EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

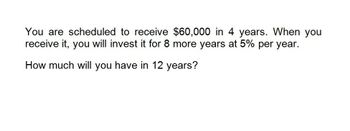

How much will you have in 12 years on these financial accounting question?

Transcribed Image Text:You are scheduled to receive $60,000 in 4 years. When you

receive it, you will invest it for 8 more years at 5% per year.

How much will you have in 12 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardHow much must be invested now to receive $50,000 for 8 years if the first $50,000 is received in one year and the rate is 10%?arrow_forwardIf you invest $15,000 today, how much will you have in (for further instructions on future value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%arrow_forward

- Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?arrow_forwardYou are scheduled to receive $27,000 in two years. When you receive it, you will invest it for 7 more years at 5 percent per year. How much will you have in 9 years?arrow_forwardYou will receive $5,000 in six years. When you receive it, you will invest it for 7 more years at an annual rate of 5%. How much money will you have 13 years from now?arrow_forward

- you are scheduled to recieve $40,000 in two years. When you recieve it, you will invest it for 9 more years at 6 percent per year. How much will you have in 11 years?arrow_forwardYou are scheduled to receive $5,000 in two years. When you receive it, you will invest it at 6.5 percent per year. How much will your investment be worth eight years from now? Can the excel and calculator solutions be provided?arrow_forwardYou are going to receive $50 at the end of each year for the next 6 years. If you invest each of those amounts at 8%, then what amount of money will you have at the end of th the 6 year?arrow_forward

- You will receive $15000 in two years when you graduate. You plan to invest this at an annual interest rate of 6.5 percent. How much money will you have 8 years from now?arrow_forwardYou expect to receive a one-time payment of $1,000 in 10 years and a second payment of $1,500 in 15 years. The annual interest rate is 3%. If you invest the amount that you'll receive in 10 years, how much money will you have in year 15 (including the cash flow in year 15)?arrow_forwardYou are scheduled to receive Rs. 13,000 in two years. When you receive it, you will invest it for six more years at 8 percent per year. How much will you have in eight years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College