FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

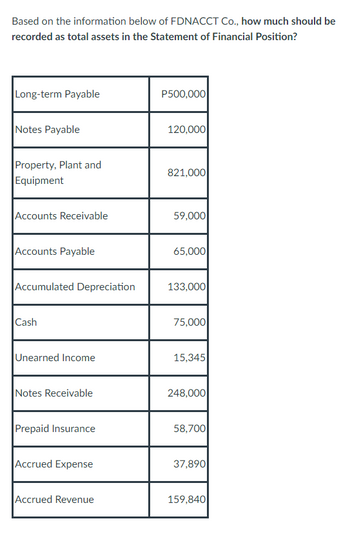

Transcribed Image Text:Based on the information below of FDNACCT Co., how much should be

recorded as total assets in the Statement of Financial Position?

Long-term Payable

Notes Payable

Property, Plant and

Equipment

Accounts Receivable

Accounts Payable

Accumulated Depreciation

Cash

Unearned Income

Notes Receivable

Prepaid Insurance

Accrued Expense

Accrued Revenue

P500,000

120,000

821,000

59,000

65,000

133,000

75,000

15,345

248,000

58,700

37,890

159,840

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information applies to the questions displayed below.] Simon Company's yearend balance sheets follow. Current 2 31 Assets Cash Accounts receivable , Merchandise inventory Prepaid expenses ? assets , Total assets Liabilities and Equity Bccounts payable Long-term payable secured by mortgages on plast assets Common stock, $ 10 par value earnings Total Isabilities and equity $ 31,224 89,900 115,000 10,055 277, 807 $523.985 $ 37,266 62,200 50,400 84,000 57,000 4,141 259,433 223,893 $ 451,712 372, 701 $ 131,777$ 77,103 $ 99,494 162,500 130.215 $523.986 104, 5 83,190 162,500 162,500 107.176 77.322 $ , 712 372, 70arrow_forwardFind BEP.arrow_forwardPrepare a balance sheet in report form as of December 31, 20Y8arrow_forward

- Current assets: Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term debt Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 par value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 48,844 51,713 22,926 4,106 35,230 162,819 105,341 37,378 32,978 $ 338,516 $ 46,236 43,700 5,522 10,260 105,718 91,807 50,503 248,028 1 45,173 45,314 90,488 $ 338,516arrow_forwardse the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $26,495 Accounts receivable 64,133 Accrued liabilities 6,993 Cash 21,465 Intangible assets 40,744 Inventory 89,481 Long-term investments 112,445 Long-term liabilities 70,738 Notes payable (short-term) 25,963 Property, plant, and equipment 664,167 Prepaid expenses 1,026 Temporary investments 30,035 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)?arrow_forwardExamine the balance sheet of commercial banks in the following table. $ Billion % Total 201.2 28.9 230.1 Assets Real assets Equipment and premises Other real estate Total real assets Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets Total $ Ratio of real assets to total assets $ $ 876.3 2,032.1 6,627.3 1,201.2 $10,736.9 $ 416.4 780.7 $ 1,197.1 $12,164.1 1.7% 0.2 1.9% 7.2% 16.7 54.5 9.9 88.3% 3.4% 6.4 9.8% 100.0% Liabilities Deposits Liabilities and Net Worth Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities Net worth Balance sheet of FDIC-insured commercial banks and savings institutions Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018. a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.) $ Billion %…arrow_forward

- Selected data from the comparative statements of financial position of Granger Ltd. are shown below: Cash Accounts receivable Inventory Property, plant, and equipment Intangible assets Total assets Cash Accounts receivable Inventory 2024 Property, plant, and equipment $152,000 606,000 783,000 3,144,000 92,000 2023 $177,000 400,000 595,000 2,793,000 98,000 $4,777,000 $4,063,000 2024 Using horizontal analysis, calculate the percentage of a base-year amount, assuming 2022 is the base year. (Round answers to 1 decimal place, e.g. 5.2%.) % % % 2022 % $75,000 453,000 706,000 2,863,000 0 $4,097,000 2023 % % % % 2022arrow_forwardQuestion Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $31,654 Accounts receivable 69,987 Accrued liabilities 6,524 Cash 16,364 Intangible assets 38,210 Inventory 80,832 Long-term investments 90,451 Long-term liabilities 73,398 Notes payable (short-term) 26,425 Property, plant, and equipment 659,739 Prepaid expenses 1,697 Temporary investments 38,252 Based on the data for Harding Company, what is the amount of quick assets?arrow_forwardIs the debt primarily short-term or long-term? Why?arrow_forward

- What's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardAll info for this question is includedarrow_forwardRequired: a. What is the ratio of real assets to total assets? (Hint: for this question, only include those listed under "Real assets") b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? Assets Real assets Equipment and intellectual property Real estate Inventories Total real assets Financial assets Deposits and cash Marketable securities Required A $ Billion $ 8,345 14,423 2,724 $ 25,492 Required B $ 2,333 4,059 4,075 14,005 $ 24,472 $ 49,964 % Total 16.7% 28.9 5.5 51.0% 4.7% 8.1 8.2 28.0 49.0% 100.0% Liabilities and Net Worth Liabilities Debt securities Bank loans & mortgages Other loans Trade debt Other Total liabilities Complete this question by entering your answers in the tabs below. Net worth $ Billion Trade and consumer credit Other Total financial assets TOTAL Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education