FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

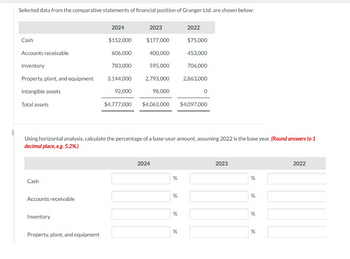

Transcribed Image Text:Selected data from the comparative statements of financial position of Granger Ltd. are shown below:

Cash

Accounts receivable

Inventory

Property, plant, and equipment

Intangible assets

Total assets

Cash

Accounts receivable

Inventory

2024

Property, plant, and equipment

$152,000

606,000

783,000

3,144,000

92,000

2023

$177,000

400,000

595,000

2,793,000

98,000

$4,777,000 $4,063,000

2024

Using horizontal analysis, calculate the percentage of a base-year amount, assuming 2022 is the base year. (Round answers to 1

decimal place, e.g. 5.2%.)

%

%

%

2022

%

$75,000

453,000

706,000

2,863,000

0

$4,097,000

2023

%

%

%

%

2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- the balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATIONBalance SheetsDecember 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 105,000 90,000 Investments 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 Less: Accumulated depreciation (528,000 ) (368,000 ) Total assets $ 1,392,000 $ 1,307,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 109,000 $ 95,000 Interest payable 7,000 13,000 Income tax payable 9,000 6,000 Long-term liabilities: Notes payable 110,000 220,000 Stockholders' equity: Common stock…arrow_forwardSelected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forward

- Find for Armstrong Company and Blair Company : Asset Turnover Ratios - (a) Fixed Asset turnover (times) (b) Receivables turnover (times) (c) Inventory turnover (times)arrow_forwardCQ Photography reported net income of $103,000 for 2022. Included in the income statement were depreciation expense of $6,500, patent amortization expense of $3,800, and a gain on disposal of plant assets of $4,000. CQ's comparative balance sheets show the following balances. Accounts receivable Accounts payable 12/31/22 $19,200 Net Income 8,400 12/31/21 Cash Flows from Operating Activities Calculate net cash provided by operating activities for CQ Photography using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) $27,000 CQ Photography Statement of Cash Flows For the Year Ended December 31, 2022 Adjustments to reconcile net income to 6,500 Net Cash Provided by Operating Activities $ 103000arrow_forwardComparative data from the statement of financial position of Munchies Ltd. are shown below. Current assets Property, plant, and equipment Goodwill Total assets Current assets Property, plant, and equipment Total assets 2021 $1,519,000 2021 3,114.000 $4.730,000 % %6 97,000 2020 $1,164.000 2,827,000 107,000 $4,098,000 Using horizontal analysis, calculate the percentage of the base-year amount, using 2019 as the base year. (Round answers to 1 decimal place, e.g. 52.7%) 2020 2019 % $1,227,000 2.871,000 -0- $4,098,000 2019arrow_forward

- Following this balance sheet of chevron's company, provide me with a horizontal analysis comparative balance sheets.arrow_forwardThe following financial information is for Cullumber Company. CULLUMBER COMPANYBalance SheetsDecember 31 Assets 2022 2021 Cash $ 69,000 $ 69,000 Debt investments (short-term) 53,000 41,000 Accounts receivable (net) 103,000 92,000 Inventory 239,000 164,000 Prepaid expenses 25,000 29,000 Land 132,000 132,000 Building and equipment (net) 263,000 188,000 Total assets $884,000 $715,000 Liabilities and Stockholders’ Equity Notes payable (current) $170,000 $101,000 Accounts payable 66,000 54,000 Accrued liabilities 42,000 42,000 Bonds payable, due 2025 251,000 170,000 Common stock, $10 par 205,000 205,000 Retained earnings 150,000 143,000 Total liabilities and stockholders’ equity $884,000 $715,000 CULLUMBER COMPANYIncome StatementsFor the Years Ended December 31 2022…arrow_forwardHow to calculate Net Operating Asset from this balance sheet for fiscal year-end 2015 .arrow_forward

- Additionally, the company informed the following: Net income = $156,042 Sales = $4,063,589 Determine the following values for the company: Total asset turnover ratio _____________ Fixed asset turnover ratio _____________arrow_forwardThe following comparative balance sheet is given for Estern Co.: Assets Dec 31, 2021 Dec 31, 2020 Cash $58,500 $351,000 72,000 Notes Receivable 63,000 Supplies & Inventory 81,000 121,500 Prepaid expense 31,500 54,000 Long-term investments 0 81,000 Machines and tools 166,500 144,000 Accumulated depreciation-equipment (63.000) (45,000) Total Assets $639,000 $477.000 Liabilities & Stockholders' Equity Accounts payable $ 76,500 $ 31,500 Bonds payable (long-term) 166,500 211,500 Common Stock 180,000 103,500 Retained Earnings 216.000 130.500 Total Liabilities & Stockholders' Equity $639.000 $477,000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021): 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000,…arrow_forwardHere are comparative balance sheets for Skysong Company. Prepare a statement of cash flows-indirect method. SKYSONG COMPANY Comparative Balance Sheets December 31 Assets 2020 2019 Cash $72,000 $22,000 Accounts receivable 86,000 77,000 Inventory 171,000 192,000 Land 72,000 101,000 Equipment 263,000 199,000 Accumulated depreciation - equipment (65,000) (32,000) Total $599,000 $559,000 Liabilities and Stockholders' Equity Accounts payable $37,000 $48,000 Bonds payable 149,000 209,000 Common stock ($1 par) 214,000 171,000 Retained earnings 199,000 131,000 Total $599,000 $559,000 Additional information: 1. Net income for 2020 was $98,000. 2. Cash dividends of $30,000 were declared and paid. 3. Bonds payable amounting to $60,000 were redeemed for cash $60,000. 4. Common stock was issued for $43,000 cash. 5. Equipment that cost $49,000 and had a book value of $28,000 was sold for $33,000 during 2020; land was sold at cost. Prepare a statement of cash flows for 2020 using the indirect method.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education