Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solve this accounting problem not use

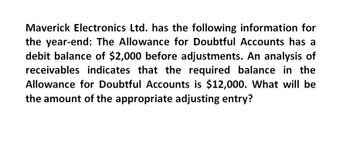

Transcribed Image Text:Maverick Electronics Ltd. has the following information for

the year-end: The Allowance for Doubtful Accounts has a

debit balance of $2,000 before adjustments. An analysis of

receivables indicates that the required balance in the

Allowance for Doubtful Accounts is $12,000. What will be

the amount of the appropriate adjusting entry?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts Receivable and the related Allowance for Doubtful Accounts were 1,200,000 and 60,000, respectively. An aging of accounts receivable indicated that 106,000 of the December 31, 2019, receivables may be uncollectible. The net realizable value of accounts receivable at December 31, 2019, was: a. 1,034,000 b. 1,094,000 c. 1,140,000 d. 1,154,000arrow_forwardHi,I am having a terrible time trying to understand when the balance in the allowance for doubtful account is involved in the final answer, and when it is not. Will you please explain why the answers are what they are in the attachment?arrow_forwardBefore the year-end adjustment the Allowance for Doubtful Accounts has a debit balance of $5,000. Using the aging of receivables method, the desired balance of the Allowance for Doubtful Accounts is estimated as $35,000. a) What is the uncollectible accounts expense for the period? b) What is the journal entry required? c) What is the balance of the Allowance for Doubtful Accounts after adjustment? d) If the accounts receivable balance is $325,000, what is the net realizable value of the receivables after adjustment?arrow_forward

- What are the adjusting entries?arrow_forwardAllowance for Doubtful Accounts has a debit balance of $2,900 at the end of the year, before adjustments. If an analysis of receivables indicates doubtful accounts of $36,000, what will be the amount of the appropriate adjusting entry? [Need The adjusting entry in Table format]arrow_forwardWhat will be the amount of the appropriate adjusting entry?arrow_forward

- Allowance for Doubtful Accounts has a credit balance of $667 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $17,457. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Bad Debt Expense, $16,790; credit Allowance for Doubtful Accounts, $16,790 debit Allowance for Doubtful Accounts, $667; credit Bad Debt Expense, $667 debit Allowance for Doubtful Accounts, $18,124; credit Bad Debt Expense, $18,124 debit Bad Debt Expense, $667; credit Allowance for Doubtful Accounts, $667arrow_forwardAllowance for Doubtful Accounts has a debit balance of $2,900 at the end of the year, before adjustments. If an analysis of receivables indicates doubtful accounts of $36,000, what will be the amount of the appropriate adjusting entry? [Need The adjusting entry in Table format] Answerarrow_forwardAllowance for Doubtful Accounts has a credit balance of $670 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $16,220. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Allowance for Doubtful Accounts, $670; credit Bad Debt Expense, $670 debit Bad Debt Expense, $670; credit Allowance for Doubtful Accounts, $670 debit Bad Debt Expense, $15,550; credit Allowance for Doubtful Accounts, $15,550 debit Allowance for Doubtful Accounts, $16,890; credit Bad Debt Expense, $16,890arrow_forward

- Oregon Ltd's account balances at December 31, 2021, before adjusting entries, include: Accounts receivable: $156,000 Allowance for doubtful accounts: $1,900 All account balances are normal balances. After reviewing the receivables balance, management estimates that $5,000 of the accounts receivable will be uncollectible. The required adjusting entry would include a credit to the allowance account in the amount of: Question 5 options: $1,900 $6,900 $5,000 $3,100arrow_forwardMazie Supply Company uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $110,500, and it estimates that 2% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has: (a) a $1,879 credit balance before the adjustment. (b) a $553 debit balance before the adjustment. View transaction list Journal entry worksheet < 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,879 credit balance before the adjustment. Note: Enter debits before credits. Transaction (a) General Journal Debit Creditarrow_forwardAllowance for Doubtful Accounts has a debit balance of $2,900 at the end of the year, before adjustments. If an analysis of receivables indicates doubtful accounts of $36,000, what will be the amount of the appropriate adjusting entry? [Need The adjusting entry in Table format] general accounting entryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning