FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

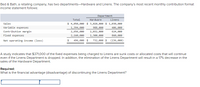

Transcribed Image Text:Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format

income statement follows:

Department

Total

Hardware

Linens

Sales

$ 4,050,000 $ 3,020,000 $ 1,030,000

Variable expenses

1,394,000

988,000

406,000

Contribution margin

2,656,000

2,032,000

624,000

Fixed expenses

2,160,000

1,300,000

860,000

Net operating income (loss)

496,000 $

732,000 $

(236, 000)

A study indicates that $371,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue

even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 17% decrease in the

sales of the Hardware Department.

Required:

What is the financial advantage (disadvantage) of discontinuing the Linens Department?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Old Jeans, Incorporated, has two divisions or profit centers, one makes regular fit jeans and the other makes relaxed fit jeans. The information for the two centers for the month of May follows: Regular fit Relaxed fit Sales $ 400,000 $ 175,000 Variable cost (as a % of Sales) 40% 50% Traceable fixed costs $ 40,000 $ 70,000 There are also common fixed costs of $27,500. Required: Prepare a responsibility income statement by profit center and in total.arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,360,000 1,375,000 2,985,000 2,220,000 $ 765,000 Department Hardware $ 3,160,000 962,000 2,198,000 1,320,000 $ 878,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $ 1,200,000 413,000 787,000 900,000 $ (113,000) A study indicates that $371,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department.arrow_forwardCaldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Activity Purchasing Warehousing Distributing Cost Driver Number of purchase orders Number of moves Number of shipments. Quantity of Cost Driver 1,040 8,400 540 Maximum cost Cost per Unit of Cost Driver $154 per order 34 per move 84 per shipment Caldwell buys 100,400 units at an average unit cost of $14 and sells them at an average unit price of $24. The firm also has fixed operating costs of $250,400 for the year. Caldwell's customers are demanding a 14% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 8% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 720 and can decrease the cost of each shipment by…arrow_forward

- Pathways Careers, Inc. has two products-Resume Reader and Cover Letter Cure. Financial data for both the products follow: Resume Cover Letter Reader Cure 2,600 units 1,300 units Units sold Sales price per unit Variable manufacturing cost per unit Sales commission (% of sales) $600 320 6% $1,000 650 4% Pathways has two sales representatives-Curtis Muller and Willow Brown. Each sales representative sold a total of 1,950 units during the month of March. Curtis had a sales mix of 60% Resume Reader and 40% Cover Letter Cure. Willow had a sales mix of 80% Resume Reader and 20% Cover Letter Cure. Based on the above information, calculate Willow's total contribution to company profits. OA. $380,640 O B. $120,900 OC. $501,540 OD. $573,300arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $4,200,000 $3,090,000 $1,110,000 Variable expenses 1,240,000 840,000 400,000 Contribution margin 2,960,000 2,250,000 710,000 Fixed expenses 2,300,000 1,470, 000 830,000 Net operating income (loss) $ 660,000 $ 780,000 $ (120,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage ( disadvantage) of discontinuing the Linens Department?arrow_forwardSubmit A retailer has two departments-Home and Garden. The company's most recent contribution format income statement follows: Total Home Garden Sales $৪00, 000 $350,000 $450,000 Variable expenses 320,000 120,000 200,000 Contribution margin Fixed expenses 480,000 230,000 250,000 400,000 140,000 260,000 35:51 Net operating income (1loss) $ 80,000 $ 90,000 $(10,000) The retailer is considering whether It should close the Garden Department. Further analysis revealed that, of the fixed expenses being charged to the Garden Department, $140,000 are sunk costs or allocated costs that will continue If Garden is discontinued. In addition, If the Garden Department is discontinued, sales in the Home Department will drop by 5%. How much does the company's profit increase or decrease if the Garden Department is discontinued? (If a decrease, the dollar amount is indicated in parentheses, ie., $ (1,000).) Multiple Cholce $ (124,000) O Quiz $ (161,500) 1009arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardCaldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Cost Driver Number of purchase orders Number of moves Distributing Number of shipments Activity Purchasing Warehousing Quantity of Cost Driver 1,200 8,900 700 Cost per Unit of Cost Driver $170 per order 39 per move 100 per shipment Caldwell buys 102,000 units at an average unit cost of $19 and sells them at an average unit price of $29. The firm also has fixed operating costs of $252,000 for the year. Maximum cost Caldwell's customers are demanding a 19% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 13% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 880 and can decrease the cost of each shipment by…arrow_forwardTike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forward

- Macee Store has three operating departments, and it conducts advertising that benefits all departments. Advertising costs are $110,000. Sales for its operating departments follow. Department Sales 1 $ 247,500 2 455,400 3 287, 100 How much advertising cost is allocated to each operating department if the allocation is based on departmental sales? Note: Do not round your intermediate calculations.arrow_forwardMacee Store has three operating departments, and it conducts advertising that benefits all departments. Advertising costs are $108,000. Sales for its operating departments follow. Department 2 Sales $ 272,500 523, 200 294,300 How much advertising cost is allocated to each operating department If the allocation is based on departmental sales? (Do not round your intermediate calculations.) Department Sales Percent of Total 1 2 3 Total % % % % Cost Allocatedarrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education