 Retailer's fixed costs per quarter:

$75,000 Wholesaler's fixed costs per quarter: $1,750

,000 Manufacturer's fixed costs per quarter: $2,500,

000 Retailer's unit sales this quarter: 1,800

Wholesaler's unit sales this quarter: 80,000

Manufacturer's unit sales this quarter: 160,000 s

What is the retailer's markup? $70 $30 $100 46.7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following, calculate the net price of the purchase by a customer who buys 1,000 cases of product and pays the supplier within 15 days of shipment. What is the total percentage discount on the sale? Cost of product: $75.00 per case Trade discount: $5.00 per case Quantity discount: 1.5% for each 500 cases Performance allowance: 5% Cash discount: 2/10, net 30arrow_forwardwhat is the dollar sales to attain that target profit is closest to Data concerning Strite Corporation's single product appear below: Selling price per unit Variable expense per unit Fixed expense per month $ 150.00 $ 42.00 $421,200 He Assume the company's target profit is $8,000. The dollar sales to attain that target profit is closest to: (Round your i calculations to 2 decimal places.)arrow_forwardA company reported the following data: • Sales price per unit: $10 • Fixed cost per month: $20,000 Variable cost per unit: $2 How many units must this company sell each month in order to reach a target profit of $50,000?arrow_forward

- A retailer buys a product from a supplier for $40. The retailer needs a 30% markup on cost to cover operating expenses. If the product is sold for $48, what is the outcome?arrow_forwardCalculate the economic ordering quantity for Nashville Records Inc. , given the following information : Sales : 15,000 units per year Sales price : $10 Purchase price : $ 5 Carrying cost: 0.25 times inventory value Fixed cost per order : $ 1000arrow_forwardEOQ? CALCULATEarrow_forward

- Schylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardWhen prices are rising (inflation), which costing method would produce the highest value for gross margin? Choose between first-in, first-out (FIFO); last-in, first-out (LIFO); and weighted average (AVG). Evansville Company had the following transactions for the month. Calculate the gross margin for each of the following cost allocation methods, assuming A62 sold just one unit of these goods for $10,000. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardSuppose a company finds that shipping cost is 3,560 each month plus 6.70 per package shipped. What is the cost formula for monthly shipping cost? Identify the independent variable, the dependent variable, the fixed cost per month, and the variable rate.arrow_forward

- Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forwardData concerning Strite Corporation's single product appear below: Selling price per unit Variable expense per unit Fixed expense per month Assume the company's target profit is $8,000. The dollar sales to attain that target profit is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1,532,857 $429,200 $596,111 $ 150.00 $ 42.00 $ 421,200 $852,723arrow_forwardA dining set costs a company $2,300 to manufacture. If it sells for $5,175, what is the percent markup based on cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College