Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this accounting question please answer

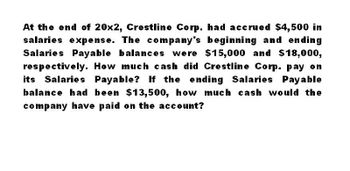

Transcribed Image Text:At the end of 20x2, Crestline Corp. had accrued $4,500 in

salaries expense. The company's beginning and ending

Salaries Payable balances were $15,000 and $18,000,

respectively. How much cash did Crestline Corp. pay on

its Salaries Payable? If the ending Salaries Payable

balance had been $13,500, how much cash would the

company have paid on the account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gibson Company engaged in the following transactions for Year 1. The beginning cash balance was $28,100 and the ending cash balance was $74,991. 1. Sales on account were $283,100. The beginning receivables balance was $94,700 and the ending balance was $77,000. 2. Salaries expense for the period was $55,460. The beginning salaries payable balance was $3,815 and the ending balance was $2,180. 3. Other operating expenses for the period were $120,170. The beginning other operating expenses payable balance was $4,860 and the ending balance was $9,181. 4. Recorded $19,330 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $14,340 and $33,670, respectively. 5. The Equipment account had beginning and ending balances of $211,970 and $238,570, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $48,500 and $150,500, respectively. There were no payoffs of…arrow_forward. In its income statement for the year ended December 31, 2020, Angel Company reported revenue of P5,000,000. The accounts receivable at January 1 is P300,000; Uncollectible accounts written off is P20,000; and accounts receivable at December 31 is P200,000. How much revenue will be reported under the cash basis of accounting? *arrow_forwardThe following are some of the year-end balances of Tyagi Company: 20X120X0 Unbilled Revenue 1,800 2,100 Interest Receivable 680 570 Unearned revenue 1,600 1,100 Prepaid Rent 7,900 5,900 Salaries Payable 850 1,200 810 730 Interest Payable The cash flow statement for 20X1 has the following information: Fees received 21,710 Interest received 2,030 Rent paid 11,600 Salaries paid 6,820 Interest paid 1,840 Compute the following for 20X1: a) Fee revenue b) Interest income c) Rent expense d) Salaries expensearrow_forward

- York Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forwardProvide Answer with calculation and explanation ofarrow_forwardAt the beginning of the year, ABC's Accounts Receivable balance was $82,300. During the year ABC sold $5,963,000 to its customers on credit. At the end of the year the firm's Accounts Receivable balance was $179,300. How much did ABC receive in payments from its customers over the course of the year?arrow_forward

- Nabb & Fry Co. reports net income of $30,000. Interest allowances are Nabb $7,300 and Fry $5,500, salary allowances are Nabb $14,300 and Fry $10,800, and the remainder is shared equally. Show the distribution of income. (If an amount reduces the account balance then enter with a negatlve slgn preceding the number e.g. -15,000 or parenthesls e.g. (15,000).) Division of Net Income Nabb Fry Total Salary allowance 24 $4 2$ Interest allowance Remaining excess/deficiency Total division of net income 2$arrow_forwardCullumber, Inc. reported the following item in its balance sheet at December 31, 2022: Accounts receivable, net of $986 allowance $59678 Which statement is true? Cullumber’s customers owe $60664. During the year, customers charged $59678 on account. Cullumber expects its customers to pay $58692. The balance owed by customers is $59678.arrow_forwardCastile Inc. had a beginning balance of $2,300 in its Accounts Receivable account. The ending balance of Accounts Receivable was $3,000. During the period, Castile recognized $37,000 of revenue on account. Castile’s Salaries Payable account has a beginning balance of $1,800 and an ending balance of $1,200. During the period, the company recognized $33,800 of accrued salary expense. Required a. Based on the information provided, determine the amount of net income. b. Based on the information provided, determine the amount of net cash flow from operating activities.arrow_forward

- Castile Incorporated had a beginning balance of $3,200 in its Accounts Receivable account. The ending balance of Accounts Receivable was $3,600. During the period, Castile recognized $50,000 of revenue on account. Castile's Salaries Payable account has a beginning balance of $2,300 and an ending balance of $900. During the period, the company recognized $39,500 of accrued salary expense. Required a. Based on the information provided, determine the amount of net income. b. Based on the information provided, determine the amount of net cash flow from operating activities. a. Net income b. Net cash flow from operating activitiesarrow_forwardThe Accounts Receivable balance for Wedge Company at December 31, 2023, was $27,000. During 2024, Wedge earned revenue of $461,000 on account and collected $324,000 on account. Wedge wrote off $5,800 receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 2% of accounts receivable. Read the reguirements. Requirement 1. Assume Wedge had an unadjusted $2,100 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Wedge's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 2. Assume Wedge had an unadjusted $1,800 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Wedge's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first,…arrow_forwardThe company's accounts receivable to 500,000. Prepaid Expenses and unearned income are 30,000 and 10,000respectively. Cash balance amounted to 100,000 while accounts payable and inventory are 20,000 and 10,000 respectively.How much is the company's current assets? Current liabilities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning