FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

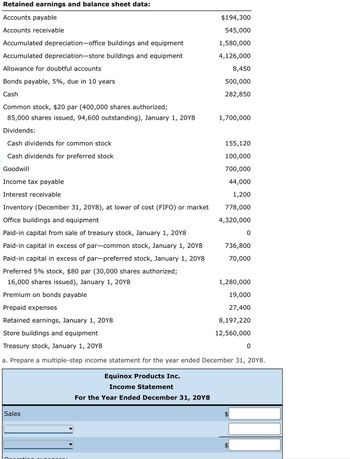

Transcribed Image Text:Retained earnings and balance sheet data:

Accounts payable

Accounts receivable

Accumulated depreciation-office buildings and equipment

Accumulated depreciation-store buildings and equipment

Allowance for doubtful accounts

Bonds payable, 5%, due in 10 years

Cash

Common stock, $20 par (400,000 shares authorized;

85,000 shares issued, 94,600 outstanding), January 1, 20Y8

Dividends:

Sales

$194,300

545,000

1,580,000

4,126,000

Operating oxpopcos:

8,450

500,000

282,850

Cash dividends for common stock

Cash dividends for preferred stock

Goodwill

Income tax payable

Interest receivable

Inventory (December 31, 20Y8), at lower of cost (FIFO) or market

Office buildings and equipment

Paid-in capital from sale of treasury stock, January 1, 2018

Paid-in capital in excess of par-common stock, January 1, 20Y8

Paid-in capital in excess of par-preferred stock, January 1, 20Y8

Preferred 5% stock, $80 par (30,000 shares authorized;

16,000 shares issued), January 1, 20Y8

Premium on bonds payable

Prepaid expenses

Retained earnings, January 1, 20Y8

Store buildings and equipment

Treasury stock, January 1, 20Y8

a. Prepare a multiple-step income statement for the year ended December 31, 20Y8.

Equinox Products Inc.

Income Statement

For the Year Ended December 31, 20Y8

1,700,000

155,120

100,000

700,000

44,000

1,200

778,000

4,320,000

736,800

70,000

0

1,280,000

19,000

27,400

8,197,220

12,560,000

$

$

0

Transcribed Image Text:Income statement data:

Advertising expense

Cost of goods sold

Delivery expense

Depreciation expense-office buildings and equipment

Depreciation expense-store buildings and equipment

Income tax expense

Interest expense

Interest revenue

Miscellaneous administrative expense

Miscellaneous selling expense

Office rent expense

Office salaries expense

Office supplies expense

Sales

Sales commissions

Sales salaries expense

Store supplies expense

Retained earnings and balance sheet data:

Accounts payable

Accounts receivable

Accumulated depreciation-office buildings and equipment

Accumulated depreciation-store buildings and equipment

Allowance for doubtful accounts

Bonds payable, 5%, due in 10 years

Cash

Common stock, $20 par (400,000 shares authorized;

85,000 shares issued, 94,600 outstanding), January 1, 20Y8

Dividends:

Cash dividends for common stock

Cash dividends for preferred stock

Goodwill

Income tax payable

$150,000

3,700,000

30,000

30,000

100,000

140,500

21,000

30,000

7,500

14,000

50,000

170,000

10,000

5,313,000

185,000

385,000

21,000

$194,300

545,000

1,580,000

4,126,000

8,450

500,000

282,850

1,700,000

155,120

100,000

700,000

44,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare a

Solution

by Bartleby Expert

Follow-up Question

Prepare a

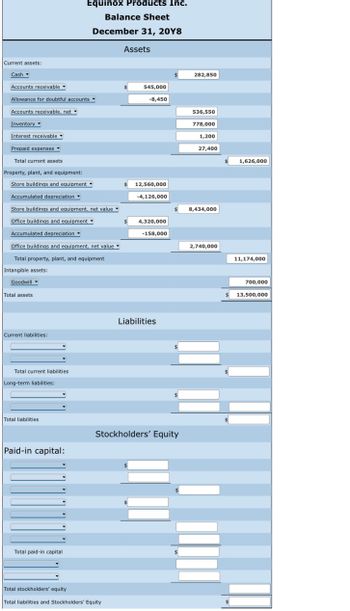

Transcribed Image Text:Current assets:

Cash

Accounts receivable

Allowance for doubtful accounts.

Accounts receivable, net

Inventory

Interest receivable

Prepaid expenses

Total current assets

Property, plant, and equipment:

Store buildings and equipment

Accumulated depreciation

Store buildings and equipment, net value

Office buildings and equipment

Accumulated depreciation

Office buildings and equipment, net value

Total property, plant, and equipment

Intangible assets:

Goodwill

Total assets

Current liabilities:

Total current liabilities

Long-term liabilities:

Equinox Products Inc.

Balance Sheet

December 31, 20Y8

Total liabilities

Paid-in capital:

Total paid-in capital

Assets

Total stockholders' equity

Total liabilities and Stockholders' Equity

$

545,000

-8,450

12,560,000

-4,126,000

4,320,000

-158,000

Liabilities

Stockholders' Equity

282,850

536,550

778,000

1,200

27,400

8,434,000

2,740,000

1,626,000

11,174,000

700,000

$ 13,500,000

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare a

Solution

by Bartleby Expert

Follow-up Question

Prepare a

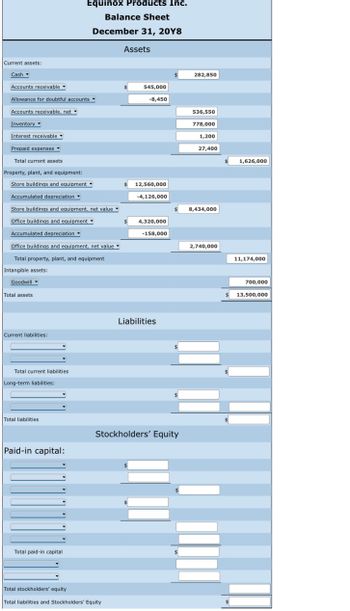

Transcribed Image Text:Current assets:

Cash

Accounts receivable

Allowance for doubtful accounts.

Accounts receivable, net

Inventory

Interest receivable

Prepaid expenses

Total current assets

Property, plant, and equipment:

Store buildings and equipment

Accumulated depreciation

Store buildings and equipment, net value

Office buildings and equipment

Accumulated depreciation

Office buildings and equipment, net value

Total property, plant, and equipment

Intangible assets:

Goodwill

Total assets

Current liabilities:

Total current liabilities

Long-term liabilities:

Equinox Products Inc.

Balance Sheet

December 31, 20Y8

Total liabilities

Paid-in capital:

Total paid-in capital

Assets

Total stockholders' equity

Total liabilities and Stockholders' Equity

$

545,000

-8,450

12,560,000

-4,126,000

4,320,000

-158,000

Liabilities

Stockholders' Equity

282,850

536,550

778,000

1,200

27,400

8,434,000

2,740,000

1,626,000

11,174,000

700,000

$ 13,500,000

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Entries for Equity Investments: Less than 20% Ownership The following equity investment transactions were completed by Vintage Company during a recent year: Apr. 10. Purchased 1,700 shares of Delew Company’s common stock for a price of $63.5 per share plus a brokerage commission of $850. Delew Company has 275,000 shares of common stock outstanding. July 8. Received a quarterly dividend of $0.40 per share on the Delew Company investment. Sept. 10. Sold 1,100 shares for a price of $57 per share less a brokerage commission of $480. Dec. 31. At the end of the accounting period, the fair value of the remaining 600 shares of Delew Company’s stock was $63.50 per share. Journalize the entries for these transactions. If an amount box does not require an entry, leave it blank. If required, round the final answers to the nearest dollar. needing help with part Darrow_forwardA corporation using the equity method of accounting for its investment in a 80%–owned investee, which earned $20,000 and paid $5,000 in dividends What is the ending balance of investment on 31/12 if investment in 1/1 amount 100,000$ ? Select one: a. 112,000 b. 115,000 c. 120,000 d. 100,00arrow_forwardContributed capital: Western Grass, Inc. Equity Section of Balance Sheet December 31, 2823 Preferred shares, $3 cumulative, 10,000 shares authorized, issued and outstanding Common shares, 100,000 shares authorized; 65,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 75,000 552,500 627 500 581 000 $1,208,500 Required: Using the Information provided, calculate book value per common share assuming: (Round the final answers to 2 decimal places.) a. There are no dividends in arrears. b. There are three years of dividends in arrears. Book Value of Common Sharesarrow_forward

- Balance sheet and income statement data indicate the following: Bonds payable, 10% (due in two years) Preferred 5% stock, $100 par (no change during year) Common stock, $50 par (no change during year) Income before income tax for year Income tax for year Common dividends paid Preferred dividends paid Interest expense Based on the data presented, what is the times interest earned ratio? Round your answer to two decimal places. 2.46 3.07 0.41 5.07 $868,000 263,400 2,167,800 353,540 81,447 108,390 13,170 86,800arrow_forwardContent Area Effect of Financing on Earnings Per Share BSF Co., which produces and sells skiing equipment, is financed as follows: Bonds payable, 10% (issued at face amount) $750,000 Preferred 2% stock, $20 par 750,000 Common stock, $25 par 750,000 Income tax is estimated at 60% of income. Round your answers to the nearest cent. a. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is $300,000. $fill in the blank 1 per share b. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is $375,000. $fill in the blank 2 per share c. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is $450,000. $fill in the blank 3 per sharearrow_forwardTotal assets Notes payable (6% interest) Common stock Preferred 2.5% stock, $100 par (no change during year) Retained earnings 20Y7 $5,200,000 2,500,000 250,000 Return on total assets December 31 20Y6 $5,000,000 2,500,000 250,000 500,000 1,222,000 500,000 1,574,000 < The 20Y7 net income was $411,000, and the 20Y6 net income was $462,500. No dividends on common stock were declared between 201 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. 20Y7 a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. Round percentages to one decimal place. 19.13 % X % 20Y5 $4,800,000 2,500,000 250,000 Return on stockholders' equity Return on common stockholders' equity h The profitability ratios indicate that the company's profitability has deteriorated % 500,000 750,000 20Y6 94.0 X % % % ✓. Because the return on commonarrow_forward

- Under the effective-interest method of bond discount or premium amortization, the periodic interest expense is equal to Select one: a. the market rate multiplied by the beginning-of-period carrying amount of the bonds b. the stated (nominal) rate of interest multiplied by the face value of the bonds. c. the stated rate multiplied by the beginning-of-period carrying amount of the bonds. 17arrow_forwardpp. Subject :- Accountingarrow_forwardVertical Analysis of Balance Sheet Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $355,300 $211,680 Property, plant, and equipment 543,400 509,600 Intangible assets 146,300 62,720 Current liabilities 188,100 94,080 Long-term liabilities 428,450 321,440 Common stock 104,500 109,760 Retained earnings 323,950 258,720 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current year year Amount Percent Previous Previous year year Amount Percent Current assets $355,300 $211,680 % Property, plant, and equipment 543,400 509,600 % Intangible assets % 146,300 62,720 % % %arrow_forward

- Journalize the entries to record the following selected transactions of Oliver Co: a. purchased $100,000 of Kruse Co. 8% bonds at par value plus accrued interest of $2,000 b. Received first semiannual interest plus accrued interest of $1,500arrow_forwardAccounts payable Accounts receivable Accumulated depreciation-buildings Additional paid-in capital in excess of par-common From treasury stock Allowance for doubtful accounts Bonds payable Buildings Cash Common stock ($1 par) Dividends payable (preferred stock-cash) Inventory Land SHEFFIELD CORPORATION Post-Closing Trial Balance December 31, 2025 Preferred stock ($50 par) Prepaid expenses Retained earnings Treasury stock (common at cost) Totals Authorized Issued Outstanding Common 585,000 195,000 Dr. 164,000 $513,000 1,489,000 203,000 579,000 392,000 42,000 181,000 $3,399,000 Preferred 66,000 11,000 Cr. $405,100 At December 31, 2025, Sheffield had the following number of common and preferred shares. 11,000 195,000 1,310,000 150,000 27,000 292,000 195,000 3,900 550,000 271,000 $3,399,000 The dividends on preferred stock are $4 cumulative. In addition, the preferred stock has a preference in liquidation of $50 per share. Prepare the stockholders' equity section of Sheffield's balance…arrow_forwardThe following information was drawn from the year-end balance sheets of Solomon River, Inc. Account Title Year 2 Year 1 Bonds $750,000 $1,005,000 payable Common stock 213,000 121,000 Treasury 27,500 5,500 stock Retained 62,200 88,900 earnings Additional information regarding transactions occurring during Year 2: 1. Solomon River, Inc. issued $42,300 of bonds during Year 2. The bonds were issued at face value. All bonds retired were retired at face value. 2. Common stock did not have a par value. 3. Solomon River, Inc. uses the cost method to account for treasury stock 4. The amount of net income shown on the Year 2 income statement was $32,700. Required a. Determine the amount of cash flow for the retirement of bonds that should appear on the Year 2 statement of cash flows. b. Determine the amount of cash flow from the issue of common stock that should appear on the Year 2 statement of cash flows. c. Determine the amount of cash flow for the purchase of treasury stock that should…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education