Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

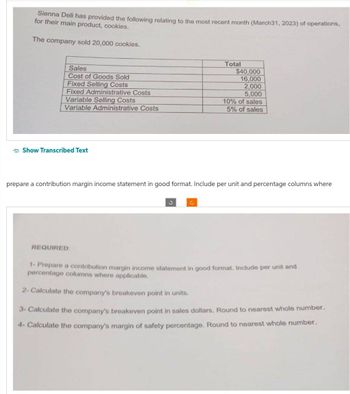

Transcribed Image Text:Sienna Deli has provided the following relating to the most recent month (March31, 2023) of operations,

for their main product, cookies.

The company sold 20,000 cookies.

Sales

Cost of Goods Sold

Fixed Selling Costs

Fixed Administrative Costs

Variable Selling Costs

Variable Administrative Costs

Show Transcribed Text

REQUIRED:

Total

prepare a contribution margin income statement in good format. Include per unit and percentage columns where

C

$40,000

16,000

2,000

5,000

10% of sales

5% of sales

1- Prepare a contribution margin income statement in good format. Include per unit and

percentage columns where applicable.

2- Calculate the company's breakeven point in units.

3- Calculate the company's breakeven point in sales dollars. Round to nearest whole number.

4- Calculate the company's margin of safety percentage. Round to nearest whole number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The contribution margin income statement of Unique Donuts for August 2024 follows: (Click the icon to view the contribution margin income statement.) Data table Unique Donuts Contribution Margin Income Statement Month Ended August 31, 2024 Net Sales Revenue Variable Costs: Cost of Goods Sold Selling Costs Administrative Costs Contribution Margin Fixed Costs: Selling Costs Administrative Costs Operating Income $ 32,300 17,200 1,300 42,210 14,070 $ $ - 127,000 50,800 76,200 56,280 19,920 Requirements Unique sells two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $3.10, with total variable cost of $1.24 per dozen. A dozen custard-filled donuts sells for $7.20, with total variable cost of $2.88 per dozen. d-filled donuts 1. Calculate the weighted-average contribution margin. 2. Determine Unique's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income…arrow_forwardA merchandising company has provided the following contribution format incomestatement:Sales (10,000 units) $ 700,000Variable expenses 350,000Contribution margin 350,000Fixed expenses 85,000Net operating income $ 265,000(a) What is the total contribution margin? (b) What is the unit contribution margin? Show your calculations. **Pls help me in clear soultion with accurate answer pls thanksarrow_forwardSmithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanities. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: Sinks Mirrors Vanities Total Units 1,000 500 500 2,000 Percentage of total sales Sales Variable expenses Contribution margin Contribution margin per unit Fixed expenses Operating income Break-even point in unit sales: Percentage sex 25% 25% 100% Break-even point in sales dollars: Total Fixed expenses. Weighted-average CM per unit Sinks 48% Product Mirrors 20% $264,000 100.00% $110,000 100.00% $176,000 100.00% $550,000 100.00% 80,000 30.30% 72,000 65.45% 82,000 46.59% 219,300 39.87% 53.41% 60.13% $184,000 $ 94,000 330,700 69.70% 38,000 34.55% S 76.00 $ 184.00 $ 188.00 Fixed expenses Overall CM ratio $293,300 $158.00 Vanities 32% $293,300 0.60 1,856.33 units Total 100% 293,300 $ 37,400 = $487,798.61 *($184.00 0.50) + ($76.00 x…arrow_forward

- Please help me with show all calculation thankuarrow_forwardPlease respond to my question using an excel worksheet as I’m trying to learn how to use excel.arrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $4,800 $3,200 Variable cost of goods sold (3,020) (2,140) Manufacturing margin $1,780 $1,060 Variable selling expenses (964) (548) Contribution margin $816 $512 Fixed expenses (380) (200) Operating income $436 $312 In addition, the following sales unit volume information for the period is as follows: Conquistador 2,800 Hurricane 2,000 Sales unit volume a. Prepare a contribution margin by product report. Compute the contribution margin ratjo for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Productarrow_forward

- please helparrow_forwardMorning Company reports the following information for March: E (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate the gross profit and operating income for March using absorption costing. Morning Company Income Statement (Absorption Costing) For the Month Ended March 31 Data Table Net Sales Revenue 67,850 Variable Cost of Goods Solłd 19,300 Operating income Fixed Cost of Goods Sold 8,400 Variable Selfing and Administrative Costs 16,500 Requirements Fixed Selling and Administrative Costs 3,800 1. Calculate the gross profit and operating income for March using absorption costing. 2. Calculate the contribution margin and operating income for March using variable costing. Print Donearrow_forwardVulcan Company's contribution format income statement for June is es follows: Vulcan Company Income Statenent For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses $ 9e0, e00 488, 00e 492, 800 455,000 Net operating income $ 37,000 Management is disoppointed with the company's performance and is wondering what con be done to improve profits. By examining soles and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $168,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $204,000 and $120,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $210,000 and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning